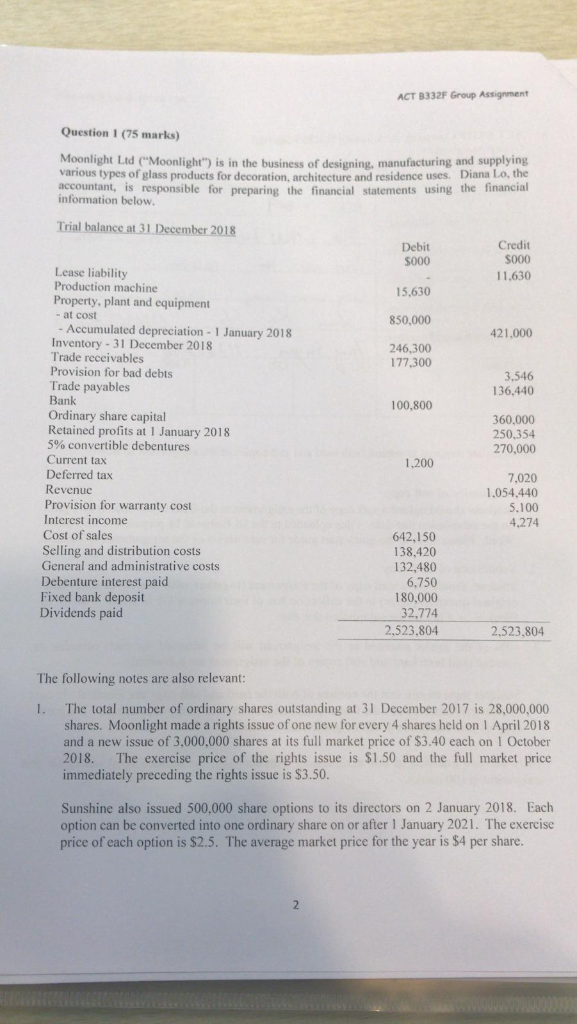

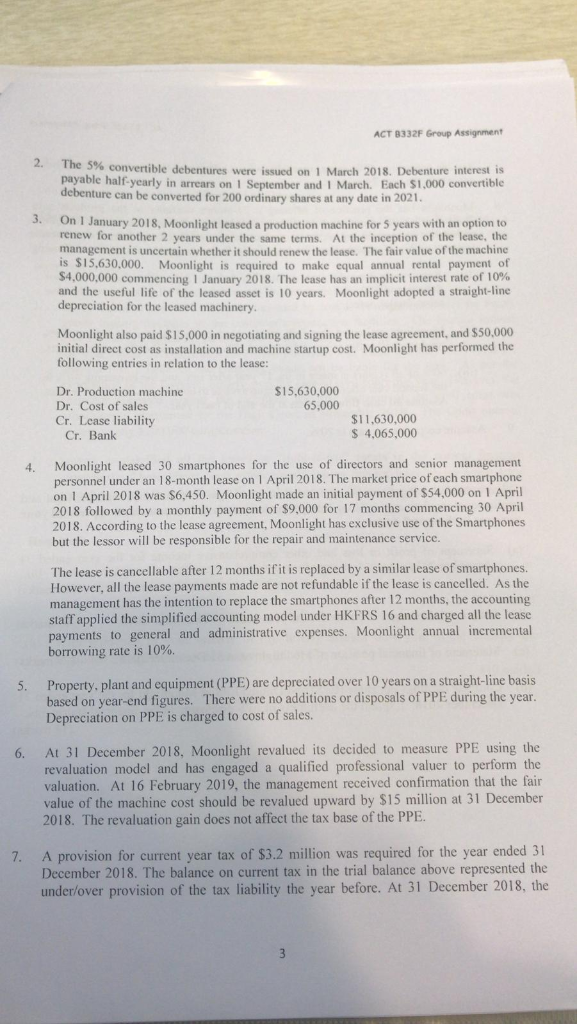

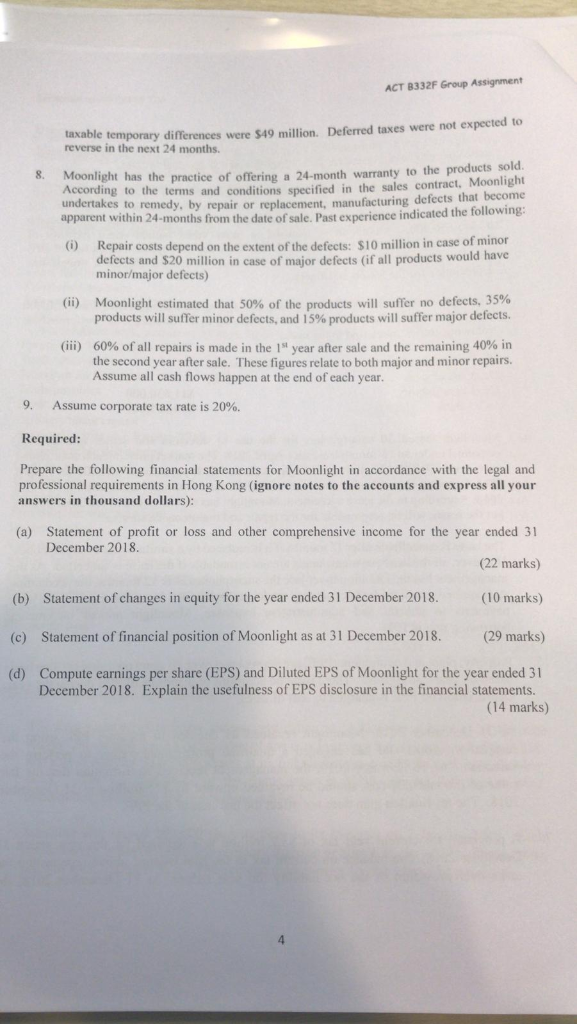

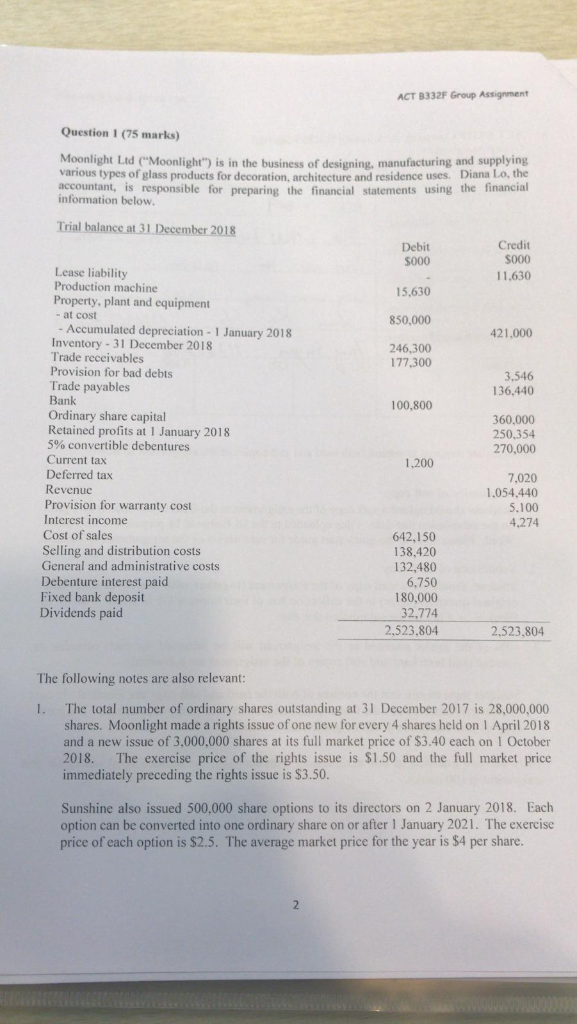

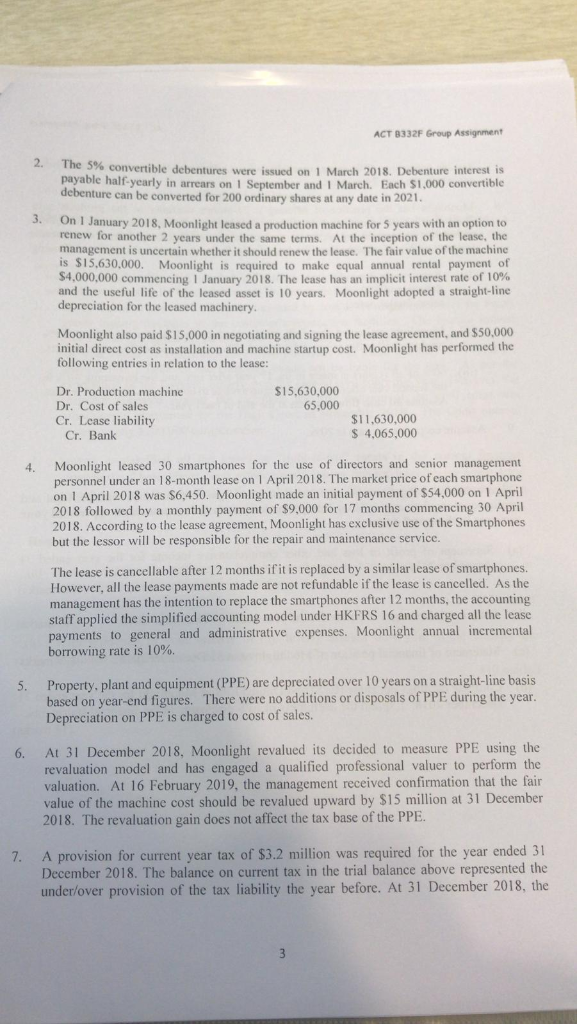

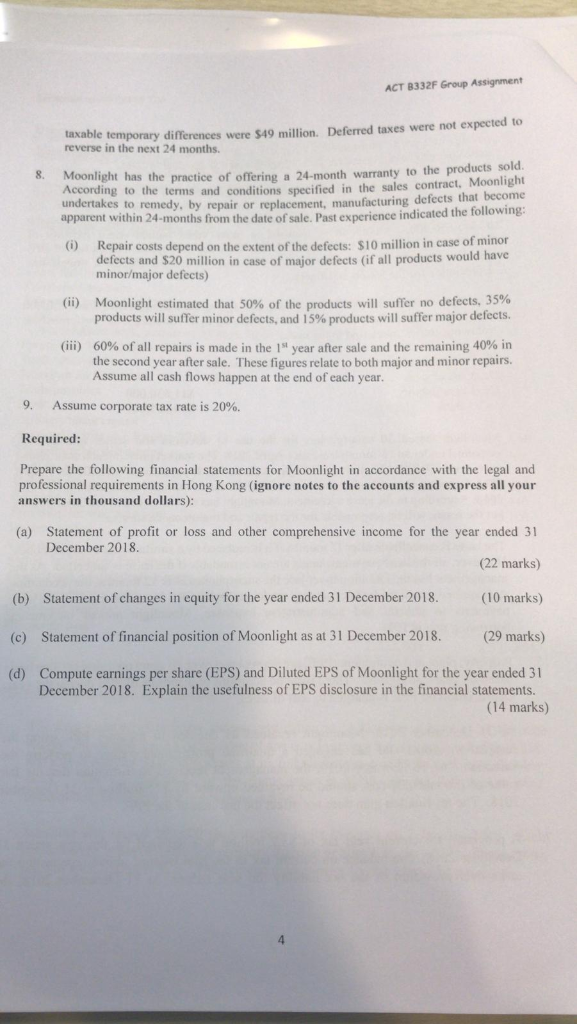

ACT B332F Group Assignment Question 1 (75 marks) Moonlight Ltd ("Moonlight") is in the business of designing, manufacturing and supplying various types of glass products for decoration, architecture and residence uses. Diana Lo, the accountant, is responsible for preparing the financial statements using the financial information below. Trial balance at 31 December 2018 Debit Credit S000 15,630 850,000 246,300 Lease liability 11.630 Production machine Property, plant and equipment at cost Accumulated depreciation- 1 January 2018 Inventory-31 December 2018 Trade receivables Provision for bad debts Trade payables Bank Ordinary share capital Retained profits at 1 January 2018 5% convertible debentures Current tax Deferred tax Revenue Provision for warranty cost Interest income Cost of sales Selling and distribution costs 421,000 77,300 3,546 136.440 00,800 360,000 250,354 270,000 1,200 7,020 1,054.440 5.100 4.274 642,150 138.420 132,480 6,750 180,000 32,774 2,523,804 General and administrative costs Debenture interest paid Fixed bank deposit Dividends paid 2,523,804 The following notes are also relevant The total number of ordinary shares outstanding at 31 December 2017 is 28,000,000 shares. Moonlight made a rights issue of one new for every 4 shares held on 1 April 2018 and a new issue of 3.000,000 shares at its full market price of $3.40 each on 1 October 2018. The exercise price of the rights issue is $1.50 and the full market price immediately preceding the rights issue is $3.50. 1. Sunshine also issued 500,000 share options to its directors on 2 January 2018. Each option can be converted into one ordinary share on or after 1 January 2021. The exercise price of each option is $2.5. The average market price for the year is $4 per share. ACT 8332F Group Assignment 2. The 5% convertible debentures were issued on 1 March 2018. Debenture interest is payable half debenture can be converted for 200 ordinary shares at any date in 2021 yearly in arrears on 1 September and 1 March. Each $1,000 convertible 3. On 1 January 2018, Moonlight leased a production machine for 5 years with an option to renew for another 2 years under the same terms. At the inception of the lease, the management is uncertain whether it should renew the lease. The fair value of the machine is $15.630.000. Moonlight is required to make equal annual rental payment of $4,000,000 commencing 1 January 2018. The lease has an implicit interest rate of 10% and the useful life of the leased asset is 10 years. Moonlight adopted a straight-line depreciation for the leased machinery Moonlight also paid $15,000 in negotiating and signing the lease agreement, and $50,000 initial direct cost as installation and machine startup cost. Moonlight has performed the following entries in relation to the lease Dr. Production machine Dr. Cost of sales $15,630,000 65,000 Cr. Lcase liability 11,630,000 s 4,065,000 Cr. Bank Moonlight leased 30 smartphones for the use of directors and senior management personnel under an 18-month lease on 1 April 2018. The market price of each smartphone on 1 April 2018 was $6,450. Moonlight made an initial payment of $54,000 on 1 April 2018 followed by a monthly payment of $9,000 for 17 months commencing 30 April 2018. According to the lease agreement, Moonlight has exclusive use of the Smartphones but the lessor will be responsible for the repair and maintenance service 4. The lease is cancellable after 12 months if it is replaced by a similar lease of smartphones. However, all the lease payments made are not refundable if the lease is cancelled. As the management has the intention to replace the smartphones after 12 months, the accounting staff applied the simplified accounting model under HKFRS 16 and charged all the lease payments to general and administrative expenses. Moonlight annual incremental borrowing rate is 10%. 5. Property. plant and equipment (PPE) are depreciated over 10 years on a straight-line basis based on year-end figures. There were no additions or disposals of PPE during the year Depreciation on PPE is charged to cost of sales. 6. At 31 December 2018, Moonlight revalued its decided to measure PPE using the revaluation model and has engaged a qualified professional valuer to perform the valuation. At 16 February 2019, the management received confirmation that the fair value of the machine cost should be revalued upward by $15 million at 31 December 2018. The revaluation gain does not affect the tax base of the PPE 7. A provision for current year tax of $3.2 million was required for the year ended 31 December 2018. The balance on current tax in the trial balance above represented the under/over provision of the tax liability the year before. At 31 December 2018, the ACT B332F Group Assignment taxable temporary differences were $49 million. Deferred taxes were not expected to reverse in the next 24 months. Moonlight has the practice of offering a 24-month warranty to According to the terms and conditions specified in the sales contract, Moonlig undertakes to remedy, by repair or replacement, manufacturing defects apparent within 24-months from the date of sale. Past experience indicated the following 8. ht that become Repair costs depend on the extent of the defects: $10 million in case of minor defects and $20 million in case of major defects (if all products would have minor/major defects) (i) Moonlight estimated that 50% of the products will suffer no defects, 35% products will suffer minor defects, and 15% products will suffer major defects (ii) 60% of all repairs is made in the 1st year after sale and the remaining 40% in the second year after sale. These figures relate to both major and minor repairs Assume all cash flows happen at the end of each year. (iii) 9, Assume corporate tax rate is 20%. Required Prepare the following financial statements for Moonlight in accordance with the legal and professional requirements in Hong Kong (ignore notes to the accounts and express all your (a) Statement of profit or loss and other comprehensive income for the year ended 31 (22 marks) (10 marks) answers in thousand dollars): December 2018 Statement of changes in equity for the year ended 31 December 2018. (b) (c) (d) Statement of financial position of Moonlight as at 31 December 2018. (29 marks) Compute earnings per share (EPS) and Diluted EPS of Moonlight for the year ended 31 December 2018. Explain the usefulness of EPS disclosure in the financial statements. (14 marks) 4 ACT B332F Group Assignment Question 1 (75 marks) Moonlight Ltd ("Moonlight") is in the business of designing, manufacturing and supplying various types of glass products for decoration, architecture and residence uses. Diana Lo, the accountant, is responsible for preparing the financial statements using the financial information below. Trial balance at 31 December 2018 Debit Credit S000 15,630 850,000 246,300 Lease liability 11.630 Production machine Property, plant and equipment at cost Accumulated depreciation- 1 January 2018 Inventory-31 December 2018 Trade receivables Provision for bad debts Trade payables Bank Ordinary share capital Retained profits at 1 January 2018 5% convertible debentures Current tax Deferred tax Revenue Provision for warranty cost Interest income Cost of sales Selling and distribution costs 421,000 77,300 3,546 136.440 00,800 360,000 250,354 270,000 1,200 7,020 1,054.440 5.100 4.274 642,150 138.420 132,480 6,750 180,000 32,774 2,523,804 General and administrative costs Debenture interest paid Fixed bank deposit Dividends paid 2,523,804 The following notes are also relevant The total number of ordinary shares outstanding at 31 December 2017 is 28,000,000 shares. Moonlight made a rights issue of one new for every 4 shares held on 1 April 2018 and a new issue of 3.000,000 shares at its full market price of $3.40 each on 1 October 2018. The exercise price of the rights issue is $1.50 and the full market price immediately preceding the rights issue is $3.50. 1. Sunshine also issued 500,000 share options to its directors on 2 January 2018. Each option can be converted into one ordinary share on or after 1 January 2021. The exercise price of each option is $2.5. The average market price for the year is $4 per share. ACT 8332F Group Assignment 2. The 5% convertible debentures were issued on 1 March 2018. Debenture interest is payable half debenture can be converted for 200 ordinary shares at any date in 2021 yearly in arrears on 1 September and 1 March. Each $1,000 convertible 3. On 1 January 2018, Moonlight leased a production machine for 5 years with an option to renew for another 2 years under the same terms. At the inception of the lease, the management is uncertain whether it should renew the lease. The fair value of the machine is $15.630.000. Moonlight is required to make equal annual rental payment of $4,000,000 commencing 1 January 2018. The lease has an implicit interest rate of 10% and the useful life of the leased asset is 10 years. Moonlight adopted a straight-line depreciation for the leased machinery Moonlight also paid $15,000 in negotiating and signing the lease agreement, and $50,000 initial direct cost as installation and machine startup cost. Moonlight has performed the following entries in relation to the lease Dr. Production machine Dr. Cost of sales $15,630,000 65,000 Cr. Lcase liability 11,630,000 s 4,065,000 Cr. Bank Moonlight leased 30 smartphones for the use of directors and senior management personnel under an 18-month lease on 1 April 2018. The market price of each smartphone on 1 April 2018 was $6,450. Moonlight made an initial payment of $54,000 on 1 April 2018 followed by a monthly payment of $9,000 for 17 months commencing 30 April 2018. According to the lease agreement, Moonlight has exclusive use of the Smartphones but the lessor will be responsible for the repair and maintenance service 4. The lease is cancellable after 12 months if it is replaced by a similar lease of smartphones. However, all the lease payments made are not refundable if the lease is cancelled. As the management has the intention to replace the smartphones after 12 months, the accounting staff applied the simplified accounting model under HKFRS 16 and charged all the lease payments to general and administrative expenses. Moonlight annual incremental borrowing rate is 10%. 5. Property. plant and equipment (PPE) are depreciated over 10 years on a straight-line basis based on year-end figures. There were no additions or disposals of PPE during the year Depreciation on PPE is charged to cost of sales. 6. At 31 December 2018, Moonlight revalued its decided to measure PPE using the revaluation model and has engaged a qualified professional valuer to perform the valuation. At 16 February 2019, the management received confirmation that the fair value of the machine cost should be revalued upward by $15 million at 31 December 2018. The revaluation gain does not affect the tax base of the PPE 7. A provision for current year tax of $3.2 million was required for the year ended 31 December 2018. The balance on current tax in the trial balance above represented the under/over provision of the tax liability the year before. At 31 December 2018, the ACT B332F Group Assignment taxable temporary differences were $49 million. Deferred taxes were not expected to reverse in the next 24 months. Moonlight has the practice of offering a 24-month warranty to According to the terms and conditions specified in the sales contract, Moonlig undertakes to remedy, by repair or replacement, manufacturing defects apparent within 24-months from the date of sale. Past experience indicated the following 8. ht that become Repair costs depend on the extent of the defects: $10 million in case of minor defects and $20 million in case of major defects (if all products would have minor/major defects) (i) Moonlight estimated that 50% of the products will suffer no defects, 35% products will suffer minor defects, and 15% products will suffer major defects (ii) 60% of all repairs is made in the 1st year after sale and the remaining 40% in the second year after sale. These figures relate to both major and minor repairs Assume all cash flows happen at the end of each year. (iii) 9, Assume corporate tax rate is 20%. Required Prepare the following financial statements for Moonlight in accordance with the legal and professional requirements in Hong Kong (ignore notes to the accounts and express all your (a) Statement of profit or loss and other comprehensive income for the year ended 31 (22 marks) (10 marks) answers in thousand dollars): December 2018 Statement of changes in equity for the year ended 31 December 2018. (b) (c) (d) Statement of financial position of Moonlight as at 31 December 2018. (29 marks) Compute earnings per share (EPS) and Diluted EPS of Moonlight for the year ended 31 December 2018. Explain the usefulness of EPS disclosure in the financial statements. (14 marks) 4