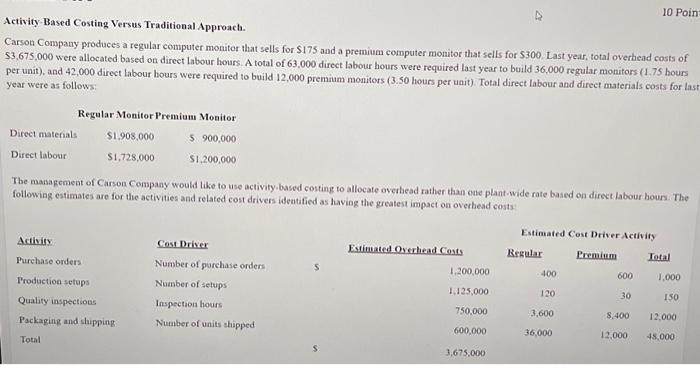

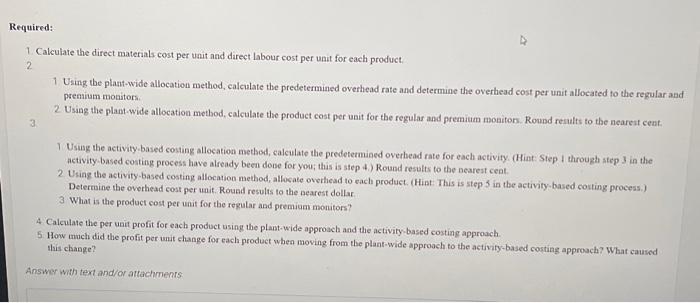

Activity-Based Costing Versus Traditional Approach. 10 Poin Carson Company produces a regular computer monitor that sells for $175 and a premium computer monitor that sells for 5300 . Last year, total overthead costs of $3,675,000 were allocated based on direct labour hours. A total of 63,000 direct labour hours were required last year to build 36,000 regular monitors (1.75 bours per unit), and 42,000 direet labour hours were required to build 12,000 premium monitors (3.50 hours per unit). Total direct labour and direct materials costs for last year were as follows: The management of Carson Company would like to use activity-based costing to allocate overtead rather than one plant-wide rate based on direct labour bour. The following estimates are for the activities and related cost drivers identified as having the greatest impact on overhesd costs 1. Cakculate the direct materials cost per unit and direct labour cost per unit for each product: 2 1 Using the plant-wide allocation method, calculate the predetermined overhead rate and determine the overhead cost per unit allocated to the regular and preaium monitors. 3. 2 Using the plant wide allocation method, calculate the product cost per unit for the regular and premium moniton. Round results to the neareat cent. 1 Usiug the activity-based costing allocation method, calculate the predetermined overhead rate for each activity. (Hint: Step I through step 3 in the activity based costing process have alfeady been done for you; this is step 4,) Round results to the nearest cent. 2 Using the activity-based costing allocation method, allosate overhead to each product. (Hint This is step 5 in the activity based couting process.) Determine the overhead cost per unit. Round results to the nearest dollar 3. What is the product cost per unit for the regular and premium monitors? 4 Calculate the per unit profit for each product using the plant-wide approach and the activity based costing approach. 5. How mach did the profit per unit change for each product when moving from the plant-wide approoch to the activity-based costing approach? What caused this change? Answer with text and/or attachments