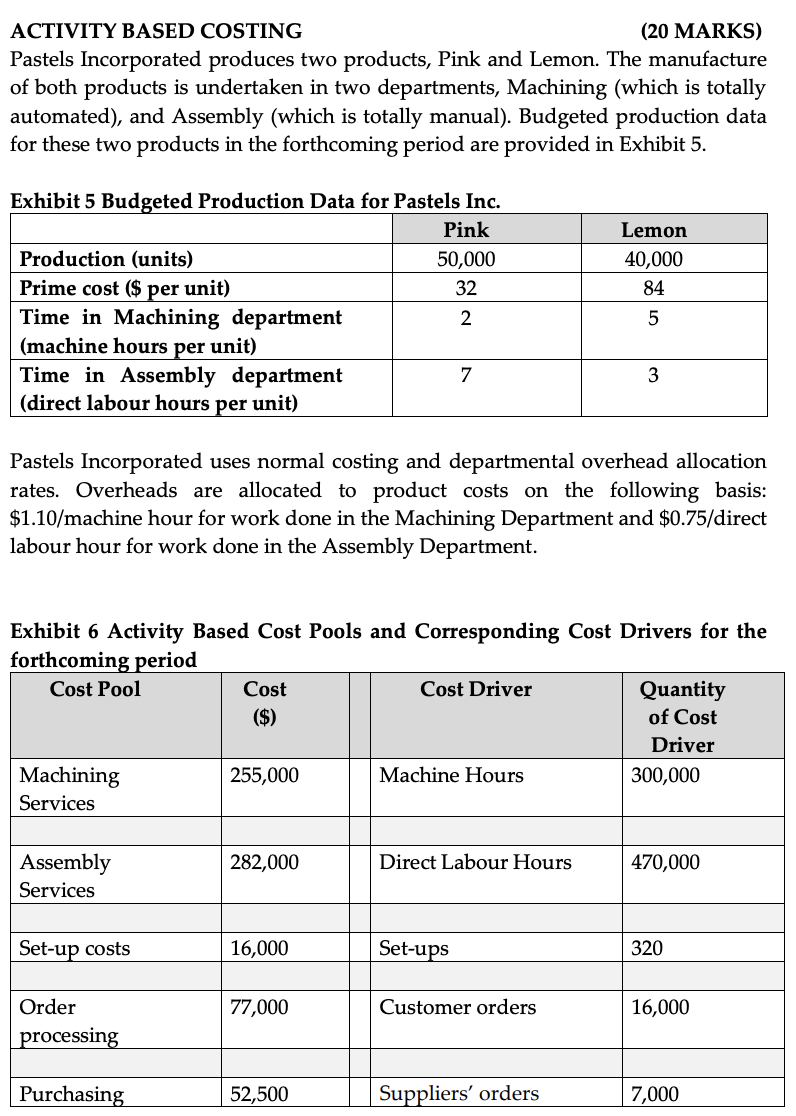

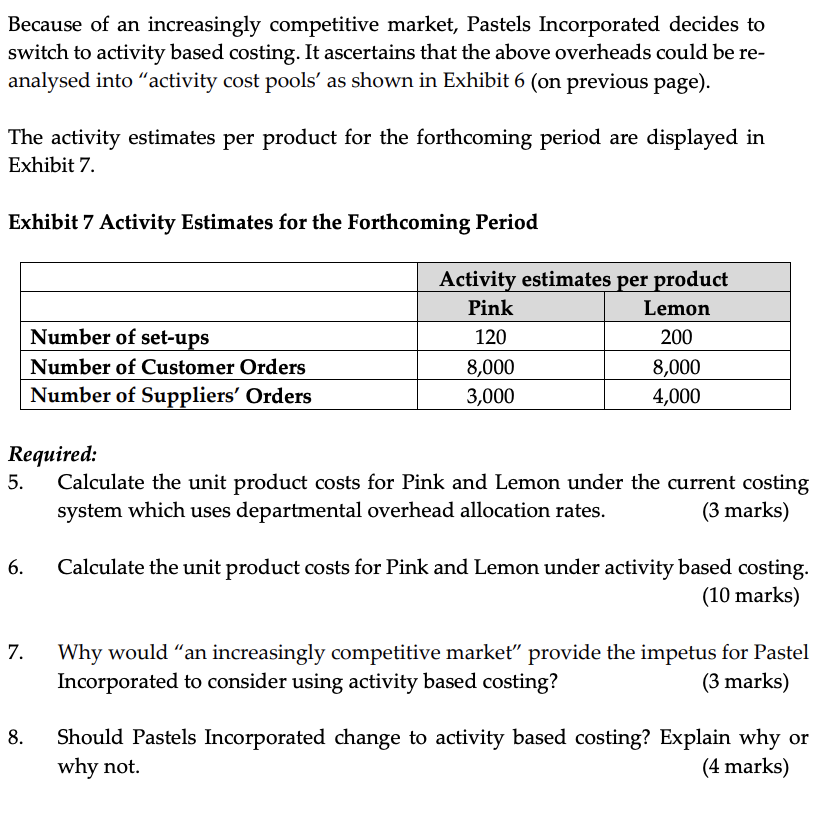

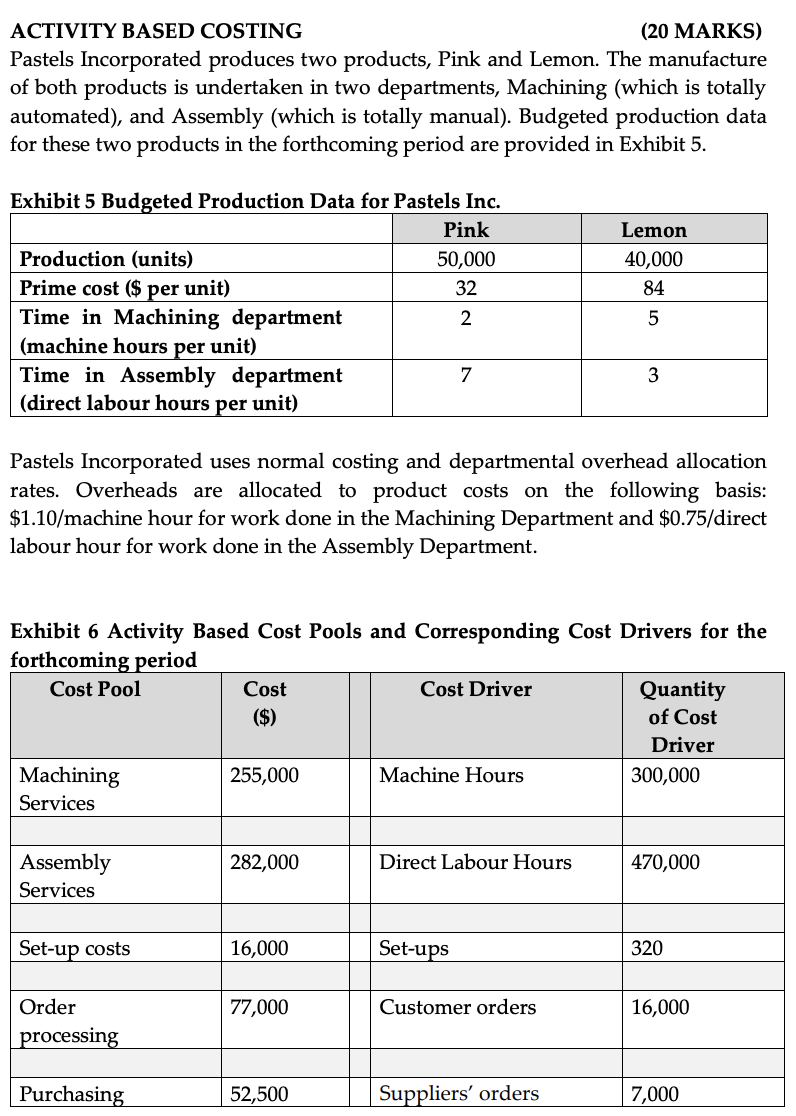

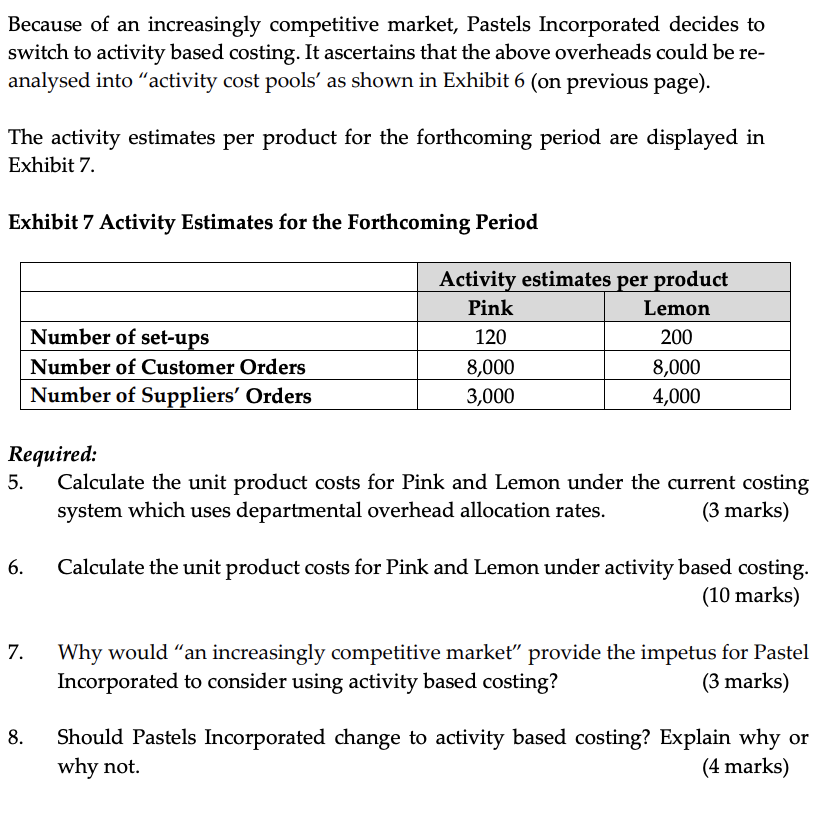

ACTIVITY BASED COSTING (20 MARKS) Pastels Incorporated produces two products, Pink and Lemon. The manufacture of both products is undertaken in two departments, Machining (which is totally automated), and Assembly (which is totally manual). Budgeted production data for these two products in the forthcoming period are provided in Exhibit 5. Exhibit 5 Budgeted Production Data for Pastels Inc. Pink Production (units) 50,000 Prime cost ($ per unit) 32 Time in Machining department 2 (machine hours per unit) Time in Assembly department 7 (direct labour hours per unit) Lemon 40,000 84 5 3 Pastels Incorporated ses normal costing and departmental overhead allocation rates. Overheads are allocated to product costs on the following basis: $1.10/machine hour for work done in the Machining Department and $0.75/direct labour hour for work done in the Assembly Department. Exhibit 6 Activity Based Cost Pools and Corresponding Cost Drivers for the forthcoming period Cost Pool Cost Cost Driver Quantity ($) of Cost Driver Machining 255,000 Machine Hours 300,000 Services 282,000 Direct Labour Hours 470,000 Assembly Services Set-up costs 16,000 Set-ups 320 77,000 Customer orders 16,000 Order processing Purchasing 52,500 Suppliers' orders 7,000 Because of an increasingly competitive market, Pastels Incorporated decides to switch to activity based costing. It ascertains that the above overheads could be re- analysed into activity cost pools' as shown in Exhibit 6 (on previous page). The activity estimates per product for the forthcoming period are displayed in Exhibit 7. Exhibit 7 Activity Estimates for the Forthcoming Period Number of set-ups Number of Customer Orders Number of Suppliers' Orders Activity estimates per product Pink Lemon 120 200 8,000 8,000 3,000 4,000 Required: 5. Calculate the unit product costs for Pink and Lemon under the current costing system which uses departmental overhead allocation rates. (3 marks) 6. Calculate the unit product costs for Pink and Lemon under activity based costing. (10 marks) 7. Why would "an increasingly competitive market" provide the impetus for Pastel Incorporated to consider using activity based costing? (3 marks) 8. Should Pastels Incorporated change to activity based costing? Explain why or why not. (4 marks)