Answered step by step

Verified Expert Solution

Question

1 Approved Answer

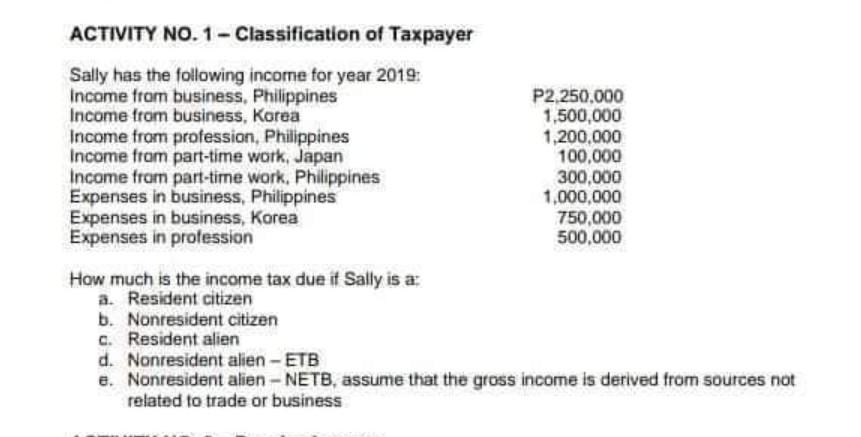

ACTIVITY NO. 1 - Classification of Taxpayer Sally has the following income for year 2019: Income from business, Philippines Income from business, Korea Income from

ACTIVITY NO. 1 - Classification of Taxpayer Sally has the following income for year 2019: Income from business, Philippines Income from business, Korea Income from profession, Philippines Income from part-time work, Japan Income from part-time work, Philippines Expenses in business, Philippines Expenses in business, Korea Expenses in profession P2.250.000 1,500,000 1,200,000 100,000 300,000 1,000,000 750,000 500.000 How much is the income tax due if Sally is a: a. Resident citizen b. Nonresident citizen c. Resident alien d. Nonresident alien - ETB e. Nonresident alien - NETB, assume that the gross income is derived from sources not related to trade or business ACTIVITY NO. 1 - Classification of Taxpayer Sally has the following income for year 2019: Income from business, Philippines Income from business, Korea Income from profession, Philippines Income from part-time work, Japan Income from part-time work, Philippines Expenses in business, Philippines Expenses in business, Korea Expenses in profession P2.250.000 1,500,000 1,200,000 100,000 300,000 1,000,000 750,000 500.000 How much is the income tax due if Sally is a: a. Resident citizen b. Nonresident citizen c. Resident alien d. Nonresident alien - ETB e. Nonresident alien - NETB, assume that the gross income is derived from sources not related to trade or business

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started