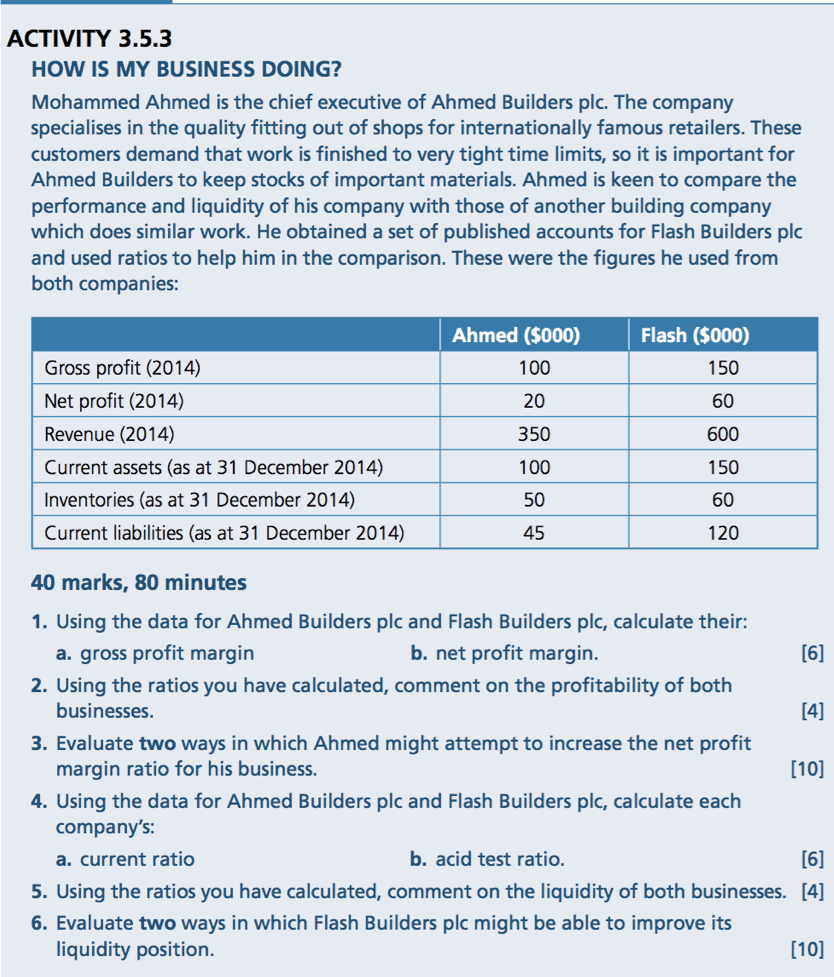

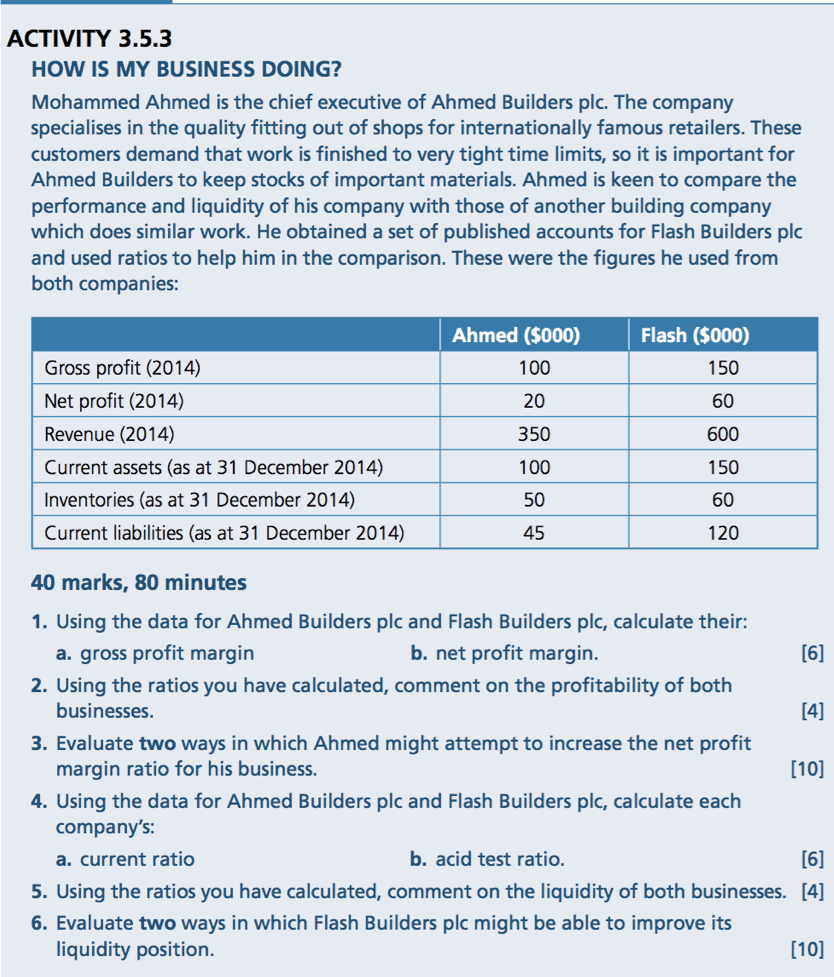

ACTIVITY 3.5.3 HOW IS MY BUSINESS DOING? Mohammed Ahmed is the chief executive of Ahmed Builders plc. The company specialises in the quality fitting out of shops for internationally famous retailers. These customers demand that work is finished to very tight time limits, so it is important for Ahmed Builders to keep stocks of important materials. Ahmed is keen to compare the performance and liquidity of his company with those of another building company which does similar work. He obtained a set of published accounts for Flash Builders plc and used ratios to help him in the comparison. These were the figures he used from both companies: Ahmed ($000) 100 Flash ($000) 150 60 20 350 600 Gross profit (2014) Net profit (2014) Revenue (2014) Current assets (as at 31 December 2014) Inventories (as at 31 December 2014) Current liabilities (as at 31 December 2014) 100 150 50 60 45 120 40 marks, 80 minutes 1. Using the data for Ahmed Builders plc and Flash Builders plc, calculate their: a. gross profit margin b. net profit margin. [6] 2. Using the ratios you have calculated, comment on the profitability of both businesses. [4] 3. Evaluate two ways in which Ahmed might attempt to increase the net profit margin ratio for his business. [10] 4. Using the data for Ahmed Builders plc and Flash Builders plc, calculate each company's: a. current ratio b. acid test ratio. [6] 5. Using the ratios you have calculated, comment on the liquidity of both businesses. [4] 6. Evaluate two ways in which Flash Builders plc might be able to improve its liquidity position. [10] ACTIVITY 3.5.3 HOW IS MY BUSINESS DOING? Mohammed Ahmed is the chief executive of Ahmed Builders plc. The company specialises in the quality fitting out of shops for internationally famous retailers. These customers demand that work is finished to very tight time limits, so it is important for Ahmed Builders to keep stocks of important materials. Ahmed is keen to compare the performance and liquidity of his company with those of another building company which does similar work. He obtained a set of published accounts for Flash Builders plc and used ratios to help him in the comparison. These were the figures he used from both companies: Ahmed ($000) 100 Flash ($000) 150 60 20 350 600 Gross profit (2014) Net profit (2014) Revenue (2014) Current assets (as at 31 December 2014) Inventories (as at 31 December 2014) Current liabilities (as at 31 December 2014) 100 150 50 60 45 120 40 marks, 80 minutes 1. Using the data for Ahmed Builders plc and Flash Builders plc, calculate their: a. gross profit margin b. net profit margin. [6] 2. Using the ratios you have calculated, comment on the profitability of both businesses. [4] 3. Evaluate two ways in which Ahmed might attempt to increase the net profit margin ratio for his business. [10] 4. Using the data for Ahmed Builders plc and Flash Builders plc, calculate each company's: a. current ratio b. acid test ratio. [6] 5. Using the ratios you have calculated, comment on the liquidity of both businesses. [4] 6. Evaluate two ways in which Flash Builders plc might be able to improve its liquidity position. [10]