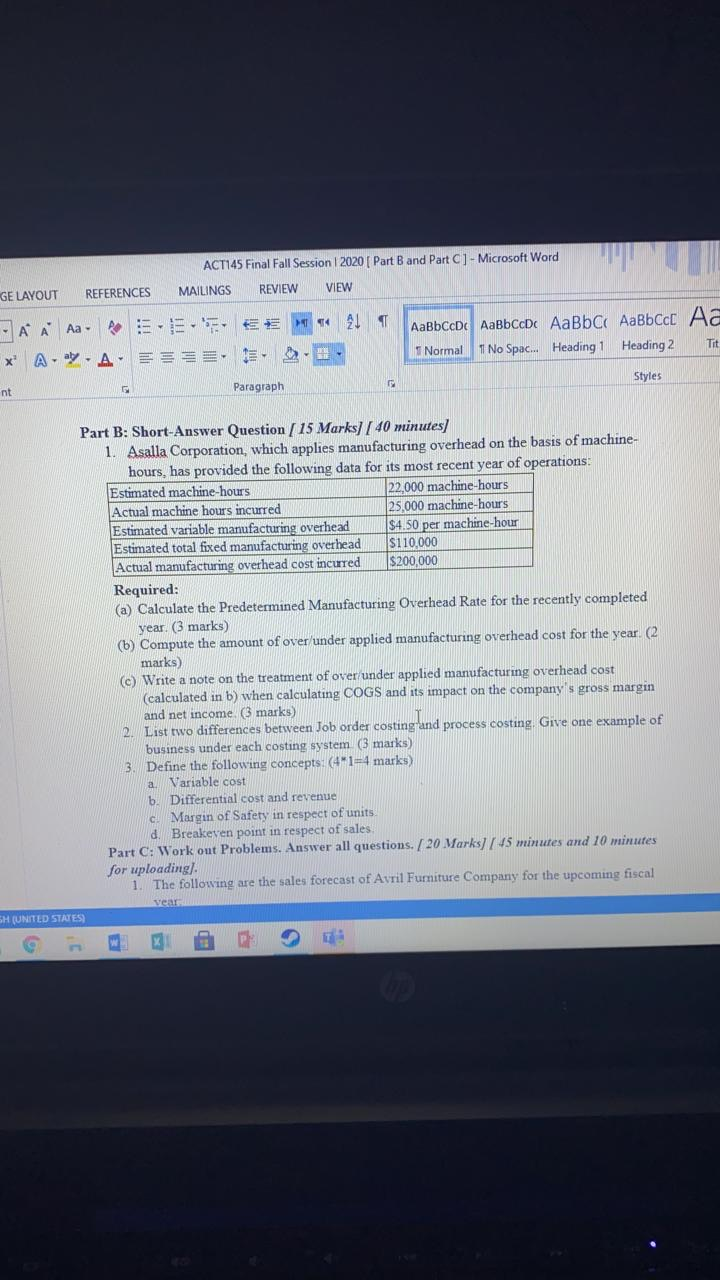

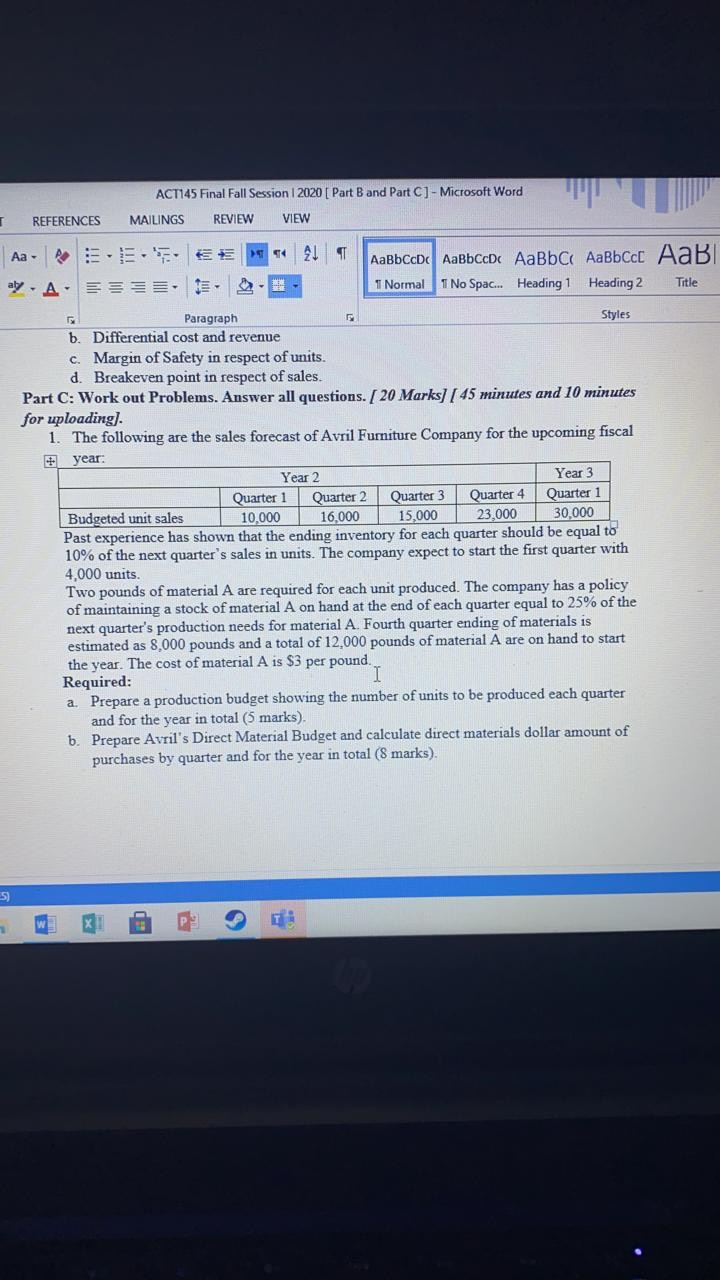

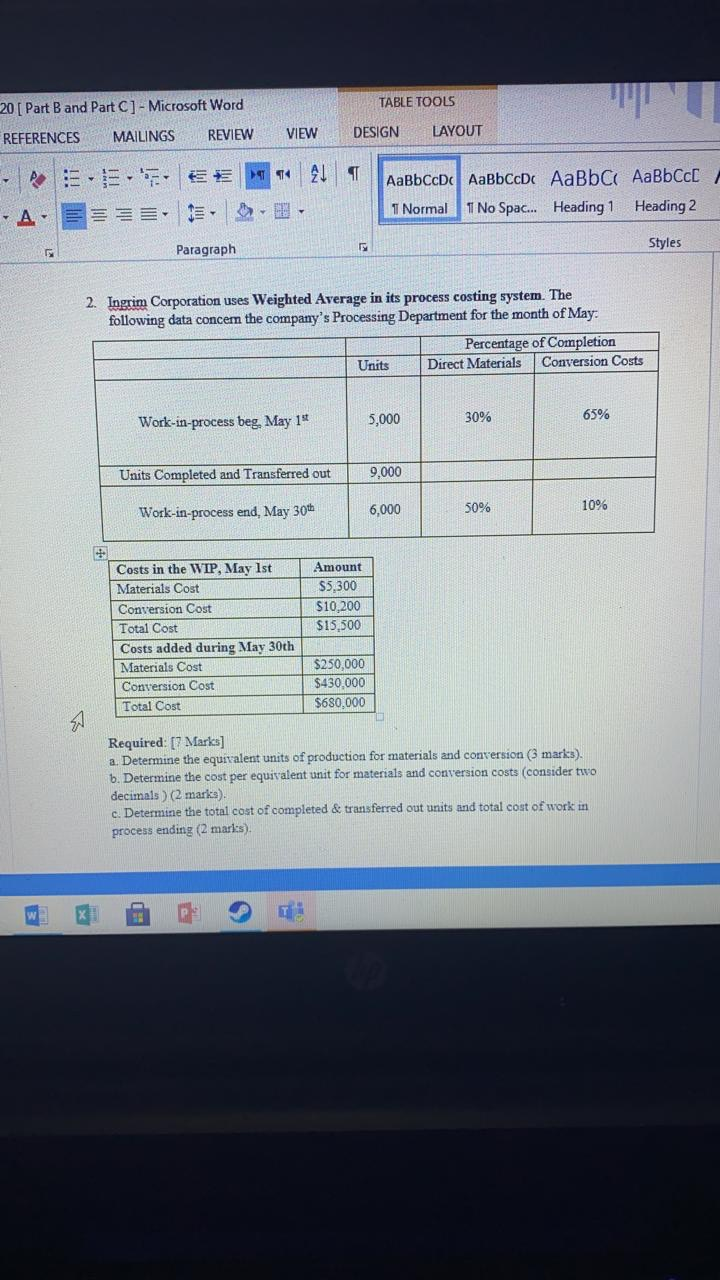

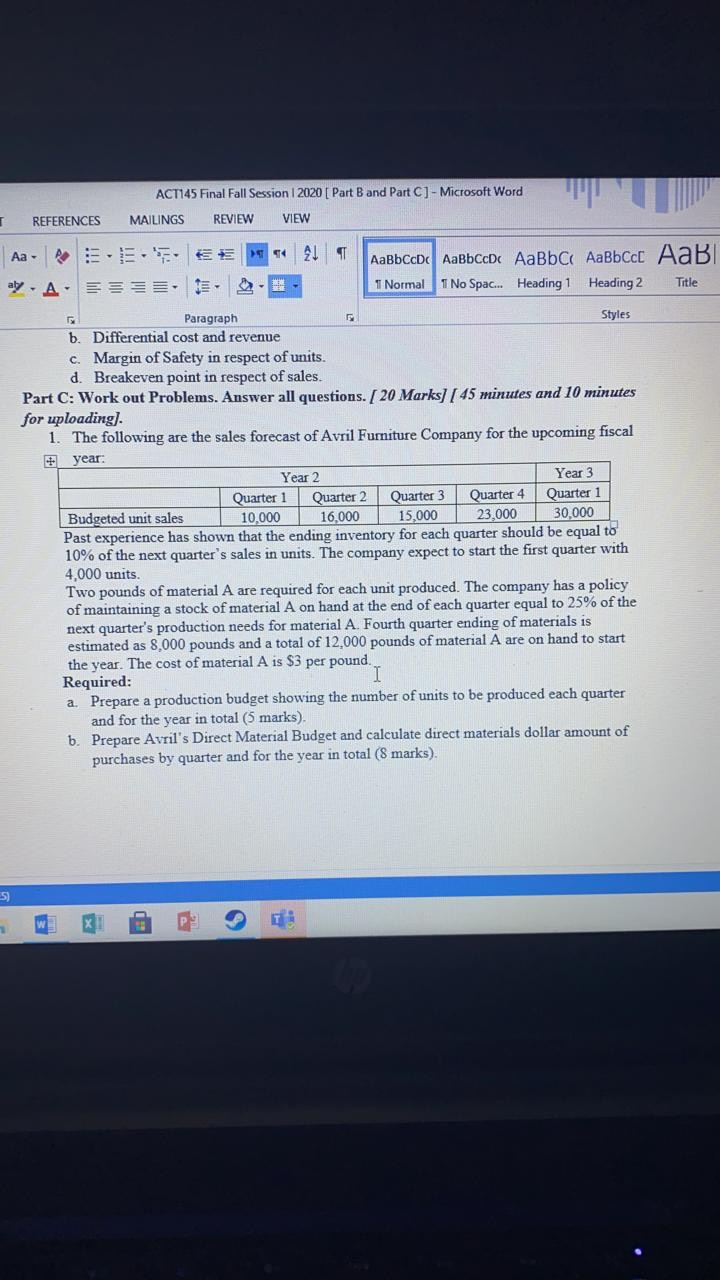

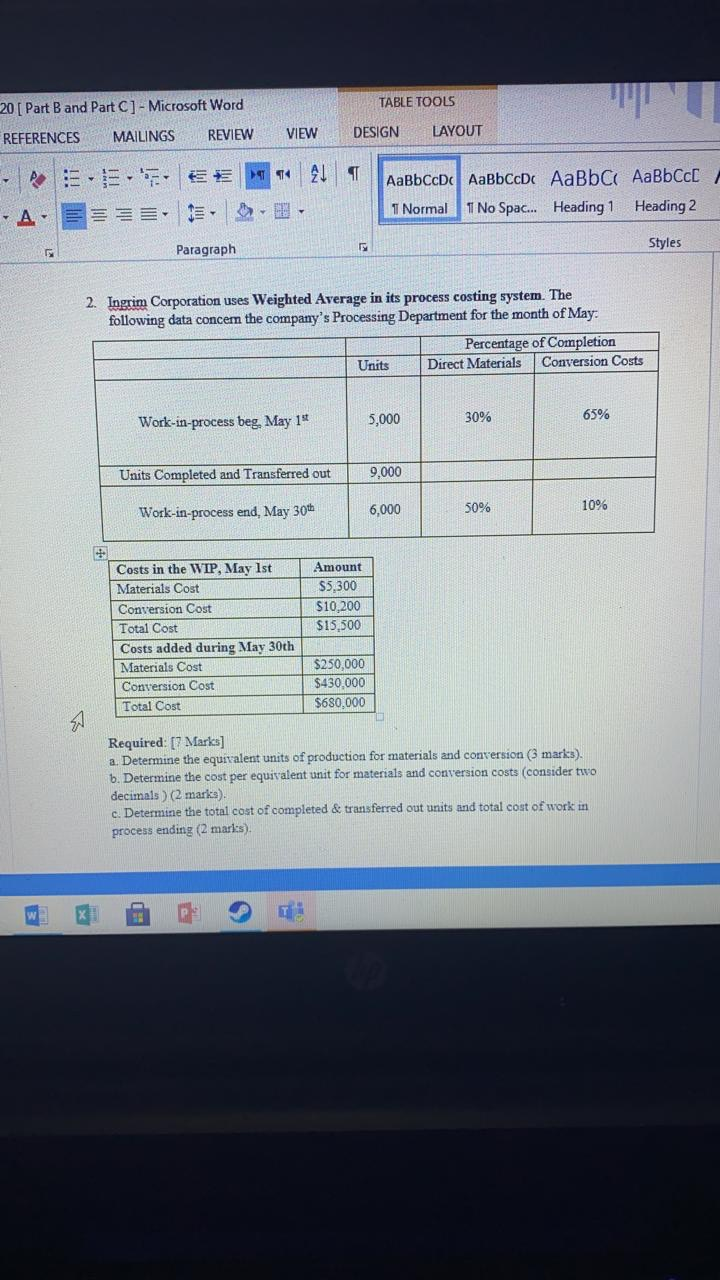

ACT145 Final Fall Session 2020 [ Part B and Part C] - Microsoft Word GE LAYOUT REFERENCES MAILINGS REVIEW VIEW A A A E EE ALT x A-ay-A.EE. Trit TE- Normal 11 No Spac... Heading 1 Heading 2 4 Styles nt 5 Paragraph Part B: Short-Answer Question / 15 Marks] [ 40 minutes 1. Asalla Corporation, which applies manufacturing overhead on the basis of machine- hours, has provided the following data for its most recent year of operations: Estimated machine-hours 22,000 machine-hours Actual machine hours incurred 25,000 machine-hours Estimated variable manufacturing overhead S4.50 per machine-hour Estimated total fixed manufacturing overhead $110.000 Actual manufacturing overhead cost incurred $200,000 Required: (a) Calculate the Predetermined Manufacturing Overhead Rate for the recently completed year. (3 marks) (b) Compute the amount of over/under applied manufacturing overhead cost for the year. (2 marks) (c) Write a note on the treatment of over/under applied manufacturing overhead cost (calculated in b) when calculating COGS and its impact on the company's gross margin and net income. (3 marks) 2. List two differences between Job order costing and process costing. Give one example of business under each costing system (3 marks) 3. Define the following concepts: (4+1-4 marks) Variable cost b. Differential cost and revenue C. Margin of Safety in respect of units d. Breakeven point in respect of sales Part C: Work out Problems. Answer all questions. / 20 Marks] / 45 minutes and 10 minutes for uploading/ 1. The following are the sales forecast of Avril Furniture Company for the upcoming fiscal SH (UNITED STATES) ACT145 Final Fall Session 2020 [ Part B and Part C] - Microsoft Word MAILINGS REVIEW VIEW REFERENCES - EE.EE ALT | . 1 Normal 1 No Spac... Heading 1 Heading 2 Title aly. A ==== HE Paragraph Styles b. Differential cost and revenue c. Margin of Safety in respect of units. d. Breakeven point in respect of sales. Part C: Work out Problems. Answer all questions. [ 20 Marks] [ 45 minutes and 10 minutes for uploading] 1. The following are the sales forecast of Avril Furniture Company for the upcoming fiscal + year Year 2 Year 3 Quarter 1 Quarter 2 Quarter 3 Quarter 4 Quarter 1 Budgeted unit sales 10,000 16,000 15,000 23,000 30,000 Past experience has shown that the ending inventory for each quarter should be equal to 10% of the next quarter's sales in units. The company expect to start the first quarter with 4,000 units. Two pounds of material A are required for each unit produced. The company has a policy of maintaining a stock of material A on hand at the end of each quarter equal to 25% of the next quarter's production needs for material A. Fourth quarter ending of materials is estimated as 8,000 pounds and a total of 12,000 pounds of material A are on hand to start the year. The cost of material A is $3 per pound. Required: I a. Prepare a production budget showing the number of units to be produced each quarter and for the year in total (5 marks) b. Prepare Avril's Direct Material Budget and calculate direct materials dollar amount of purchases by quarter and for the year in total (8 marks). . TABLE TOOLS 20[ Part B and Part C] - Microsoft Word REFERENCES MAILINGS REVIEW VIEW DESIGN LAYOUT FEE AL ST R : -- AaBbCcDc AaBbCcDc AaBb C AaBbcc 1 Normal 1 No Spac... Heading 1 Heading 2 - A- Styles Paragraph 2. Ingrim Corporation uses Weighted Average in its process costing system. The following data concer the company's Processing Department for the month of May: Percentage of Completion Units Direct Materials Conversion Costs 30% 5,000 65% Work-in-process beg, May 13 Units Completed and Transferred out 9,000 6,000 Work-in-process end, May 30th 50% 10% Amount $5,300 $10.200 $15,500 Costs in the WIP, May 1st Materials Cost Conversion Cost Total Cost Costs added during May 30th Materials Cost Conversion Cost Total Cost $250.000 $430.000 $680.000 A Required: [? Marks] a. Determine the equivalent units of production for materials and conversion (3 marks). b. Determine the cost per equivalent unit for materials and conversion costs (consider two decimals) (2 marks) c. Determine the total cost of completed & transferred out units and total cost of work in process ending (2 marks)