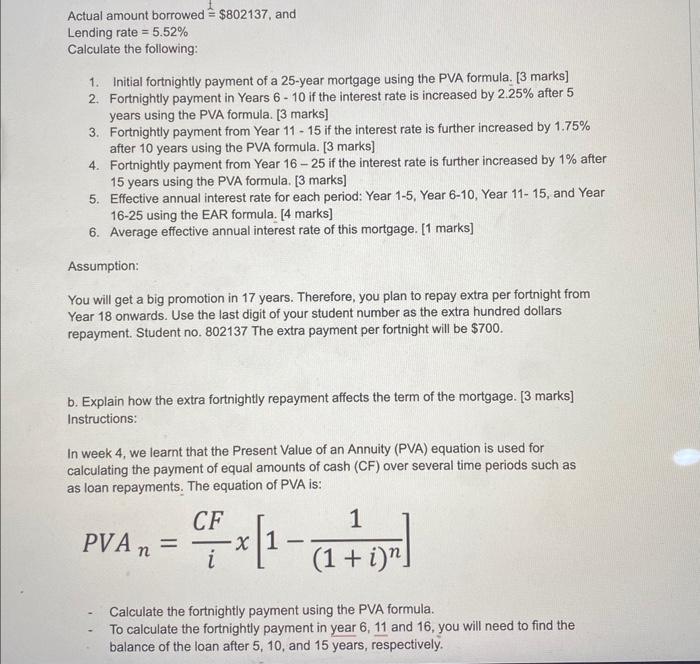

Actual amount borrowed =$802137, and Lending rate =5.52% Calculate the following: 1. Initial fortnightly payment of a 25 -year mortgage using the PVA formula. [3 marks] 2. Fortnightly payment in Years 610 if the interest rate is increased by 2.25% after 5 years using the PVA formula. [ 3 marks] 3. Fortnightly payment from Year 1115 if the interest rate is further increased by 1.75% after 10 years using the PVA formula. [ 3 marks] 4. Fortnightly payment from Year 1625 if the interest rate is further increased by 1% after 15 years using the PVA formula. [ 3 marks] 5. Effective annual interest rate for each period: Year 1-5, Year 6-10, Year 11- 15, and Year 16-25 using the EAR formula. [4 marks] 6. Average effective annual interest rate of this mortgage. [1 marks] Assumption: You will get a big promotion in 17 years. Therefore, you plan to repay extra per fortnight from Year 18 onwards. Use the last digit of your student number as the extra hundred dollars repayment. Student no. 802137 The extra payment per fortnight will be $700. b. Explain how the extra fortnightly repayment affects the term of the mortgage. [ 3 marks] Instructions: In week 4, we learnt that the Present Value of an Annuity (PVA) equation is used for calculating the payment of equal amounts of cash (CF) over several time periods such as as loan repayments. The equation of PVA is: PVAn=iCFx[1(1+i)n1] - Calculate the fortnightly payment using the PVA formula. - To calculate the fortnightly payment in year 6,11 and 16 , you will need to find the balance of the loan after 5,10 , and 15 years, respectively. Actual amount borrowed =$802137, and Lending rate =5.52% Calculate the following: 1. Initial fortnightly payment of a 25 -year mortgage using the PVA formula. [3 marks] 2. Fortnightly payment in Years 610 if the interest rate is increased by 2.25% after 5 years using the PVA formula. [ 3 marks] 3. Fortnightly payment from Year 1115 if the interest rate is further increased by 1.75% after 10 years using the PVA formula. [ 3 marks] 4. Fortnightly payment from Year 1625 if the interest rate is further increased by 1% after 15 years using the PVA formula. [ 3 marks] 5. Effective annual interest rate for each period: Year 1-5, Year 6-10, Year 11- 15, and Year 16-25 using the EAR formula. [4 marks] 6. Average effective annual interest rate of this mortgage. [1 marks] Assumption: You will get a big promotion in 17 years. Therefore, you plan to repay extra per fortnight from Year 18 onwards. Use the last digit of your student number as the extra hundred dollars repayment. Student no. 802137 The extra payment per fortnight will be $700. b. Explain how the extra fortnightly repayment affects the term of the mortgage. [ 3 marks] Instructions: In week 4, we learnt that the Present Value of an Annuity (PVA) equation is used for calculating the payment of equal amounts of cash (CF) over several time periods such as as loan repayments. The equation of PVA is: PVAn=iCFx[1(1+i)n1] - Calculate the fortnightly payment using the PVA formula. - To calculate the fortnightly payment in year 6,11 and 16 , you will need to find the balance of the loan after 5,10 , and 15 years, respectively