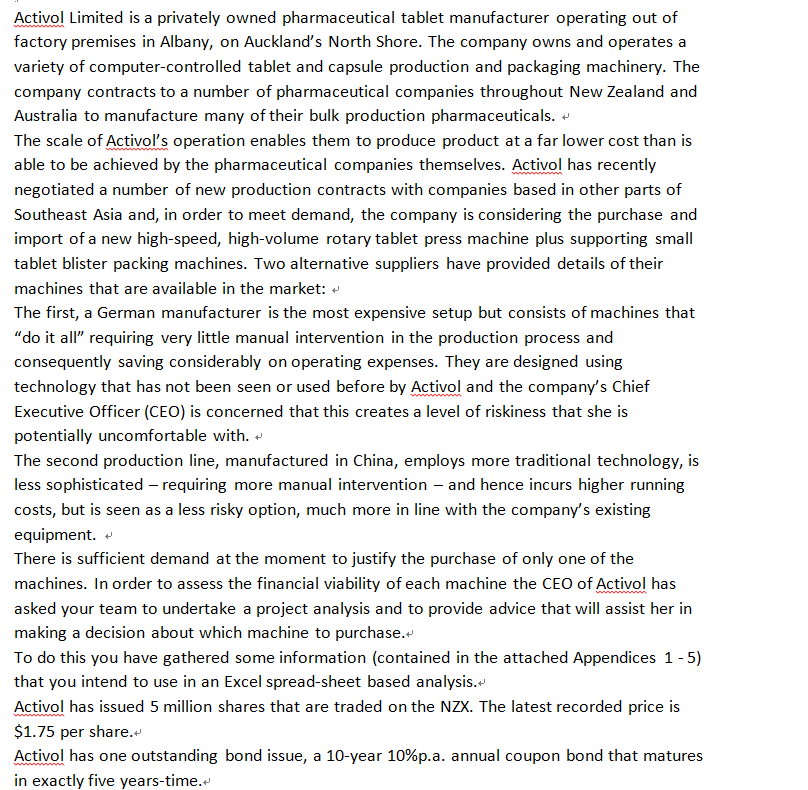

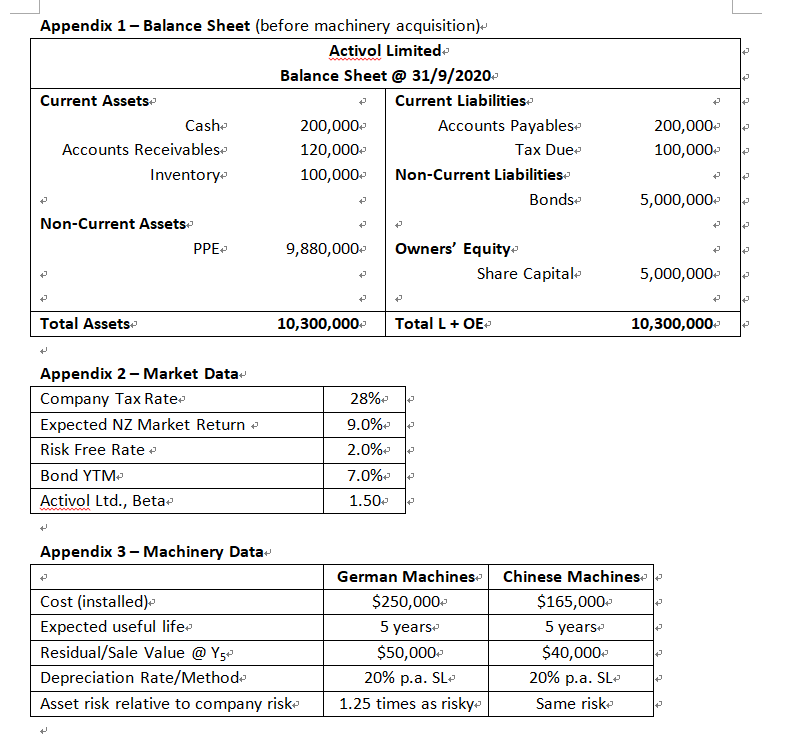

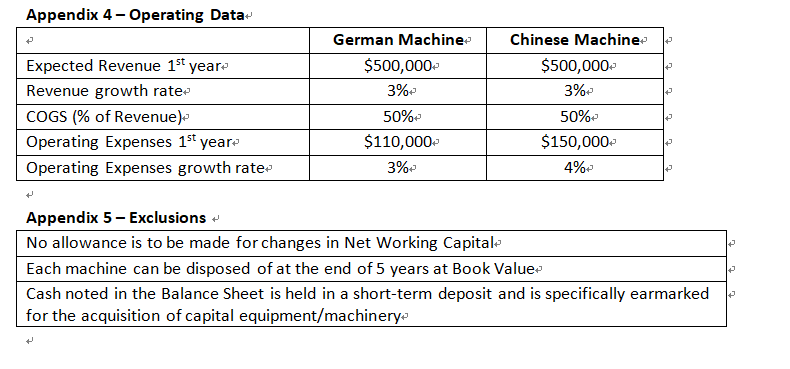

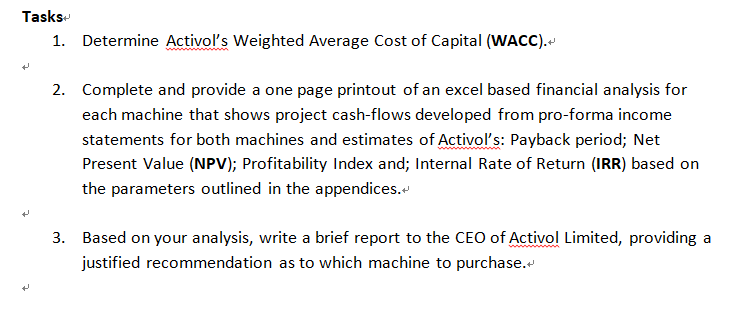

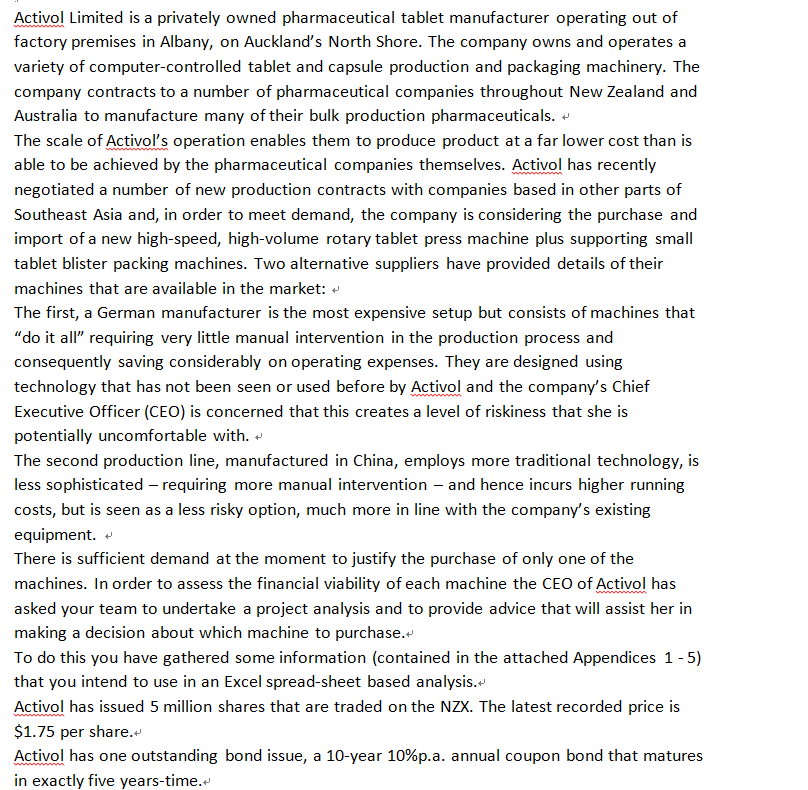

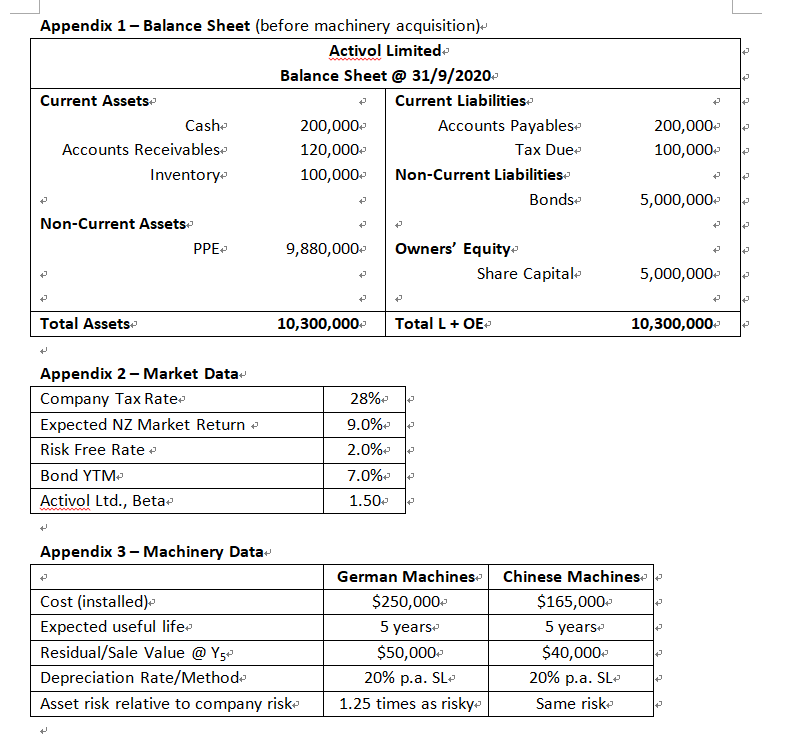

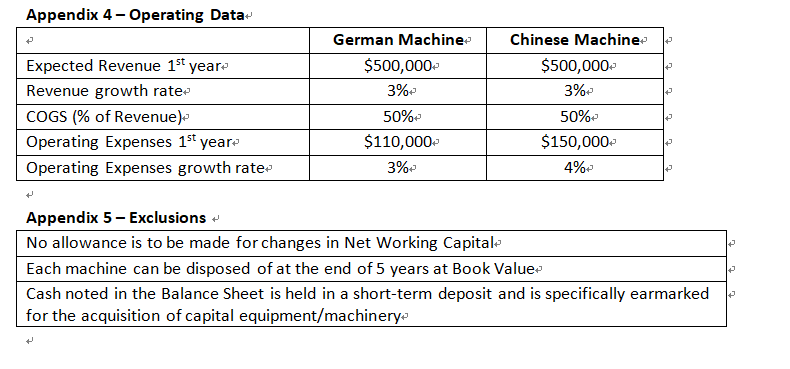

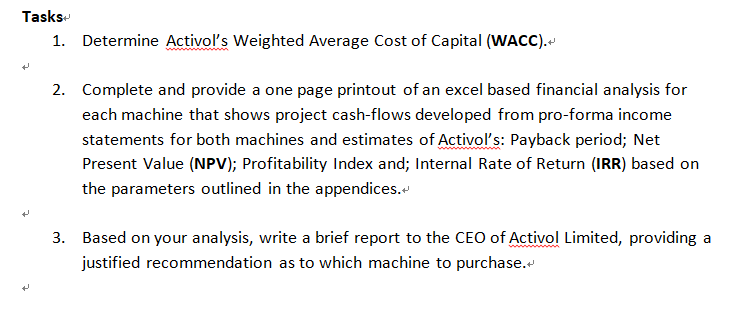

Activol Limited is a privately owned pharmaceutical tablet manufacturer operating out of factory premises in Albany, on Auckland's North Shore. The company owns and operates a variety of computer-controlled tablet and capsule production and packaging machinery. The company contracts to a number of pharmaceutical companies throughout New Zealand and Australia to manufacture many of their bulk production pharmaceuticals. " The scale of Activol's operation enables them to produce product at a far lower cost than is able to be achieved by the pharmaceutical companies themselves. Activol has recently negotiated a number of new production contracts with companies based in other parts of Southeast Asia and, in order to meet demand, the company is considering the purchase and import of a new high-speed, high-volume rotary tablet press machine plus supporting small tablet blister packing machines. Two alternative suppliers have provided details of their machines that are available in the market: + The first, a German manufacturer is the most expensive setup but consists of machines that "do it all requiring very little manual intervention in the production process and consequently saving considerably on operating expenses. They are designed using technology that has not been seen or used before by Activol and the company's Chief Executive Officer (CEO) is concerned that this creates a level of riskiness that she is potentially uncomfortable with. + The second production line, manufactured in China, employs more traditional technology, is less sophisticated requiring more manual intervention - and hence incurs higher running costs, but is seen as a less risky option, much more in line with the company's existing equipment. + There is sufficient demand at the moment to justify the purchase of only one of the machines. In order to assess the financial viability of each machine the CEO of Activol has asked your team to undertake a project analysis and to provide advice that will assist her in making a decision about which machine to purchase. To do this you have gathered some information contained in the attached Appendices 1-5) that you intend to use in an Excel spread-sheet based analysis. Activol has issued 5 million shares that are traded on the NZX. The latest recorded price is $1.75 per share. Activol has one outstanding bond issue, a 10-year 10%p.a. annual coupon bond that matures in exactly five years-time. 12 2 Appendix 1 - Balance Sheet (before machinery acquisition) Activol Limited Balance Sheet @ 31/9/2020- Current Assets Current Liabilities: Cashe 200,000 Accounts Payables Accounts Receivables 120,000 Tax Due- Inventory 100,000+ Non-Current Liabilities: Bonds- Non-Current Assets- PPE- 9,880,000- Owners' Equity Share Capital 200,000- 100,000- 1 5,000,000- 12 + 5,000,000 t Total Assets 10,300,000- Total L + OE 10,300,000,- Appendix 2 - Market Data- Company Tax Rate Expected NZ Market Return Risk Free Rate Bond YTM Activol Ltd., Beta- 28%- 9.0% 2.0% 7.0% 1.50- + Appendix 3 - Machinery Data- t Cost (installed) Expected useful life- Residual/Sale Value @ Y5+ Depreciation Rate/Methode Asset risk relative to company risk German Machines Chinese Machines $250,000 $165,000- 5 yearse 5 years $50,000+ $40,000- 20% p.a. SLP 20% p.a. SL- 1.25 times as risky Same risk ] Appendix 4 - Operating Data- Expected Revenue 1st year- Revenue growth rate- COGS (% of Revenue) Operating Expenses 1st year- Operating Expenses growth rate- German Machine- $500,000 3% 50%- $110,000 3% Chinese Machine- $500,000- 3%- 50%- $150,000 4% 2 Appendix 5 - Exclusions No allowance is to be made for changes in Net Working Capital Each machine can be disposed of at the end of 5 years at Book Value- Cash noted in the Balance Sheet is held in a short-term deposit and is specifically earmarked for the acquisition of capital equipment/machinerye 2 Tasks 1. Determine Activols Weighted Average cost of Capital (WACC).- 2. Complete and provide a one page printout of an excel based financial analysis for each machine that shows project cash-flows developed from pro-forma income statements for both machines and estimates of Activol's: Payback period; Net Present Value (NPV); Profitability Index and; Internal Rate of Return (IRR) based on the parameters outlined in the appendices. t 3. Based on your analysis, write a brief report to the CEO of Activol Limited, providing a justified recommendation as to which machine to purchase