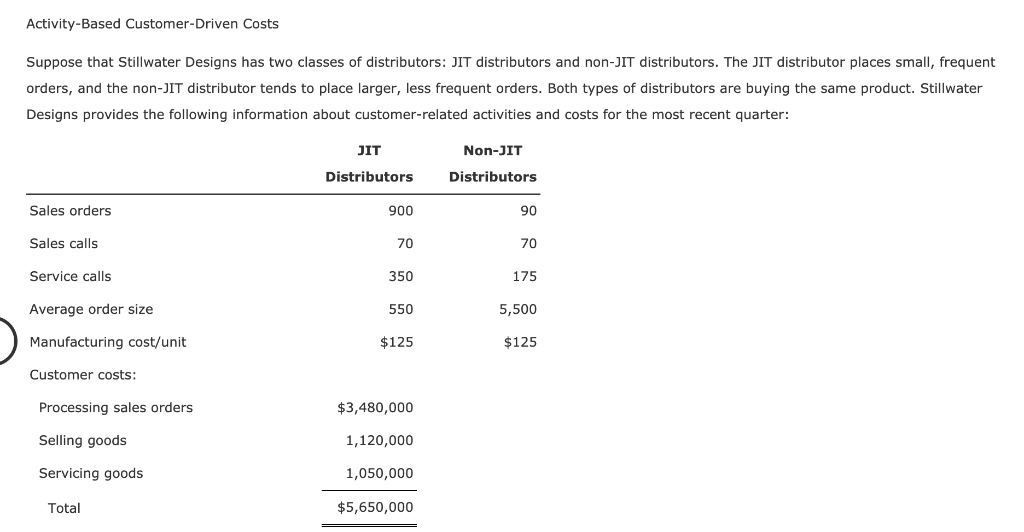

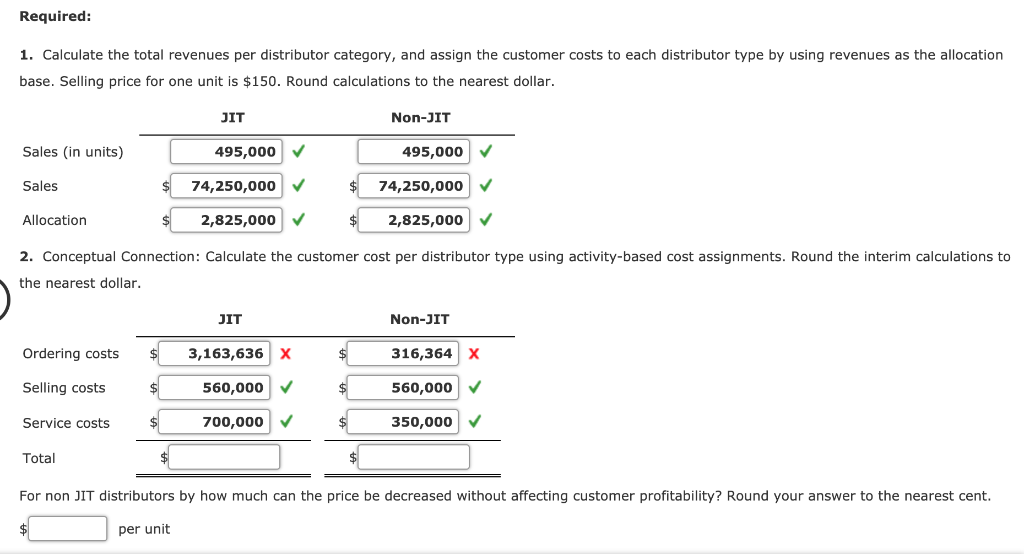

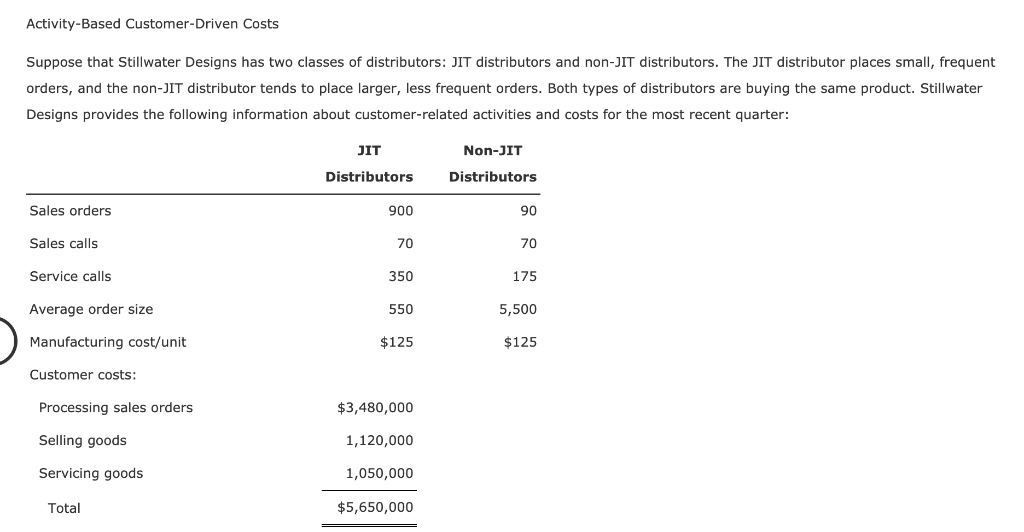

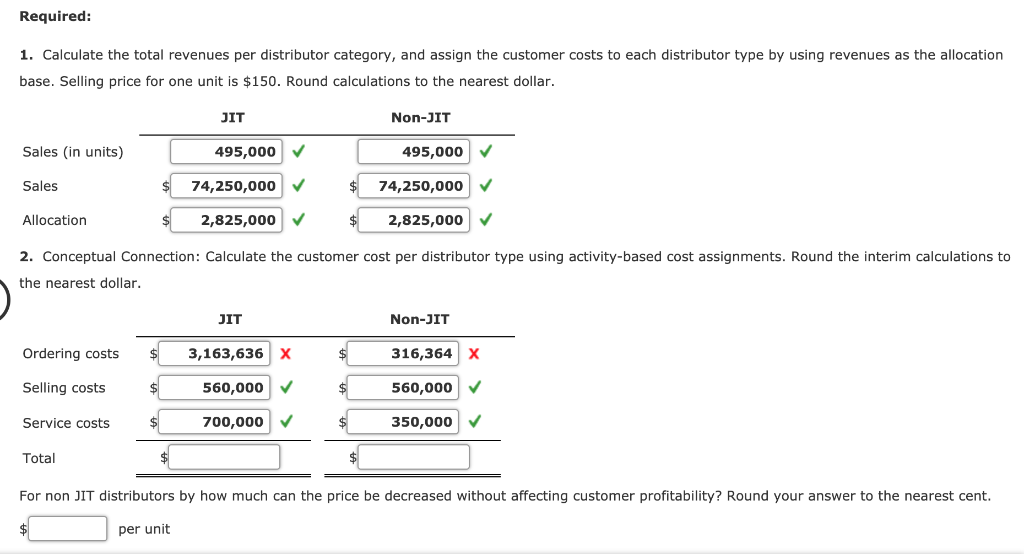

Activity-Based Customer-Driven Costs Suppose that Stillwater Designs has two classes of distributors: JIT distributors and non-JIT distributors. The JIT distributor places small, frequent orders, and the non-JIT distributor tends to place larger, less frequent orders. Both types of distributors are buying the same product. Stillwater Designs provides the following information about customer-related activities and costs for the most recent quarter: JIT Non-JIT Sales orders Sales calls Service calls Average order size Manufacturing cost/unit Customer costs: Distributors 900 70 350 550 $125 Distributors 90 70 175 5,500 $125 Processing sales orders Selling goods Servicing goods $3,480,000 1,120,000 1,050,000 $5,650,000 Total Required: 1. Calculate the total revenues per distributor category, and assign the customer costs to each distributor type by using revenues as the allocation base. Selling price for one unit is $150. Round calculations to the nearest dollar IT Non-JIT 495,000 Sales (in units) Sales Allocation 495,000 74,250,000 2,825,000 74,250,000 2,825,000 2. Conceptual Connection: Calculate the customer cost per distributor type using activity-based cost assignments. Round the interim calculations to the nearest dollar JIT Ordering costs Selling costs Service costs Total For non JIT distributors by how much can the price be decreased without affecting customer profitability? Round your answer to the nearest cent Non-JIT 316,364 X 560,000 350,000 3,163,636 X 560,000 700,000 per unit Activity-Based Customer-Driven Costs Suppose that Stillwater Designs has two classes of distributors: JIT distributors and non-JIT distributors. The JIT distributor places small, frequent orders, and the non-JIT distributor tends to place larger, less frequent orders. Both types of distributors are buying the same product. Stillwater Designs provides the following information about customer-related activities and costs for the most recent quarter: JIT Non-JIT Sales orders Sales calls Service calls Average order size Manufacturing cost/unit Customer costs: Distributors 900 70 350 550 $125 Distributors 90 70 175 5,500 $125 Processing sales orders Selling goods Servicing goods $3,480,000 1,120,000 1,050,000 $5,650,000 Total Required: 1. Calculate the total revenues per distributor category, and assign the customer costs to each distributor type by using revenues as the allocation base. Selling price for one unit is $150. Round calculations to the nearest dollar IT Non-JIT 495,000 Sales (in units) Sales Allocation 495,000 74,250,000 2,825,000 74,250,000 2,825,000 2. Conceptual Connection: Calculate the customer cost per distributor type using activity-based cost assignments. Round the interim calculations to the nearest dollar JIT Ordering costs Selling costs Service costs Total For non JIT distributors by how much can the price be decreased without affecting customer profitability? Round your answer to the nearest cent Non-JIT 316,364 X 560,000 350,000 3,163,636 X 560,000 700,000 per unit