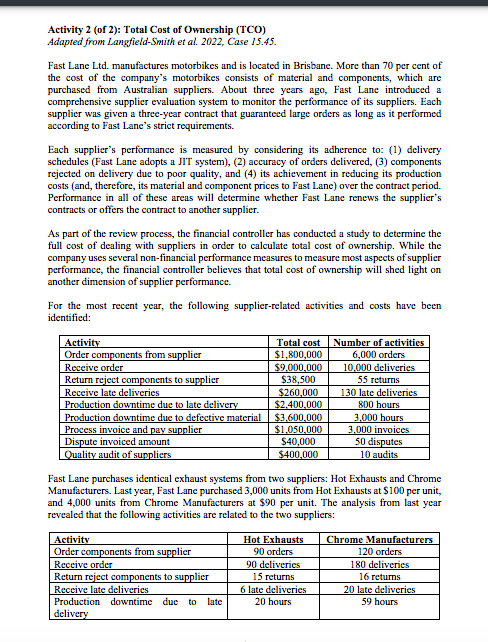

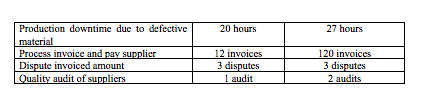

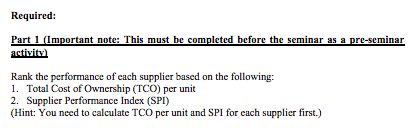

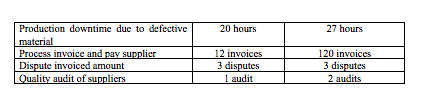

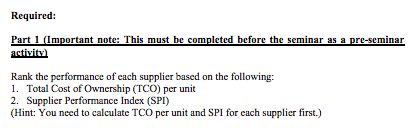

Activity 2 (of 2): Total Cost of Ownership ( TCO ) Adapted from Langfield-Smith et al. 2022, Case 15.45. Fast Lane Ltd. manufactures motorbikes and is located in Brisbane. More than 70 per cent of the cost of the company's motorbikes consists of material and components, which are purchased from Australian suppliers. About three years ago, Fast Lane introduced a comprehensive supplier evaluation system to monitor the performance of its suppliers. Each supplier was given a three-year contract that guaranteed large orders as long as it performed according to Fast Lane's strict requirements. Each supplier's performance is measured by considering its adherence to: (1) delivery schedules (Fast Lane adopts a JIT system), (2) accuracy of orders delivered, (3) components rejected on delivery due to poor quality, and (4) its achievement in reducing its production costs (and, therefore, its material and component prices to Fast Lane) over the contract period. Performance in all of these areas will determine whether Fast Lane renews the supplier's contracts or offers the contract to another supplier. As part of the review process, the financial controller has conducted a study to determine the full cost of dealing with suppliers in order to calculate total cost of ownership. While the company uses several non-financial performance measures to measure most aspects of supplier performance, the financial controller believes that total cost of ownership will shed light on another dimension of supplier performance. For the most recent year, the following supplier-related activities and costs have been identified: Fast Lane purchases identical exhaust systems from two suppliers: Hot Exhausts and Chrome Manufacturers. Last year, Fast Lane purchased 3,000 units from Hot Exhausts at $100 per unit, and 4,000 units from Chrome Manufacturers at $90 per unit. The analysis from last year revealed that the following activities are related to the two suppliers: \begin{tabular}{|l|c|c|} \hline Production downtime due to defective material & 20 hours & 27 hours \\ \hline Process invoice and pay supplier & 12 invoices & 120 invoices \\ \hline Dispute invoiced amount & 3 disputes & 3 disputes \\ \hline Quality audit of suppliers & 1 audit & 2 audits \\ \hline \end{tabular} Required: Part 1 (Important note: This must be completed before the seminar as a pre-seminar activity. Rank the performance of each supplier based on the following: 1. Total Cost of Ownership (TCO) per unit 2. Supplier Performance Index (SPI) (Hint: You need to calculate TCO per unit and SPI for each supplier first.) Activity 2 (of 2): Total Cost of Ownership ( TCO ) Adapted from Langfield-Smith et al. 2022, Case 15.45. Fast Lane Ltd. manufactures motorbikes and is located in Brisbane. More than 70 per cent of the cost of the company's motorbikes consists of material and components, which are purchased from Australian suppliers. About three years ago, Fast Lane introduced a comprehensive supplier evaluation system to monitor the performance of its suppliers. Each supplier was given a three-year contract that guaranteed large orders as long as it performed according to Fast Lane's strict requirements. Each supplier's performance is measured by considering its adherence to: (1) delivery schedules (Fast Lane adopts a JIT system), (2) accuracy of orders delivered, (3) components rejected on delivery due to poor quality, and (4) its achievement in reducing its production costs (and, therefore, its material and component prices to Fast Lane) over the contract period. Performance in all of these areas will determine whether Fast Lane renews the supplier's contracts or offers the contract to another supplier. As part of the review process, the financial controller has conducted a study to determine the full cost of dealing with suppliers in order to calculate total cost of ownership. While the company uses several non-financial performance measures to measure most aspects of supplier performance, the financial controller believes that total cost of ownership will shed light on another dimension of supplier performance. For the most recent year, the following supplier-related activities and costs have been identified: Fast Lane purchases identical exhaust systems from two suppliers: Hot Exhausts and Chrome Manufacturers. Last year, Fast Lane purchased 3,000 units from Hot Exhausts at $100 per unit, and 4,000 units from Chrome Manufacturers at $90 per unit. The analysis from last year revealed that the following activities are related to the two suppliers: \begin{tabular}{|l|c|c|} \hline Production downtime due to defective material & 20 hours & 27 hours \\ \hline Process invoice and pay supplier & 12 invoices & 120 invoices \\ \hline Dispute invoiced amount & 3 disputes & 3 disputes \\ \hline Quality audit of suppliers & 1 audit & 2 audits \\ \hline \end{tabular} Required: Part 1 (Important note: This must be completed before the seminar as a pre-seminar activity. Rank the performance of each supplier based on the following: 1. Total Cost of Ownership (TCO) per unit 2. Supplier Performance Index (SPI) (Hint: You need to calculate TCO per unit and SPI for each supplier first.)