Question

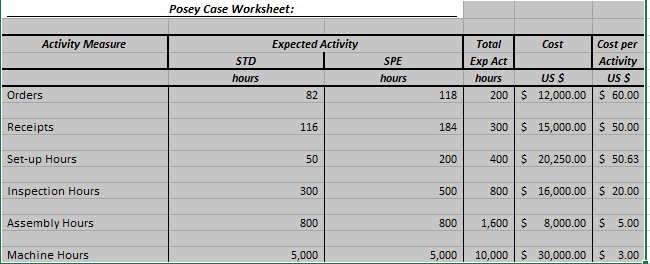

Activity Cost Pool Activity Measure Estimated Overhead $ Purchasing Number of Orders $12,000.00 Material Handling Number of Receipts $15,000.00 Production orders Set-up Hours $20,250.00 Inspection

Activity Cost Pool Activity Measure Estimated Overhead $ Purchasing Number of Orders $12,000.00 Material Handling Number of Receipts $15,000.00 Production orders Set-up Hours $20,250.00 Inspection Inspection Hours $16,000.00 Frame assembly Assembly Hours $8,000.00 Machine related Machine Hours $30,000.00 Total Manufacturing Overhead costs $101,250.00.

To complete an "activity-based" cost structure, you are required to apply manufacturing overhead to each of the briefcase products on the activity cost pool data provided. Note that the Activity Cost Pools are determined by management and therefore vary in number and total dollar cost. Under the activity based costing system you will be allocating the same "traditional" overhead costs first to the activities, and then to the products using the data provided. Please use the Part 2 worksheet to show your workings.

The following-additional information is of interest.T 1. Standard briefcases are produced in batches of 200 units, and-specialty briefcases are produced in batches of 25-units. Thus the company does 50-setups (of machinery)-for the standard items each month and-100-setups-for the specialty items.- 2. - A setup for the standard items requires one hour of time, whereas a setup for the specialty items requires 2 hours of time.I 3. All-briefcases are inspectedto ensure that international quality standards are met. .. A total of-300 hours of inspection time is spent on the standard briefcases and-500 hours ofinspection time is spent on the specialty briefcases each month. 4. A-standard-briefcase requires 0.5hours ofmachine time, anda-specialty-briefcase requires 2-hours of machine time. CarryAll-is-considering the use of activity.based-costing as an alternative toits traditional costing system when computing unit product costs.1 Since these unit product-costs-will be used-for external financialreporting, all manufacturing overhead costs are to be allocated to products and non-manufacturing costs are to-be excluded-from product-costs.T Research for the activity based-costing system identifies six cost pools, the activity measures, and-the make-up of the manufacturing overhead costs of S101,250 as follows Posey Case Worksheet Activity Measure Expected Activity Total Cost Cost per Activity us S STD SPE Exp Act hours hours us S 200 S 12,000.00$ 60.00 300 $ 15,000.00 50.00 400 20,250.00$ 50.63 800 $ 16,000.00 20.00 800 1,600$ 8,000.00$ 5.00 5,000 10,000 30,000.00 S 3.00 Orders 82 118 116 Receipts Set-up Hours Inspection Hours Assembly Hours 184 50 200 300 500 800 Machine Hours 5,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started