Question

ACT 1103: Accounting I Lessons 4, 5, & 6 Spring 2021 Case Study Total Points: 75 Due: Accounting 1103.001 & 1103.002: Wednesday, March 31, 2021

ACT 1103: Accounting I Lessons 4, 5, & 6 Spring 2021

Case Study

Total Points: 75 Due: Accounting 1103.001 & 1103.002: Wednesday, March 31, 2021

Accounting 1103.003: Tuesday, March 30, 2021

Omas Boutique & Bakery offers original unique, handmade linens, home decor, and a cozy spot for patrons to sit and enjoy a drink and a homemade German delicacy. Omas B& B uses the following accounts.

Account Omas Boutique & Bakery # Accounts

111 Cash 113 Accounts Receivable 115 Office Supplies 116 Operating Supplies 117 PrePaid Rent 118 PrePaid Insurance 142 Building 146 Office Equipment 147 Accumulated Depreciation Equipment 156 Operating Equipment 157 Accumulated Depreciation Operating Equipment 211 Accounts Payable 212 Unearned Revenue 213 Notes Payable 214 Wages Payable 311 Omas Capital 313 Withdrawals 314 Income Summary 414 Revenue 511 Wages Expense 512 Utilities Expense 513 T elephone/Cable/Internet Expense 514 Rent Expense 515 Insurance 516 Office Supplies Expense 517 Operating Supplies Expense 518 Depreciation Expense Equipment 519 Depreciation Expense Office Equipment

Omas pay period is for two weeks ending August 12th and August 26th. Oma pays two sales clerks for the store and one assistant for the office. Each clerk works a normal eight-hour day, 40 hours per week. (No overtime) The clerks earn $12/hour. The assistant is paid $3,600 per month, or $1,800 per paid period. Assume that these calculations include all the necessary and required deductions for taxes and withholdings.

For example, the pay period ending August 26 is for the work completed during the weeks August 1 5 and August 8 12. Assume that all a normal work week was completed.

Office Equipment Depreciation

The office equipment was purchased price was $6,320 and has an estimated life of 5 years with a total salvage value of $1,000. Round to nearest dollar. Operating Equipment Depreciation The operating equipment was purchased price was $18,780 and has an estimated life of 12 years with a total scrap value estimated at $1,200. Round to nearest dollar.

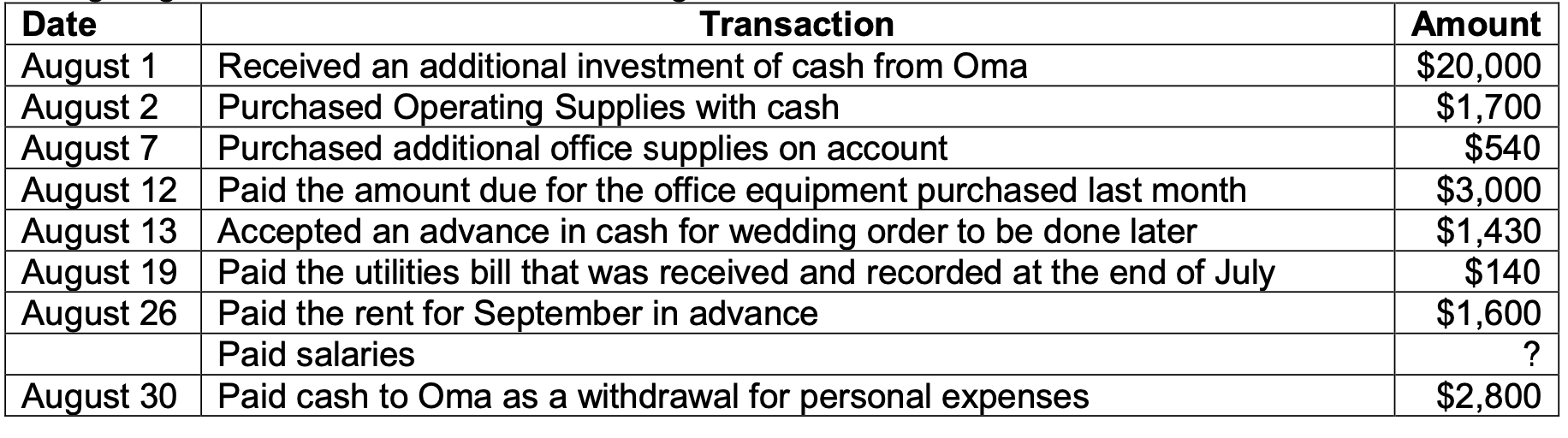

During August, Omas B&B had the following transactions.

-

(5 points) Record the transactions for August in journal form in a proper format.

-

(10 points) Post the August transactions to the ledger accounts in a proper format

-

(5 points) Prepare the Trial Balance column of a work sheet.

-

(15 points) Prepare adjusting entries and complete the worksheet using the following information: a. One months prepaid rent has expired, $1,600 b. An inventory of operating supplies reveals $2,080 still on hand on August 31 c. Review and include any other necessary adjusting entries.

-

(5 points) Complete an adjusted trial balance

-

(15 points) Prepare a properly formatted income statement, a statement of owners equity, and a balance sheet for August 31, 2020.

7. (20 points) Prepare a post-closing trial balance at August 31 including the appropriate journal and ledger entries to close out necessary accounts.

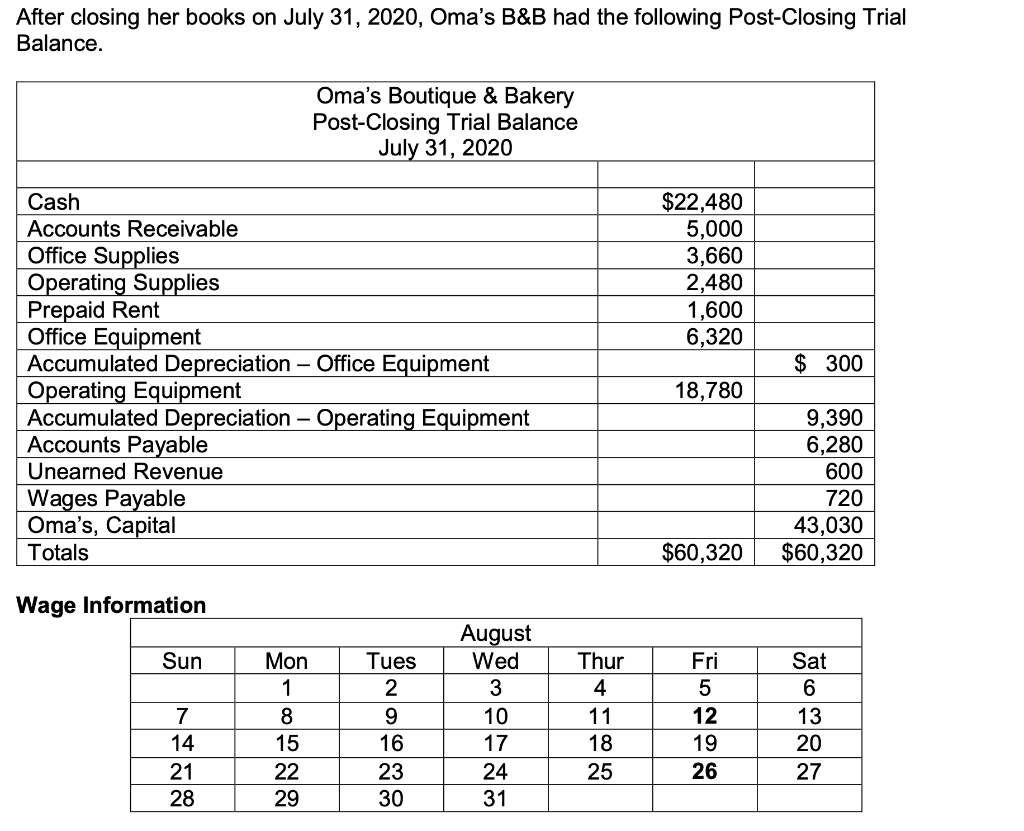

After closing her books on July 31, 2020, Oma's B&B had the following Post-Closing Trial Balance. Oma's Boutique & Bakery Post-Closing Trial Balance July 31, 2020 $22,480 5,000 3,660 2,480 1,600 6,320 $ 300 Cash Accounts Receivable Office Supplies Operating Supplies Prepaid Rent Office Equipment Accumulated Depreciation - Office Equipment Operating Equipment Accumulated Depreciation - Operating Equipment Accounts Payable Unearned Revenue Wages Payable Oma's, Capital Totals 18,780 9,390 6,280 600 720 43,030 $60,320 $60,320 Wage Information Sun 7 14 21 28 Mon 1 8 15 22 29 Tues 2 9 16 23 30 August Wed 3 10 17 24 31 Thur 4 11 18 25 Fri 5 12 19 26 Sat 6 13 20 27 Date Transaction August 1 Received an additional investment of cash from Oma August 2 Purchased Operating Supplies with cash August 7 Purchased additional office supplies on account August 12 Paid the amount due for the office equipment purchased last month August 13 Accepted an advance in cash for wedding order to be done later August 19 Paid the utilities bill that was received and recorded at the end of July August 26 Paid the rent for September in advance Paid salaries August 30 Paid cash to Oma as a withdrawal for personal expenses Amount $20,000 $1,700 $540 $3,000 $1.430 $140 $1.600 ? $2,800 After closing her books on July 31, 2020, Oma's B&B had the following Post-Closing Trial Balance. Oma's Boutique & Bakery Post-Closing Trial Balance July 31, 2020 $22,480 5,000 3,660 2,480 1,600 6,320 $ 300 Cash Accounts Receivable Office Supplies Operating Supplies Prepaid Rent Office Equipment Accumulated Depreciation - Office Equipment Operating Equipment Accumulated Depreciation - Operating Equipment Accounts Payable Unearned Revenue Wages Payable Oma's, Capital Totals 18,780 9,390 6,280 600 720 43,030 $60,320 $60,320 Wage Information Sun 7 14 21 28 Mon 1 8 15 22 29 Tues 2 9 16 23 30 August Wed 3 10 17 24 31 Thur 4 11 18 25 Fri 5 12 19 26 Sat 6 13 20 27 Date Transaction August 1 Received an additional investment of cash from Oma August 2 Purchased Operating Supplies with cash August 7 Purchased additional office supplies on account August 12 Paid the amount due for the office equipment purchased last month August 13 Accepted an advance in cash for wedding order to be done later August 19 Paid the utilities bill that was received and recorded at the end of July August 26 Paid the rent for September in advance Paid salaries August 30 Paid cash to Oma as a withdrawal for personal expenses Amount $20,000 $1,700 $540 $3,000 $1.430 $140 $1.600 ? $2,800Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started