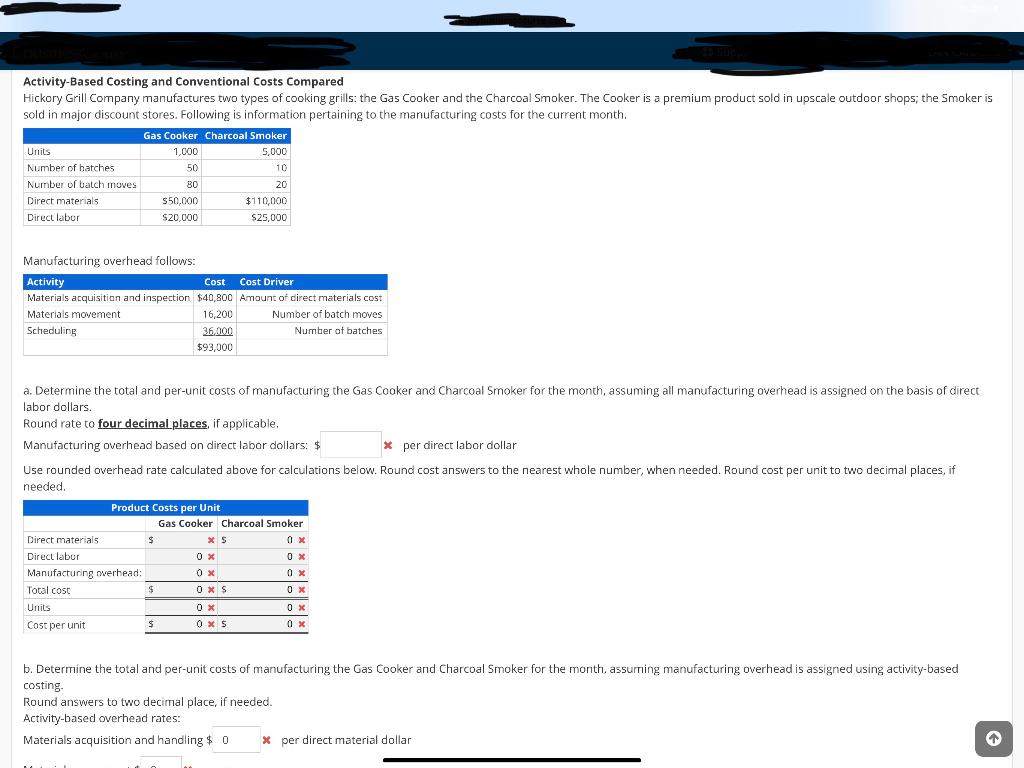

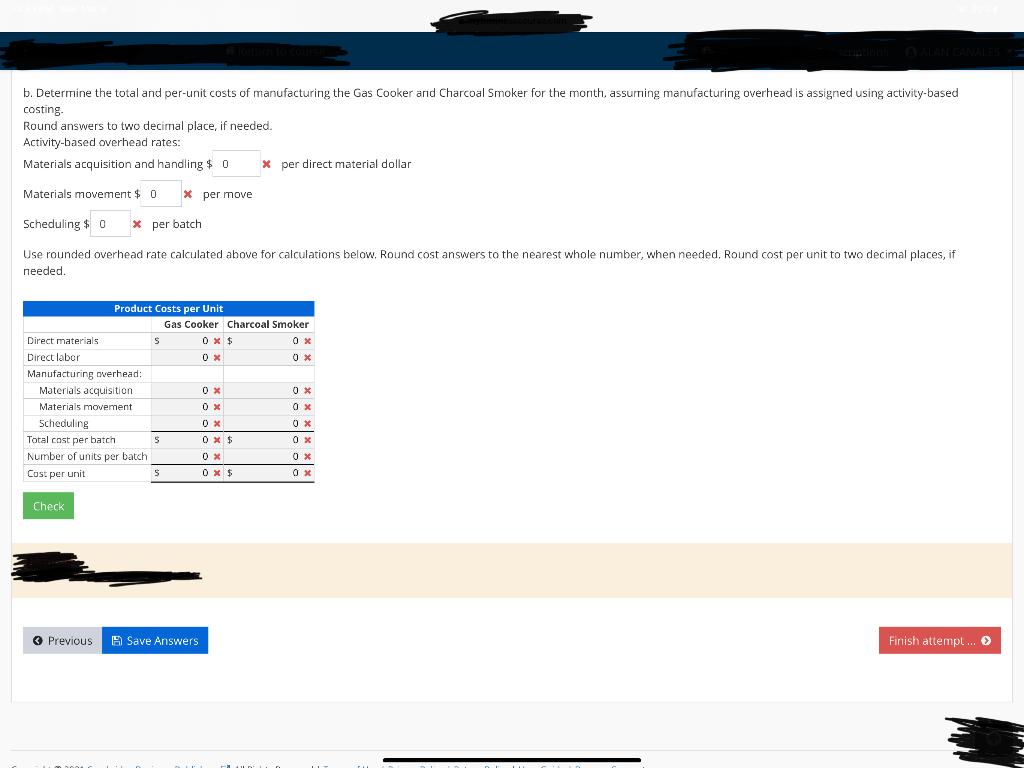

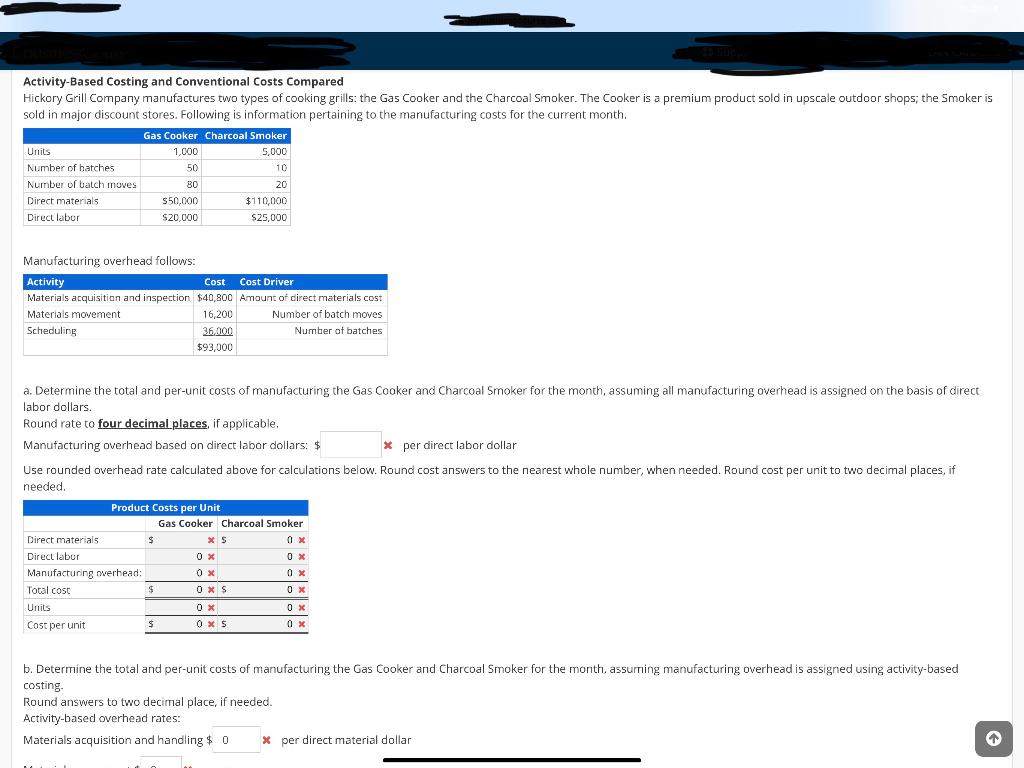

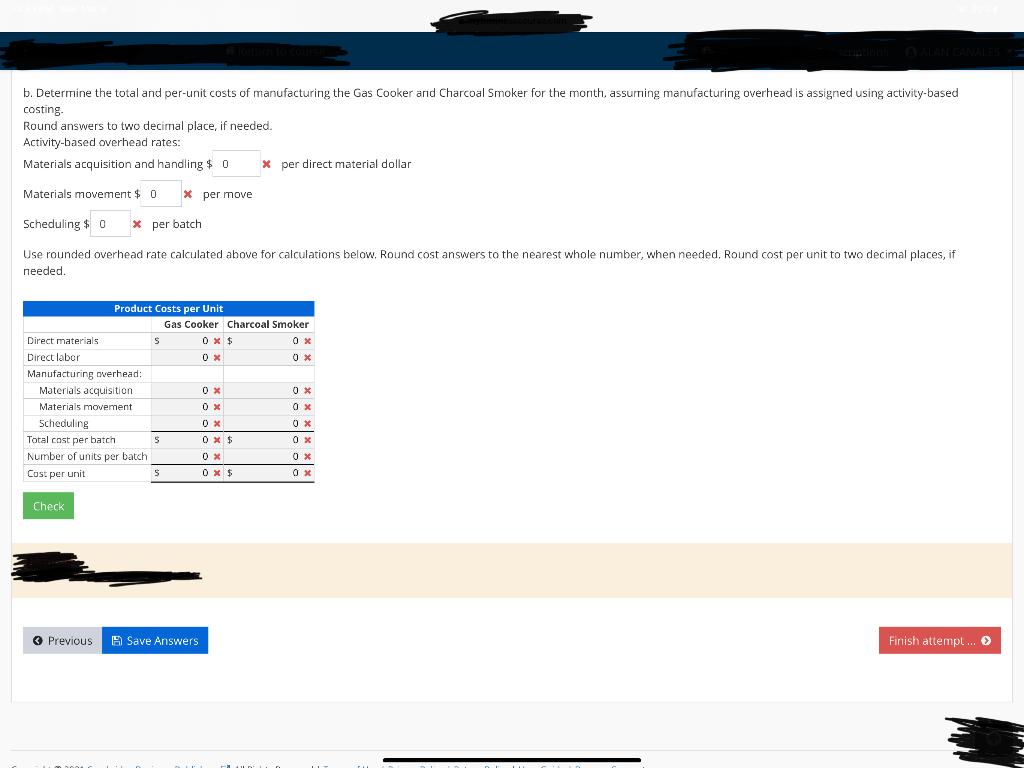

Activity-Based Costing and Conventional Costs Compared Hickory Grill Company manufactures two types of cooking grills: the Gas Cooker and the Charcoal Smoker. The Cooker is a premium product sold in upscale outdoor shops; the Smoker is sold in major discount stores. Following is information pertaining to the manufacturing costs for the current month. Gas Cooker Charcoal Smoker Units 1,000 5,000 Number of hatches 50 10 Number of batch moves 80 20 Direct materials $50,000 $110,000 Direct labor $20,000 $25,000 Manufacturing overhead follows: Activity Cost Cost Driver Materials acquisition and inspection $40,800 Amount of direct materials cost Materials movement 16,200 Number of batch moves Scheduling 36.000 Number of batches $93,000 a. Determine the total and per-unit costs of manufacturing the Gas Cooker and Charcoal Smoker for the month, assuming all manufacturing overhead is assigned on the basis of direct labor dollars. Round rate to four decimal places, if applicable, Manufacturing overhead based on direct labor dollars: $ x per direct labor dollar Use rounded overhead rate calculated above for calculations below. Round cost answers to the nearest whole number, when needed. Round cost per unit to two decimal places, if needed. Product Costs per Unit Gas Cooker Charcoal Smoker Direct materials $ XS 0 X Direct labur OX Manufacturing overhead: 0 x 0 X Total cost $ 0XS OX Units OX OX Cost per unit $ 0 x 5 0 X b. Determine the total and per-unit costs of manufacturing the Gas Cooker and Charcoal Smoker for the month, assurning manufacturing overhead is assigned using activity-based costing. Round answers to two decimal place, if needed. Activity-based overhead rates: Materials acquisition and handling $ 0 x per direct material dollar b. Determine the total and per-unit costs of manufacturing the Gas Cooker and Charcoal Smoker for the month, assurning manufacturing overhead is assigned using activity-based costing Round answers to two decimal place, if needed. Activity-based overhead rates: Materials acquisition and handling $ 0 * per direct material dollar Materials movement $ 0 X per move Scheduling $ 0 X per batch Use rounded overhead rate calculated above for calculations below. Round cost answers to the nearest whole number, when needed, Round cost per unit to two decimal places, if needed. Product Costs per Unit Gas Cooker Charcoal Smoker Direct materials S 0 x $ Direct labor 0 OX Manufacturing overhead: Materials acquisition OX 0X Materials movement OX OX Scheduling Ox OX Total cost per batch S 0X $ OX Number of units per batch 0X 0X Cost per unit 0 X $ 0 x Check Previous Save Answers Finish attempt