Answered step by step

Verified Expert Solution

Question

1 Approved Answer

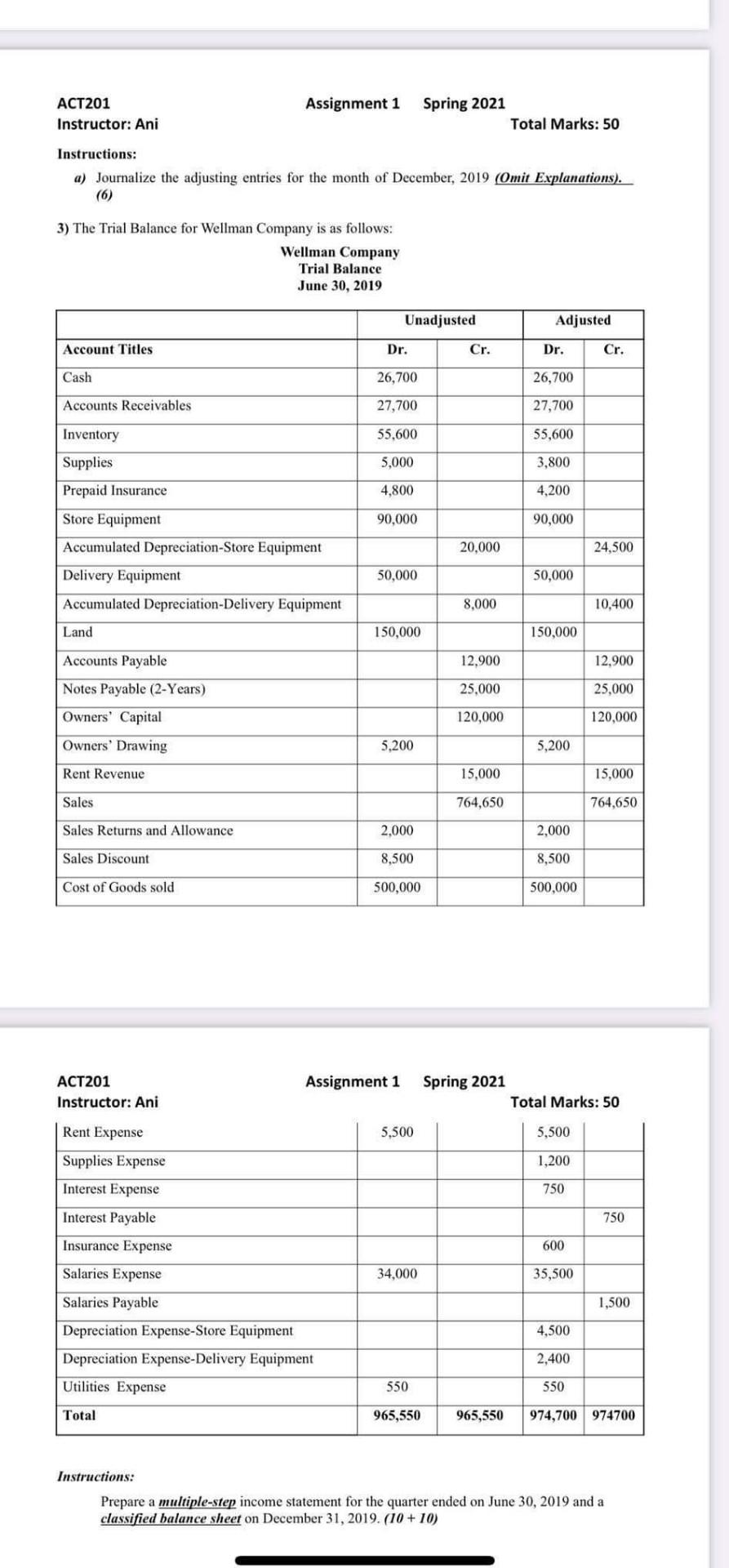

ACT201 Assignment 1 Spring 2021 Instructor: Ani Total Marks: 50 Instructions: a) Journalize the adjusting entries for the month of December, 2019 (Omit Explanations). (6)

ACT201 Assignment 1 Spring 2021 Instructor: Ani Total Marks: 50 Instructions: a) Journalize the adjusting entries for the month of December, 2019 (Omit Explanations). (6) 3) The Trial Balance for Wellman Company is as follows: Wellman Company Trial Balance June 30, 2019 Unadjusted Adjusted Account Titles Dr. Cr. Dr. Cr. Cash 26,700 26,700 Accounts Receivables 27,700 27,700 55,600 55,600 Inventory Supplies Prepaid Insurance 5,000 3,800 4,800 4,200 90,000 90,000 20.000 24,500 Store Equipment Accumulated Depreciation-Store Equipment Delivery Equipment Accumulated Depreciation-Delivery Equipment 50,000 50,000 8,000 10,400 Land 150,000 150,000 12.900 12,900 Accounts Payable Notes Payable (2-Years) Owners' Capital 25,000 25,000 120,000 120,000 Owners' Drawing 5,200 5,200 Rent Revenue 15,000 15.000 Sales 764,650 764,650 Sales Returns and Allowance 2.000 2,000 Sales Discount 8.500 8,500 Cost of Goods sold 500,000 500,000 Assignment 1 ACT201 Instructor: Ani Spring 2021 Total Marks: 50 Rent Expense 5,500 5,500 1,200 Supplies Expense Interest Expense 750 750 Interest Payable Insurance Expense Salaries Expense 600 34,000 35,500 Salaries Payable 1,500 Depreciation Expense-Store Equipment 4,500 2,400 Depreciation Expense-Delivery Equipment Utilities Expense 550 550 Total 965,550 965,550 974,700 974700 Instructions: Prepare a multiple-step income statement for the quarter ended on June 30, 2019 and a classified balance sheet on December 31, 2019. (10 + 10)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started