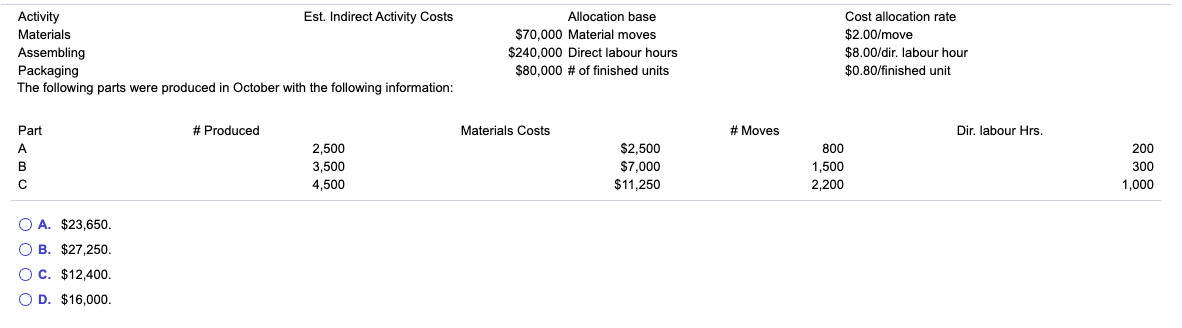

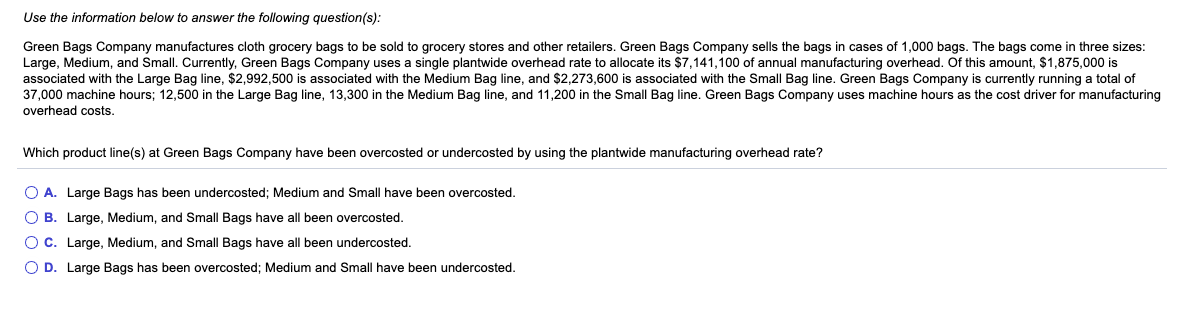

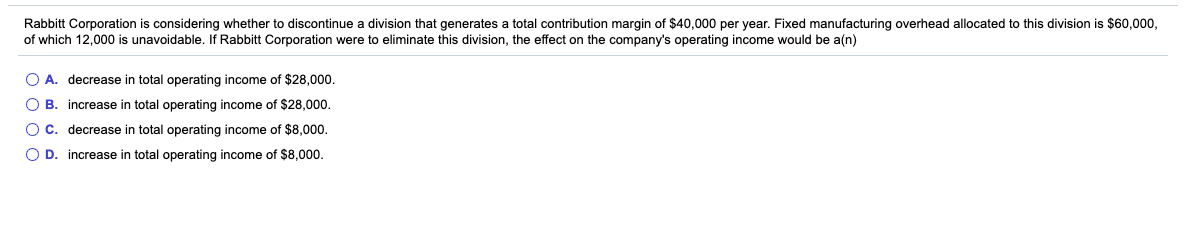

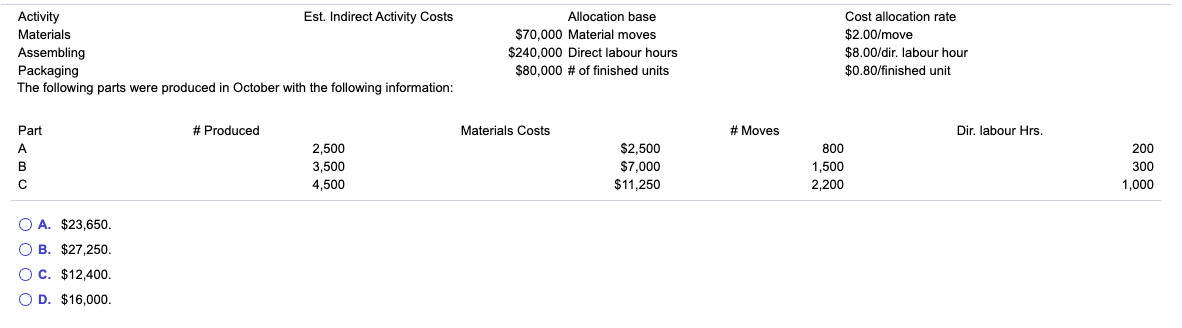

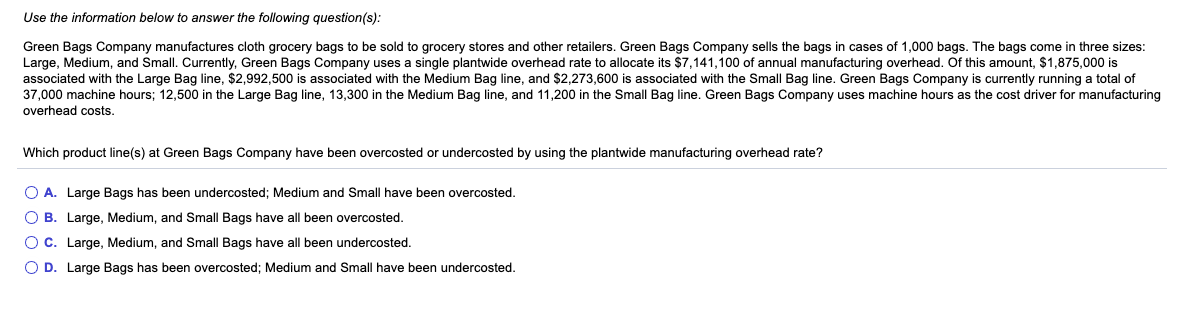

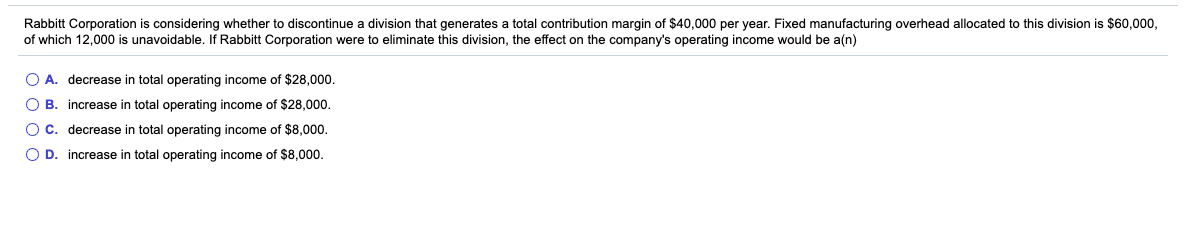

Activity Est. Indirect Activity Costs Materials Assembling Packaging The following parts were produced in October with the following information: Allocation base $70,000 Material moves $240,000 Direct labour hours $80,000 # of finished units Cost allocation rate $2.00/move $8.00/dir, labour hour $0.80/finished unit # Produced Materials Costs # Moves Dir, labour Hrs. Part A B 2,500 3,500 $2.500 $7,000 $11,250 800 1,500 2,200 200 300 4,500 1,000 A. $23,650. B. $27,250. O C. $12,400. OD. $16,000. Use the information below to answer the following question(s): Green Bags Company manufactures cloth grocery bags to be sold to grocery stores and other retailers. Green Bags Company sells the bags in cases of 1,000 bags. The bags come in three sizes: Large, Medium, and Small. Currently, Green Bags Company uses a single plantwide overhead rate to allocate its $7,141,100 of annual manufacturing overhead. Of this amount, $1,875,000 is associated with the Large Bag line, $2,992,500 is associated with the Medium Bag line, and $2,273,600 is associated with the Small Bag line. Green Bags Company is currently running a total of 37,000 machine hours; 12,500 in the Large Bag line, 13,300 in the Medium Bag line, and 11,200 in the Small Bag line. Green Bags Company uses machine hours as the cost driver for manufacturing overhead costs. Which product line(s) at Green Bags Company have been overcosted or undercosted by using the plantwide manufacturing overhead rate? O A. Large Bags has been undercosted; Medium and Small have been overcosted. O B. Large, Medium, and Small Bags have all been overcosted. O C. Large, Medium, and Small Bags have all been undercosted. OD. Large Bags has been overcosted; Medium and Small have been undercosted. Rabbitt Corporation is considering whether to discontinue a division that generates a total contribution margin of $40,000 per year. Fixed manufacturing overhead allocated to this division is $60,000, of which 12,000 is unavoidable. If Rabbitt Corporation were to eliminate this division, the effect on the company's operating income would be a(n) O A. decrease in total operating income of $28,000. OB. increase in total operating income of $28,000. C decrease in total operating income of $8,000. OD increase in total operating income of $8,000. Activity Est. Indirect Activity Costs Materials Assembling Packaging The following parts were produced in October with the following information: Allocation base $70,000 Material moves $240,000 Direct labour hours $80,000 # of finished units Cost allocation rate $2.00/move $8.00/dir, labour hour $0.80/finished unit # Produced Materials Costs # Moves Dir, labour Hrs. Part A B 2,500 3,500 $2.500 $7,000 $11,250 800 1,500 2,200 200 300 4,500 1,000 A. $23,650. B. $27,250. O C. $12,400. OD. $16,000. Use the information below to answer the following question(s): Green Bags Company manufactures cloth grocery bags to be sold to grocery stores and other retailers. Green Bags Company sells the bags in cases of 1,000 bags. The bags come in three sizes: Large, Medium, and Small. Currently, Green Bags Company uses a single plantwide overhead rate to allocate its $7,141,100 of annual manufacturing overhead. Of this amount, $1,875,000 is associated with the Large Bag line, $2,992,500 is associated with the Medium Bag line, and $2,273,600 is associated with the Small Bag line. Green Bags Company is currently running a total of 37,000 machine hours; 12,500 in the Large Bag line, 13,300 in the Medium Bag line, and 11,200 in the Small Bag line. Green Bags Company uses machine hours as the cost driver for manufacturing overhead costs. Which product line(s) at Green Bags Company have been overcosted or undercosted by using the plantwide manufacturing overhead rate? O A. Large Bags has been undercosted; Medium and Small have been overcosted. O B. Large, Medium, and Small Bags have all been overcosted. O C. Large, Medium, and Small Bags have all been undercosted. OD. Large Bags has been overcosted; Medium and Small have been undercosted. Rabbitt Corporation is considering whether to discontinue a division that generates a total contribution margin of $40,000 per year. Fixed manufacturing overhead allocated to this division is $60,000, of which 12,000 is unavoidable. If Rabbitt Corporation were to eliminate this division, the effect on the company's operating income would be a(n) O A. decrease in total operating income of $28,000. OB. increase in total operating income of $28,000. C decrease in total operating income of $8,000. OD increase in total operating income of $8,000