Answered step by step

Verified Expert Solution

Question

1 Approved Answer

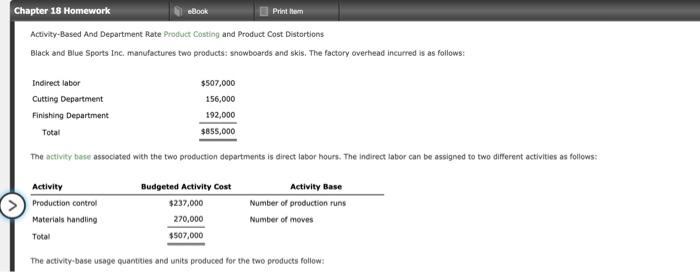

Activity-Based And Department Rate Product Costing and Product Cost Distortions Black and Blue Sports Inc. manufactures two products: snowboards and skis. The factory overhead incurred

Activity-Based And Department Rate Product Costing and Product Cost Distortions

Black and Blue Sports Inc. manufactures two products: snowboards and skis. The factory overhead incurred is as follows:

Required:

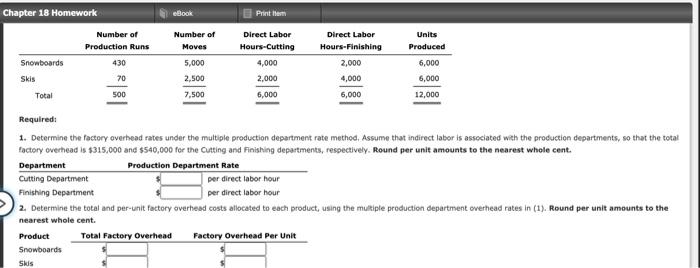

1. Determine the factory overhead rates under the multiple production department rate method. Assume that indirect labor is associated with the production departments, so that the total factory overhead is $315,000 and $540,000 for the Cutting and Finishing departments, respectively. Round per unit amounts to the nearest whole cent.

2. Determine the total and per-unit factory overhead costs allocated to each product, using the multiple production department overhead rates in (1). Round per unit amounts to the nearest whole cent.

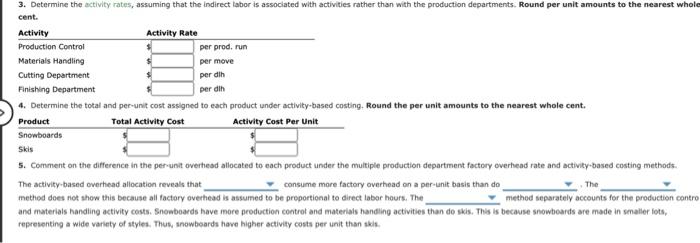

3. Determine the activity rates, assuming that the indirect labor is associated with activities rather than with the production departments. Round per unit amounts to the nearest whole cent.

4. Determine the total and per-unit cost assigned to each product under activity-based costing. Round the per unit amounts to the nearest whole cent.

5. Comment on the difference in the per-unit overhead allocated to each product under the multiple production department factory overhead rate and activity-based costing methods.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started