Answered step by step

Verified Expert Solution

Question

1 Approved Answer

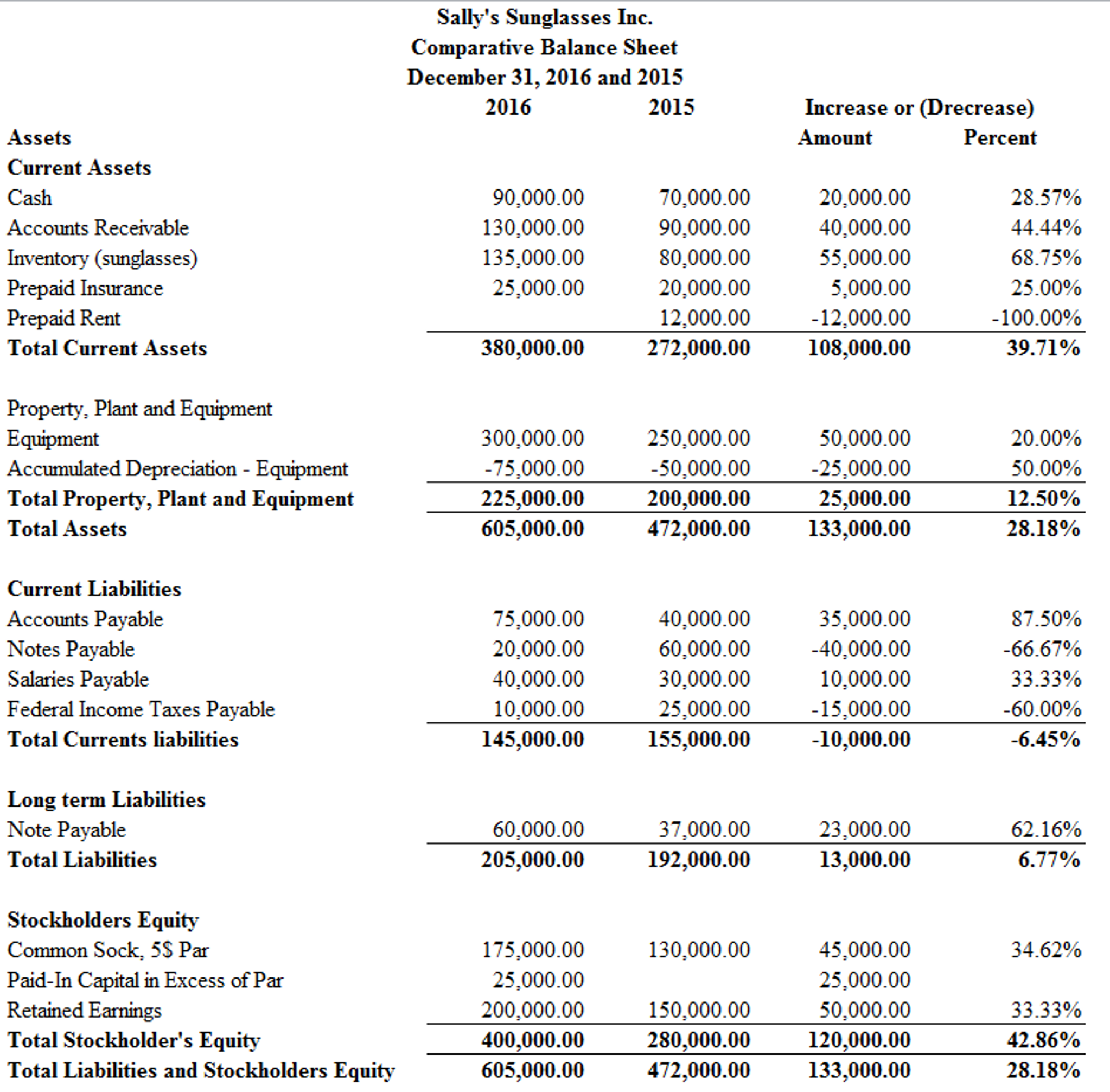

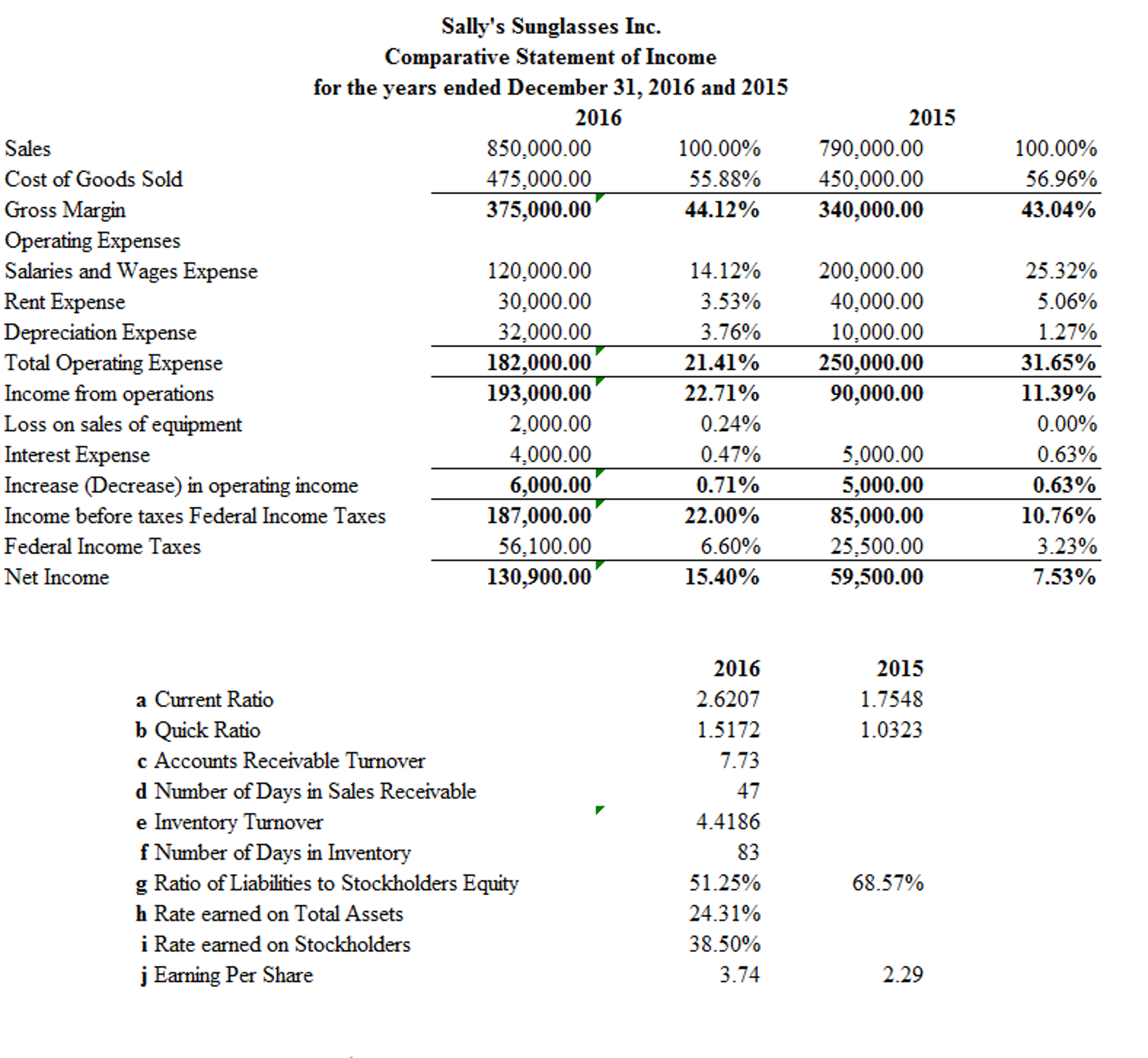

Acting as an accounting advisor to the firm, prepare a memo in which you analyze the financial statements you prepared and along with the ratios

Acting as an accounting advisor to the firm, prepare a memo in which you analyze the financial statements you prepared and along with the ratios that you have calculated prepare an analysis of the companys financial position. Identify two strengths and two weaknesses in the company. Make two recommendations to improve the companys financial position. Be specific in each of the recommendations and use the ratios to support your analysis. The length should be no more than two paragraphs long.

Acting as an accounting advisor to the firm, prepare a memo in which you analyze the financial statements you prepared and along with the ratios that you have calculated prepare an analysis of the companys financial position. Identify two strengths and two weaknesses in the company. Make two recommendations to improve the companys financial position. Be specific in each of the recommendations and use the ratios to support your analysis. The length should be no more than two paragraphs long.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started