Answered step by step

Verified Expert Solution

Question

1 Approved Answer

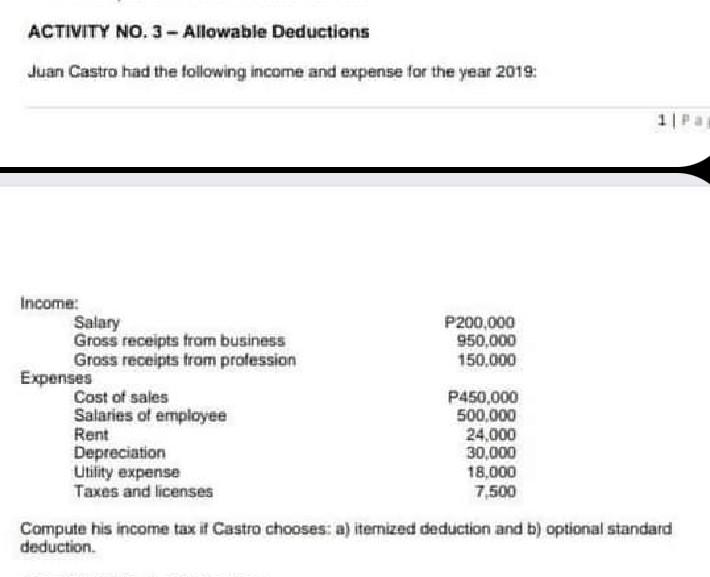

ACTIVITY NO. 3 - Allowable Deductions Juan Castro had the following income and expense for the year 2019: 11 Pa Income: Salary P200.000 Gross receipts

ACTIVITY NO. 3 - Allowable Deductions Juan Castro had the following income and expense for the year 2019: 11 Pa Income: Salary P200.000 Gross receipts from business 950,000 Gross receipts from profession 150,000 Expenses Cost of sales P450,000 Salaries of employee 500,000 Rent 24,000 Depreciation 30,000 Utility expense 18,000 Taxes and licenses 7,500 Compute his income tax it Castro chooses: a) iternized deduction and b) optional standard deduction

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started