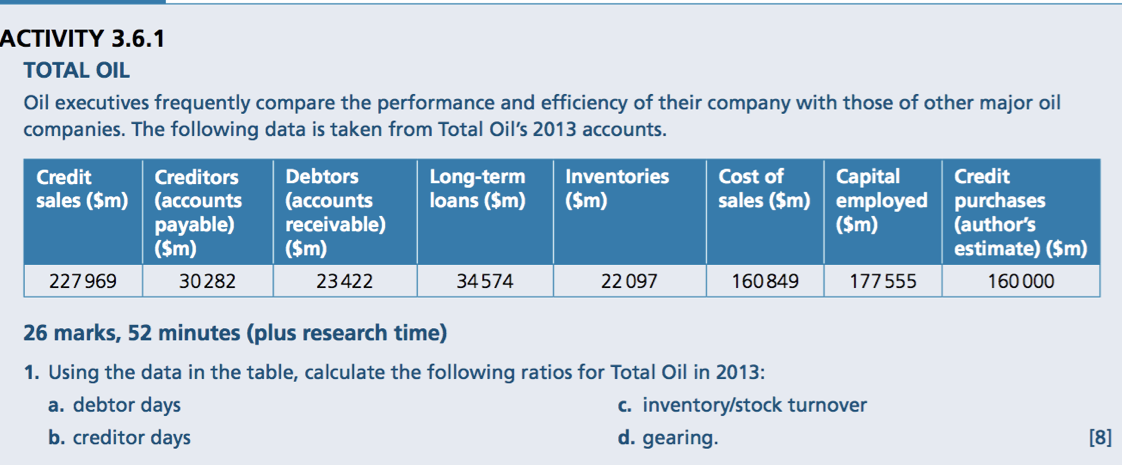

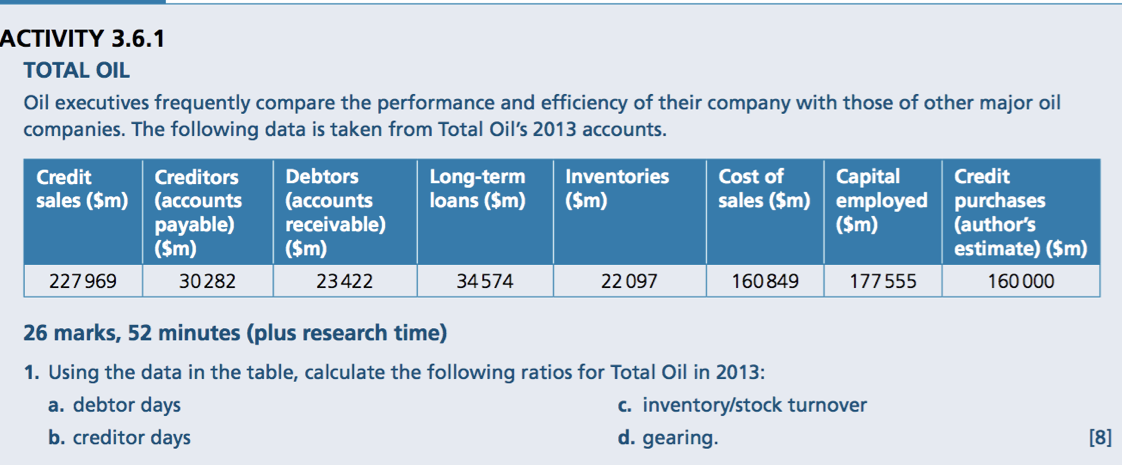

ACTIVITY 3.6.1 TOTAL OIL Oil executives frequently compare the performance and efficiency of their company with those of other major oil companies. The following data is taken from Total Oil's 2013 accounts. Credit Creditors Debtors Long-term Inventories Cost of Capital Credit sales ($m) (accounts (accounts loans ($m) ($m) sales ($m) employed purchases payable) receivable) ($m) (author's ($m) ($m) estimate) ($m) 227 969 30 282 23422 34574 22 097 160 849 177555 160 000 26 marks, 52 minutes (plus research time) 1. Using the data in the table, calculate the following ratios for Total Oil in 2013: a. debtor days c. inventory/stock turnover b. creditor days d. gearing. [8] 2. Using the ratios you have calculated for Total Oil, comment on its efficiency and gearing. [8] 3. Evaluate a strategy Total Oil might use to improve its efficiency and gearing. [10] Research task Use the internet to research the efficiency and gearing ratios of another oil company for 2013 - perhaps one that operates in your country. Compare these ratio results with those for Total. Compare and contrast the efficiency and gearing of these two businesses. TOTAL C ACTIVITY 3.6.1 TOTAL OIL Oil executives frequently compare the performance and efficiency of their company with those of other major oil companies. The following data is taken from Total Oil's 2013 accounts. Credit Creditors Debtors Long-term Inventories Cost of Capital Credit sales ($m) (accounts (accounts loans ($m) ($m) sales ($m) employed purchases payable) receivable) ($m) (author's ($m) ($m) estimate) ($m) 227 969 30 282 23422 34574 22 097 160 849 177555 160 000 26 marks, 52 minutes (plus research time) 1. Using the data in the table, calculate the following ratios for Total Oil in 2013: a. debtor days c. inventory/stock turnover b. creditor days d. gearing. [8] 2. Using the ratios you have calculated for Total Oil, comment on its efficiency and gearing. [8] 3. Evaluate a strategy Total Oil might use to improve its efficiency and gearing. [10] Research task Use the internet to research the efficiency and gearing ratios of another oil company for 2013 - perhaps one that operates in your country. Compare these ratio results with those for Total. Compare and contrast the efficiency and gearing of these two businesses. TOTAL C