Answered step by step

Verified Expert Solution

Question

1 Approved Answer

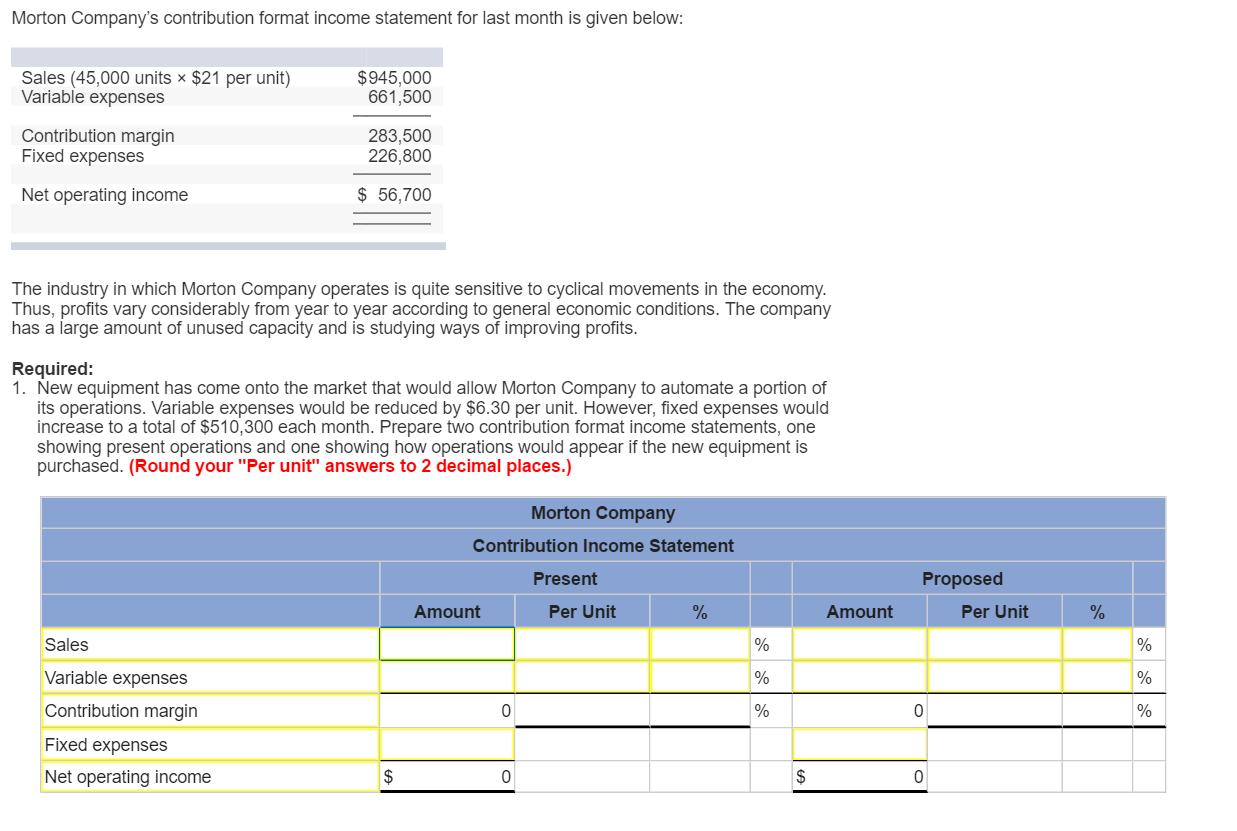

rn Morton Company's contribution format income statement for last month is given below: Sales (45,000 units x $21 per unit) Variable expenses Contribution margin Fixed

rn

rn

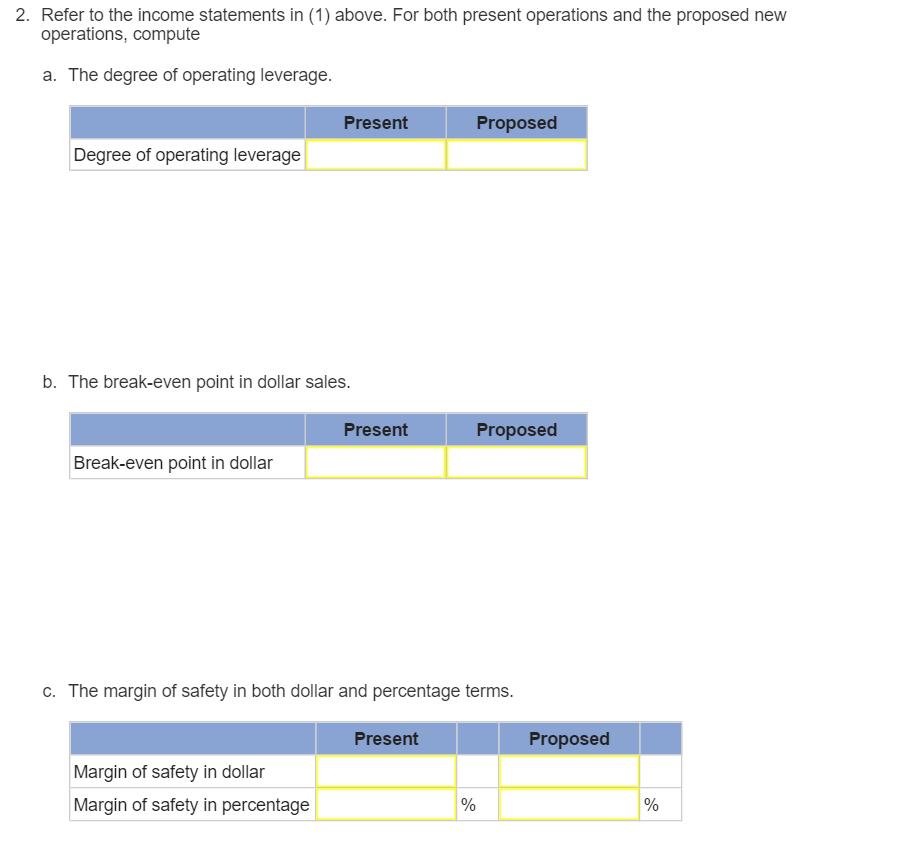

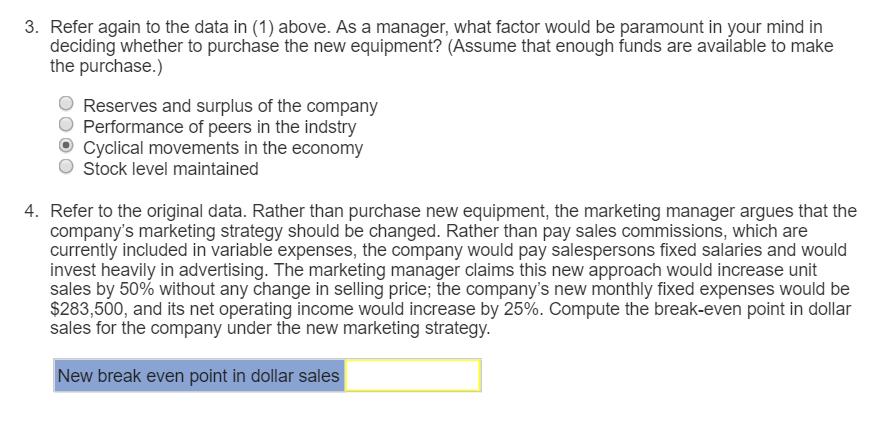

Morton Company's contribution format income statement for last month is given below: Sales (45,000 units x $21 per unit) Variable expenses Contribution margin Fixed expenses Net operating income $945,000 661,500 The industry in which Morton Company operates is quite sensitive to cyclical movements in the economy. Thus, profits vary considerably from year to year according to general economic conditions. The company has a large amount of unused capacity and is studying ways of improving profits. Sales Variable expenses Contribution margin 283,500 226,800 $ 56,700 Required: 1. New equipment has come onto the market that would allow Morton Company to automate a portion of its operations. Variable expenses would be reduced by $6.30 per unit. However, fixed expenses would increase to a total of $510,300 each month. Prepare two contribution format income statements, one showing present operations and one showing how operations would appear if the new equipment is purchased. (Round your "Per unit" answers to 2 decimal places.) Fixed expenses Net operating income $ Morton Company Contribution Income Statement Amount 0 0 Present Per Unit % % % % $ Amount Proposed 0 0 Per Unit % % % %

Step by Step Solution

★★★★★

3.54 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

Solution 1 Income statements Sales Less Variable cpost Contirbution Les...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started