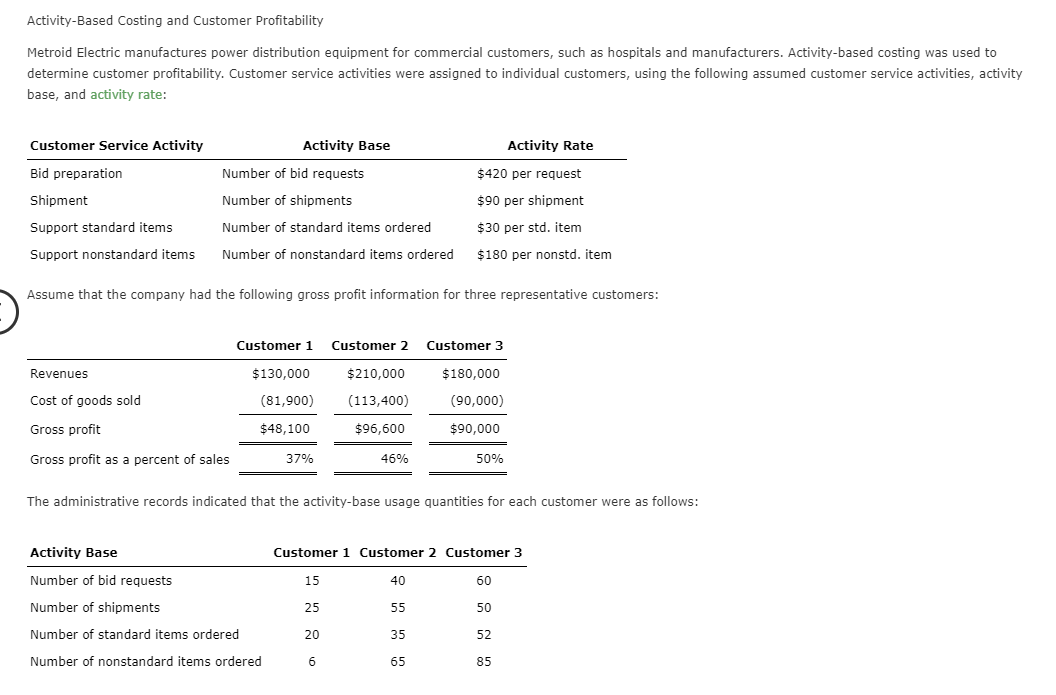

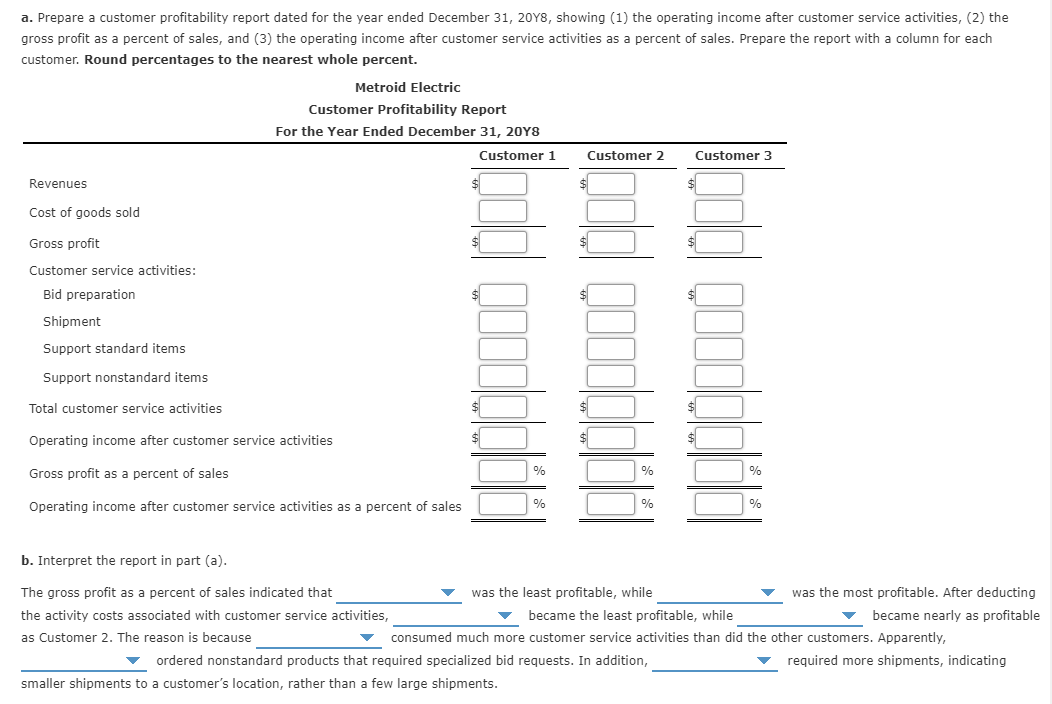

Activity-Based Costing and Customer Profitability Metroid Electric manufactures power distribution equipment for commercial customers, such as hospitals and manufacturers. Activity-based costing was used to determine customer profitability. Customer service activities were assigned to individual customers, using the following assumed customer service activities, activity base, and activity rate: Customer Service Activity Activity Base Activity Rate Number of bid requests $420 per request Bid preparation Shipment $90 per shipment Number of shipments Number of standard items ordered Support standard items $30 per std. item Support nonstandard items Number of nonstandard items ordered $180 per nonstd. item Assume that the company had the following gross profit information for three representative customers: Customer 1 Customer 2 Customer 3 Revenues $130,000 $180,000 $210,000 (113,400) Cost of goods sold (81,900) (90,000) Gross profit $48,100 $96,600 $90,000 Gross profit as a percent of sales 37% 46% 50% The administrative records indicated that the activity-base usage quantities for each customer were as follows: Activity Base Customer 1 Customer 2 Customer 3 Number of bid requests 15 40 60 Number of shipments 25 55 50 Number of standard items ordered 20 35 52 Number of nonstandard items ordered 6 65 85 a. Prepare a customer profitability report dated for the year ended December 31, 20Y8, showing (1) the operating income after customer service activities, (2) the gross profit as a percent of sales, and (3) the operating income after customer service activities as a percent of sales. Prepare the report with a column for each customer. Round percentages to the nearest whole percent. Metroid Electric Customer Profitability Report For the Year Ended December 31, 2018 Customer 1 Customer 2 Customer 3 Revenues Cost of goods sold Gross profit ledd 001 Customer service activities: Bid preparation Shipment Support standard items Support nonstandard items Total customer service activities $ $ $ Operating income after customer service activities $ $ Gross profit as a percent of sales % % % Operating income after customer service activities as a percent of sales % b. Interpret the report in part (a). The gross profit as a percent of sales indicated that was the least profitable, while was the most profitable. After deducting the activity costs associated with customer service activities, became the least profitable, while became nearly as profitable as Customer 2. The reason is because consumed much more customer service activities than did the other customers. Apparently, ordered nonstandard products that required specialized bid requests. In addition, required more shipments, indicating smaller shipments to a customer's location, rather than a few large shipments