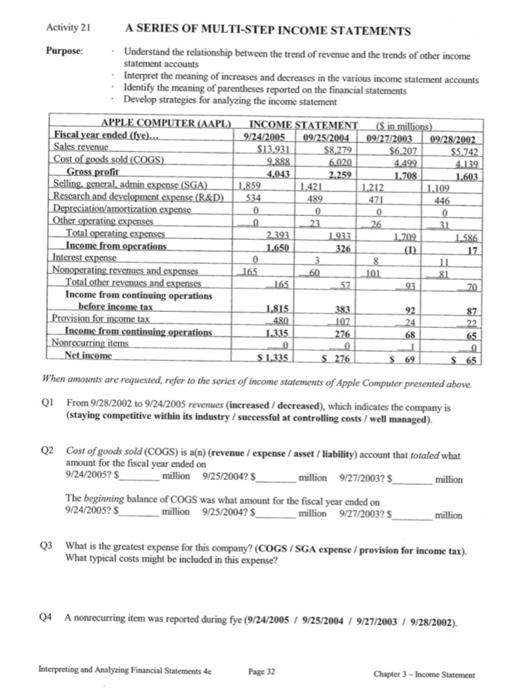

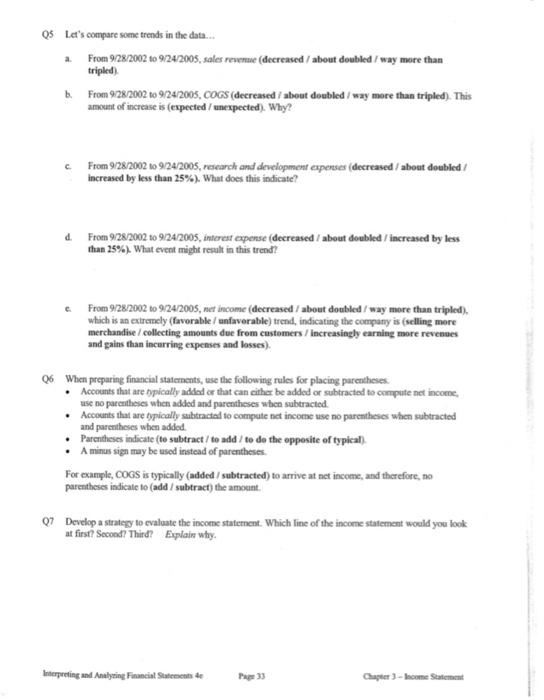

Activity 21 A SERIES OF MULTI-STEP INCOME STATEMENTS Purpose: Understand the relationship between the trend of revenue and the trends of other income statement accounts Interpret the meaning of increases and decreases in the various income statement accounts Identify the meaning of parentheses reported on the financial statements Develop strategies for analyzing the income statement APPLE COMPUTER (AAPL) INCOME STATEMENT (Sin millions) Fiscal year ended (fy)... 9/24/2005 09/25/2004 09/27/2003 09/28/2002 Sales revenus $13.931 58.279 $6.207 $5.742 Cost of goods sold (COGS) 9.888 6.020 4.499 4.139 Gross profit 4,043 2.259 1.708 1.603 Selling, general, admin.cspense (SGA) 1.859 1.421 1.212 1.109 Research and development expense (R&D) 489 446 Depreciation amortization expense 0 0 O Other operating expenses 22 26 31 Total operating expenses 2392 1.923 1.709 1.586 Income from operations 1.650 326 (1) 17 Interest expense 0 8 11 Nonoperating revenues and expenses 165 60 101 81 Total other revenues and expenses 165 52 20 Income from continuing operations before income tax 1.815 383 92 87 Provision for income tax 480 107 24 22 Income from continuing operations 1.135 276 68 65 Nonrecurring items 1 Net income S1.135 $ 276 S69 S_65 471 93 0 0 Wher amounts are requested, refer to the series of income statements of Apple Computer presented above Q1 From 9/28/2002 to 9/24/2005 revenues (increased / decreased), which indicates the company is (staying competitive within its industry / successful at controlling costs/well managed) Q2 Cost of goods sold (COGS) is a(n) (revenue / expense l asset / liability) account that totaled what amount for the fiscal year ended on 9/24/200575 million 9/25/20042 million 9/27/2003? The beginning balance of COGS was what amount for the fiscal year ended on 9/24/2005 million 9/25/2004? million 9/27/200325 million million Q3 What is the greatest expense for this company? (COGS/SGA expense/provision for income tax) What typical costs might be included in this expense? 04 A nonrecurring item was reported during fye (9/24/2005 / 9/25/2004 / 9127/2003 / 9/28/2002). Interpreting and Analyzing Financial Statements de Page 32 Chapter 3 - Income Statement 05 Let's compare some trends in the data... 1. From 928/2002 to 9/24/2005, sales revenue (decreased / about doubled / way more than tripled) From 9/28/2002 10 9/24/2005, COGS (decreased about doubled / way more than tripled). This amount of increase is (expected / unexpected). Why? From 9/28/2002 to 9/24/2005, research and development expenses (decreased / about doubled increased by less than 25%). What does this indicate? 4. From 9/28/2002 to 9/24/2005, interest expense (decreased about doubled / increased by less than 25%). What event might result in this trend? From 9/28/2002 to 9/24/2005, net income (decreased / about doubled / way more than tripled), which is an extremely (favorable / unfavorable) trend, indicating the company is (selling more merchandise / collecting amounts due from customers / Increasingly earning more revenues and gains than incurring expenses and losses) 06 When preparing financial statements, tase tae following rules for placing parentheses Accounts that are typically added or that can either be added or subtracted to compute net income use no parentheses when added and parentheses when subtracted Accounts that are typically subtracted to compute net income use no parentheses when subtracted Parentheses indicate (to subtract / to add / to do the opposite of typical) A minus sign may be used instead of parentheses For example, COGS is typically (added / subtracted) to arrive at net income, and therefore, to parentheses indicate to add / subtract) the amount 07 Develop a strategy to evaluate the income statement. Which line of the income statement would you look at first second Third? Explain why. Interpreting and Analyting Financial Statements Page 33 Chapter 3 - Income Statement