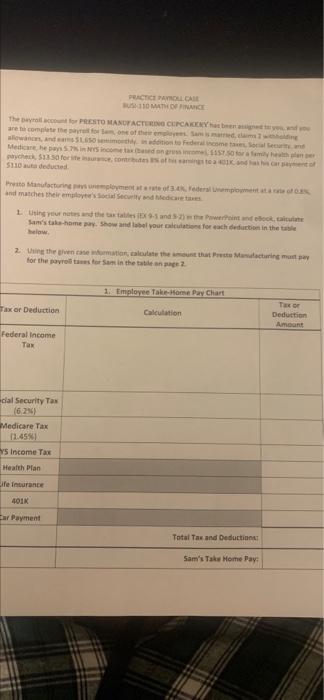

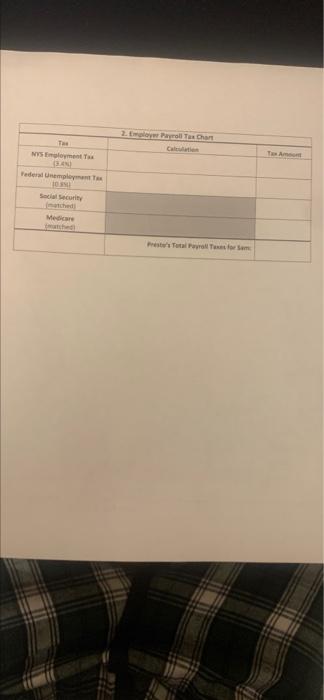

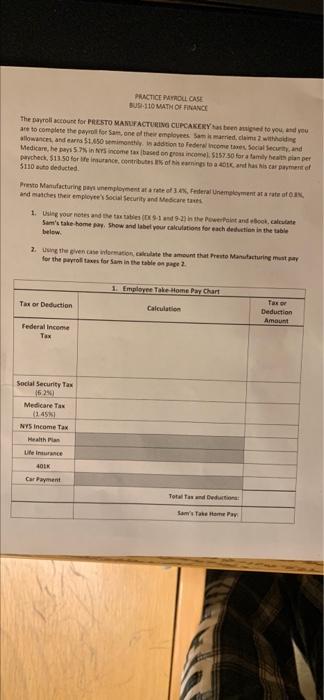

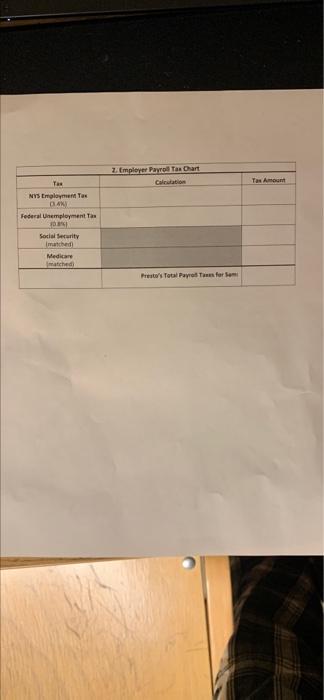

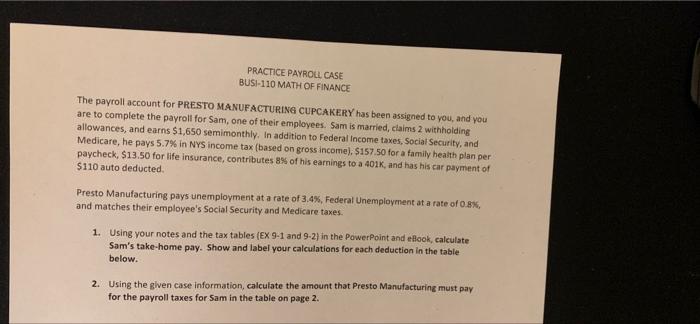

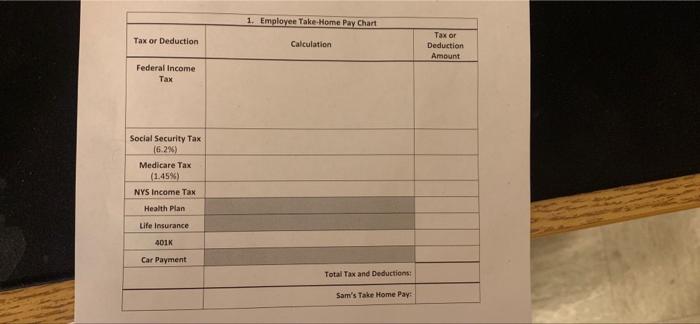

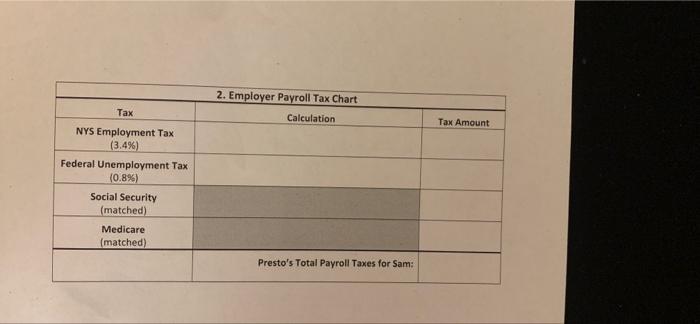

ACTICAL CARE MATHE The wyrai PRESTO MANUFACTURING CUPCAKE are complete the form of the name was, and motion to Federal come Medicare in Sicons so forma check for its contestato 5810 at deducted Presto Manufacturing employment des momento and matches their meer dedicare 1. Using your nutes the states and indookalite Sane's take home. Show and love your foreachdeution in the tale how 2 the generation, calotte them that rest Mastering musta for the parts for Sam in the tablean 2 1. Employee TakeHome Pay Chart Taxor Deduction Calculation er Deduction Amount Federal Income Tax cial Security Tas (623) Medicare Tax y Income Tax Health Plan Life Insurance 401K Car Payment Total Tax and Deduction Sam's Take Home Pay: Ca NYS Flomat der 10 Sched Medicare PRACTICE PAYROLL CASE SUSO MATH OF FINANCE The payroll account for PRESTO MANUFACTURING CUPCAKERY hasted to you and you are to complete the roll for Sam, one of the employees and claim the allowance, and earn $1.450 imothy dition to Federal con Social Securand Medicare, he in income tax based on proin.com 17:30 for the percheck. $11.50 for the contributes of the 5110 e deducted Presto Manufacturing unemployment of features and matches their employee Social Security and Medicare 1. in your notes and taste 1-2 is the tandbook Sant's take home. Show and the your calculations for eached in the below. 2. the generation call the meant that he Machine for the parts for Sain the table2 1 Employee Take Home Pay Chart Tax or Deduction Calculation Taxor Deduction Amount Federal Income Tax Social Security Tax 15.25 Medicare Tax (145 NYS Income Tax Health Pia Litere 40K Car Payment Total de Sam's Tanpa 2. Employer Payro Tas Chart Carotation TA Tas NYS Employment To DAK Federal Unemployment Social Security marched Medicare matched Presto Total Payrols for som PRACTICE PAYROLL CASE BUSI-110 MATH OF FINANCE The payroll account for PRESTO MANUFACTURING CUPCAKERY has been assigned to you, and you are to complete the payroll for Sam, one of their employees. Sam is married, claims 2 withholding allowances, and earns $1,650 semimonthly. In addition to Federal Income taxes, Social Security, and Medicare, he pays 5.7% in NYS income tax (based on gross income). $157.50 for a family health plan per paycheck, $13.50 for life insurance, contributes 8% of his earnings to a 401K, and has his car payment of $110 auto deducted. Presto Manufacturing pays unemployment at a rate of 3.4%, Federal Unemployment at a rate of 0.8%. and matches their employee's Social Security and Medicare taxes. 1. Using your notes and the tax tables (EX 9-1 and 9-2) in the PowerPoint and flook, calculate Sam's take-home pay. Show and label your calculations for each deduction in the table below. 2. Using the given case information, calculate the amount that Presto Manufacturing must pay for the payroll taxes for Sam in the table on page 2 1. Employee Take Home Pay Chart Tax or Deduction Calculation Tax or Deduction Amount Federal Income Tax Social Security Tax (6.296) Medicare Tax (1.45%) NYS Income Tax Health Plan Life Insurance 401K Car Payment Total Tax and Deductions Sam's Take Home Pay: 2. Employer Payroll Tax Chart Calculation Tax Tax Amount NYS Employment Tax (3.4%) Federal Unemployment Tax (0.8%) Social Security (matched) Medicare (matched) Presto's Total Payroll Taxes for Sam: ACTICAL CARE MATHE The wyrai PRESTO MANUFACTURING CUPCAKE are complete the form of the name was, and motion to Federal come Medicare in Sicons so forma check for its contestato 5810 at deducted Presto Manufacturing employment des momento and matches their meer dedicare 1. Using your nutes the states and indookalite Sane's take home. Show and love your foreachdeution in the tale how 2 the generation, calotte them that rest Mastering musta for the parts for Sam in the tablean 2 1. Employee TakeHome Pay Chart Taxor Deduction Calculation er Deduction Amount Federal Income Tax cial Security Tas (623) Medicare Tax y Income Tax Health Plan Life Insurance 401K Car Payment Total Tax and Deduction Sam's Take Home Pay: Ca NYS Flomat der 10 Sched Medicare PRACTICE PAYROLL CASE SUSO MATH OF FINANCE The payroll account for PRESTO MANUFACTURING CUPCAKERY hasted to you and you are to complete the roll for Sam, one of the employees and claim the allowance, and earn $1.450 imothy dition to Federal con Social Securand Medicare, he in income tax based on proin.com 17:30 for the percheck. $11.50 for the contributes of the 5110 e deducted Presto Manufacturing unemployment of features and matches their employee Social Security and Medicare 1. in your notes and taste 1-2 is the tandbook Sant's take home. Show and the your calculations for eached in the below. 2. the generation call the meant that he Machine for the parts for Sain the table2 1 Employee Take Home Pay Chart Tax or Deduction Calculation Taxor Deduction Amount Federal Income Tax Social Security Tax 15.25 Medicare Tax (145 NYS Income Tax Health Pia Litere 40K Car Payment Total de Sam's Tanpa 2. Employer Payro Tas Chart Carotation TA Tas NYS Employment To DAK Federal Unemployment Social Security marched Medicare matched Presto Total Payrols for som PRACTICE PAYROLL CASE BUSI-110 MATH OF FINANCE The payroll account for PRESTO MANUFACTURING CUPCAKERY has been assigned to you, and you are to complete the payroll for Sam, one of their employees. Sam is married, claims 2 withholding allowances, and earns $1,650 semimonthly. In addition to Federal Income taxes, Social Security, and Medicare, he pays 5.7% in NYS income tax (based on gross income). $157.50 for a family health plan per paycheck, $13.50 for life insurance, contributes 8% of his earnings to a 401K, and has his car payment of $110 auto deducted. Presto Manufacturing pays unemployment at a rate of 3.4%, Federal Unemployment at a rate of 0.8%. and matches their employee's Social Security and Medicare taxes. 1. Using your notes and the tax tables (EX 9-1 and 9-2) in the PowerPoint and flook, calculate Sam's take-home pay. Show and label your calculations for each deduction in the table below. 2. Using the given case information, calculate the amount that Presto Manufacturing must pay for the payroll taxes for Sam in the table on page 2 1. Employee Take Home Pay Chart Tax or Deduction Calculation Tax or Deduction Amount Federal Income Tax Social Security Tax (6.296) Medicare Tax (1.45%) NYS Income Tax Health Plan Life Insurance 401K Car Payment Total Tax and Deductions Sam's Take Home Pay: 2. Employer Payroll Tax Chart Calculation Tax Tax Amount NYS Employment Tax (3.4%) Federal Unemployment Tax (0.8%) Social Security (matched) Medicare (matched) Presto's Total Payroll Taxes for Sam