Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Activity 1 : Employment Termination Payment Jeremy Lim has consulted with you and requested you to prepare working papers and to lodge his tax documentation.

Activity : Employment Termination Payment

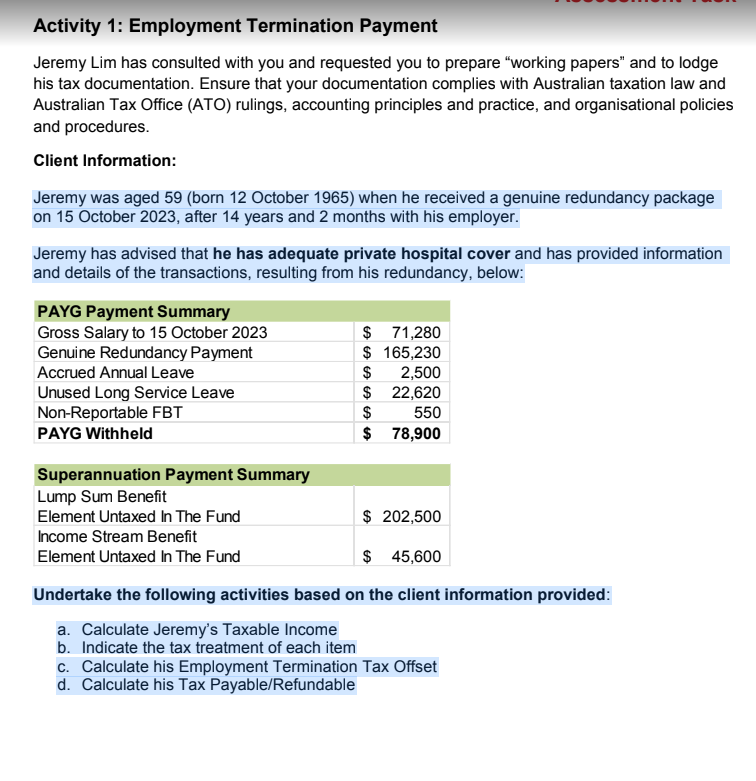

Jeremy Lim has consulted with you and requested you to prepare "working papers" and to lodge his tax documentation. Ensure that your documentation complies with Australian taxation law and Australian Tax Office ATO rulings, accounting principles and practice, and organisational policies and procedures.

Client Information:

Jeremy was aged born October when he received a genuine redundancy package on October after years and months with his employer.

Jeremy has advised that he has adequate private hospital cover and has provided information and details of the transactions, resulting from his redundancy, below:

Undertake the following activities based on the client information provided:

a Calculate Jeremy's Taxable Income

b Indicate the tax treatment of each item

c Calculate his Employment Termination Tax Offset

d Calculate his Tax PayableRefundable

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started