Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Activity: Determine whether you have enough monies to live comfortably each year for 2 0 years in your dream state of Massachusetts. Assume you are

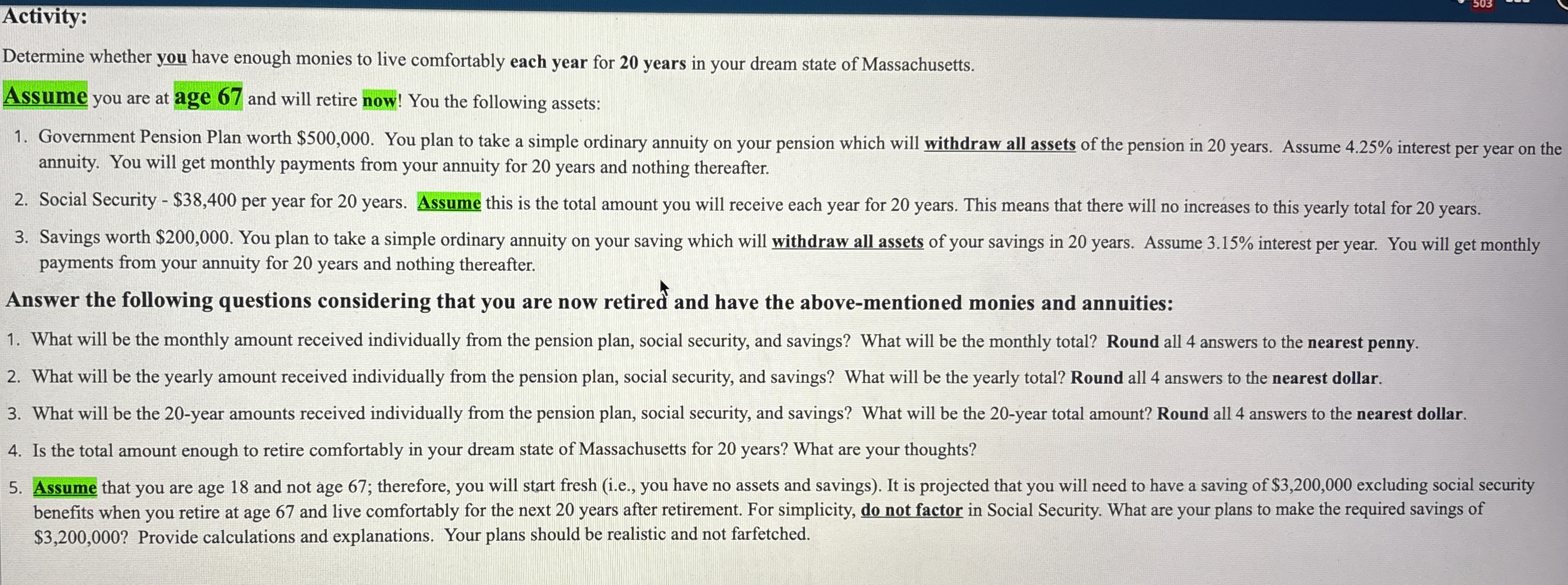

Activity:

Determine whether you have enough monies to live comfortably each year for years in your dream state of Massachusetts.

Assume you are at age and will retire now! You the following assets:

Government Pension Plan worth $ You plan to take a simple ordinary annuity on your pension which will withdraw all assets of the pension in years. Assume interest per year on the

annuity. You will get monthly payments from your annuity for years and nothing thereafter.

Social Security $ per year for years. Assume this is the total amount you will receive each year for years. This means that there will no increases to this yearly total for years.

Savings worth $ You plan to take a simple ordinary annuity on your saving which will withdraw all assets of your savings in years. Assume interest per year. You will get monthly

payments from your annuity for years and nothing thereafter.

Answer the following questions considering that you are now retired and have the abovementioned monies and annuities:

What will be the monthly amount received individually from the pension plan, social security, and savings? What will be the monthly total? Round all answers to the nearest penny.

What will be the yearly amount received individually from the pension plan, social security, and savings? What will be the yearly total? Round all answers to the nearest dollar.

What will be the year amounts received individually from the pension plan, social security, and savings? What will be the year total amount? Round all answers to the nearest dollar.

Is the total amount enough to retire comfortably in your dream state of Massachusetts for years? What are your thoughts?

Assume that you are age and not age ; therefore, you will start fresh ie you have no assets and savings It is projected that you will need to have a saving of $ excluding social security

benefits when you retire at age and live comfortably for the next years after retirement. For simplicity, do not factor in Social Security. What are your plans to make the required savings of

$ Provide calculations and explanations. Your plans should be realistic and not farfetched.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started