Answered step by step

Verified Expert Solution

Question

1 Approved Answer

active portfolio with expected return 18% and standard deviation 28%. The risk-free rate is 3%. 27. Draw the CML and your funds' CAL on an

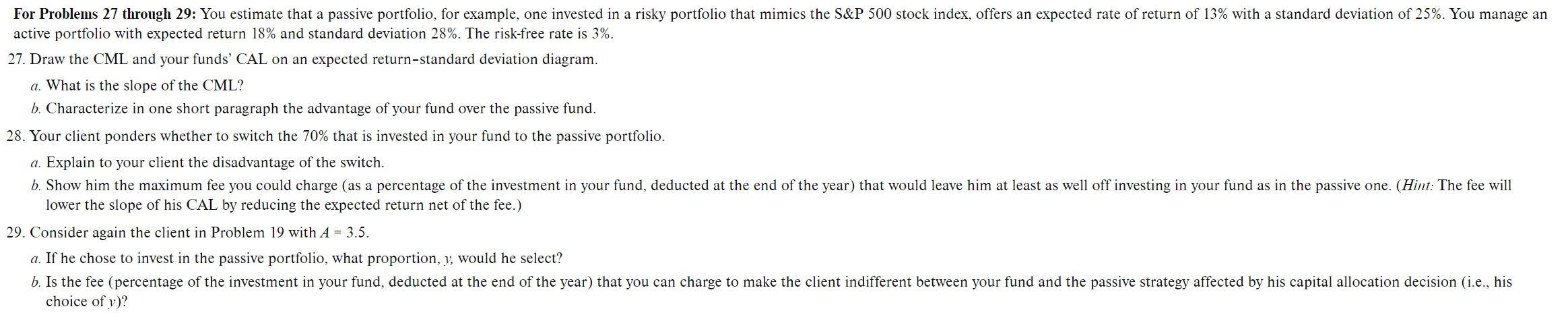

active portfolio with expected return 18% and standard deviation 28%. The risk-free rate is 3%. 27. Draw the CML and your funds' CAL on an expected return-standard deviation diagram. a. What is the slope of the CML? b. Characterize in one short paragraph the advantage of your fund over the passive fund. 28. Your client ponders whether to switch the 70% that is invested in your fund to the passive portfolio. a. Explain to your client the disadvantage of the switch. lower the slope of his CAL by reducing the expected return net of the fee.) 29. Consider again the client in Problem 19 with A=3.5. a. If he chose to invest in the passive portfolio, what proportion, y, would he select? choice of y )? active portfolio with expected return 18% and standard deviation 28%. The risk-free rate is 3%. 27. Draw the CML and your funds' CAL on an expected return-standard deviation diagram. a. What is the slope of the CML? b. Characterize in one short paragraph the advantage of your fund over the passive fund. 28. Your client ponders whether to switch the 70% that is invested in your fund to the passive portfolio. a. Explain to your client the disadvantage of the switch. lower the slope of his CAL by reducing the expected return net of the fee.) 29. Consider again the client in Problem 19 with A=3.5. a. If he chose to invest in the passive portfolio, what proportion, y, would he select? choice of y )

active portfolio with expected return 18% and standard deviation 28%. The risk-free rate is 3%. 27. Draw the CML and your funds' CAL on an expected return-standard deviation diagram. a. What is the slope of the CML? b. Characterize in one short paragraph the advantage of your fund over the passive fund. 28. Your client ponders whether to switch the 70% that is invested in your fund to the passive portfolio. a. Explain to your client the disadvantage of the switch. lower the slope of his CAL by reducing the expected return net of the fee.) 29. Consider again the client in Problem 19 with A=3.5. a. If he chose to invest in the passive portfolio, what proportion, y, would he select? choice of y )? active portfolio with expected return 18% and standard deviation 28%. The risk-free rate is 3%. 27. Draw the CML and your funds' CAL on an expected return-standard deviation diagram. a. What is the slope of the CML? b. Characterize in one short paragraph the advantage of your fund over the passive fund. 28. Your client ponders whether to switch the 70% that is invested in your fund to the passive portfolio. a. Explain to your client the disadvantage of the switch. lower the slope of his CAL by reducing the expected return net of the fee.) 29. Consider again the client in Problem 19 with A=3.5. a. If he chose to invest in the passive portfolio, what proportion, y, would he select? choice of y ) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started