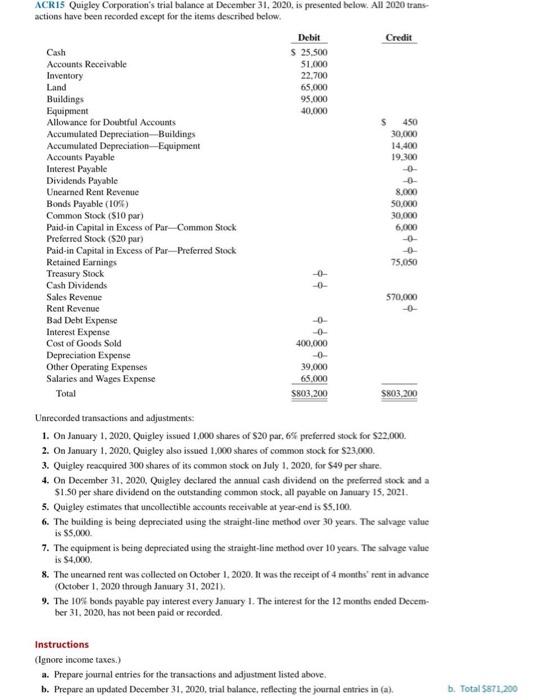

ACRI5 Quigley Corporation's trial balance at December 31, 2020. is presented below. All 2020 trans- actions have been recorded except for the items described below. Debit Credit Cash $ 25,500 Accounts Receivable 51.000 Inventory 22,700 Land 65.000 Buildings 95.000 Equipment 40.000 Allowance for Doubtful Accounts 450 Accumulated Depreciation Buildings 30.OKO Accumulated Depreciation-Equipment 14.400 Accounts Payable 19.300 Interest Payable Dividends Payable -0- Unearned Rent Revenue 8.000 Bonds Payable (105) 50.000 Common Stock (510 par) 30,000 Paid-in Capital in Excess of Par-Common Stock 6.000 Preferred Stock (S20 par) Paid-in Capital in Excess of Par-Preferred Stock Retained Earnings 75.00 Treasury Stock -0- Cash Dividends Sales Revenue 570,000 Rent Revenue Bad Debt Expense Interest Expense Cost of Goods Sold 400.000 Depreciation Expense -0- Other Operating Expenses 39.000 Salaries and Wages Expense 65.000 Total $803.200 $803,200 Unrecorded transactions and adjustments: 1. On January 1, 2020. Quigley issued 1,000 shares of $20 par, 6% preferred stock for $22,000. 2. On January 1, 2020, Quigley also issued 1,000 shares of common stock for $23,000. 3. Quigley reacquired 300 shares of its common stock on July 1, 2020, for 549 per share. 4. On December 31, 2020. Quigley declared the annual cash dividend on the preferred stock and a $1.50 per share dividend on the outstanding common stock, all payable on January 15, 2021 5. Quigley estimates that uncollectible accounts receivable at year-end is 5,100 6. The building is being depreciated using the straight-line method over 30 years. The salvage value 7. The equipment is being depreciated using the straight-line method over 10 years. The salvage value is $4,000 8. The unearned rent was collected on October 1, 2020. It was the receipt of 4 months rent in advance (October 1, 2020 through January 31, 2021). 9. The 10% bonds payable pay interest every January 1. The interest for the 12 months ended Decem her 31, 2020, has not been paid or recorded. is SS.OX Instructions (Ignore income taxes.) a. Prepare journal entries for the transactions and adjustment listed above. b. Prepare an updated December 31, 2020, trial balance, reflecting the journal entries in (a). b. Total 5571.200