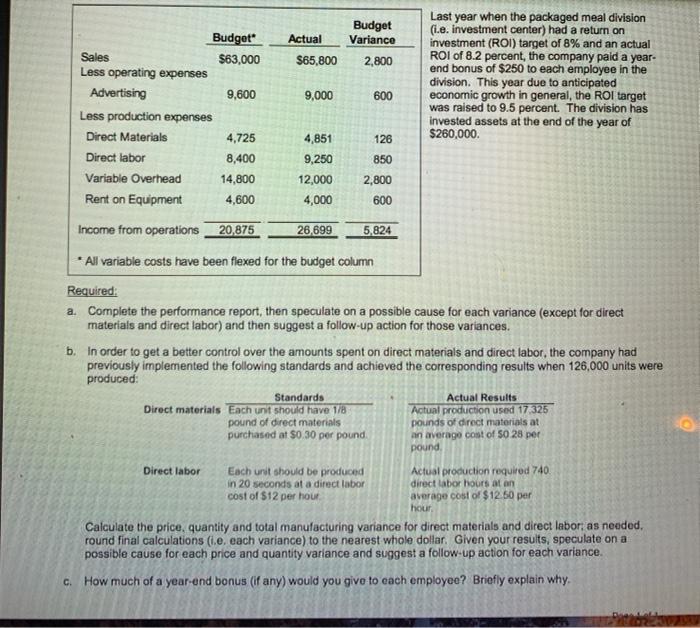

Actual Budget Variance 2,800 $65,800 Last year when the packaged meal division (i.e. investment center) had a return on investment (ROI) target of 8% and an actual ROI of 8.2 percent, the company paid a year- end bonus of $250 to each employee in the division. This year due to anticipated economic growth in general, the ROI target was raised to 9.5 percent. The division has invested assets at the end of the year of $260,000 9,000 Budget Sales $63,000 Less operating expenses Advertising 9,600 Less production expenses Direct Materials 4,725 Direct labor 8,400 Variable Overhead 14,800 Rent on Equipment 4,600 Income from operations 20,875 600 126 850 4,851 9,250 12,000 4,000 2,800 600 26,699 5,824 * All variable costs have been flexed for the budget column Required: a Complete the performance report, then speculate on a possible cause for each variance (except for direct materials and direct labor) and then suggest a follow-up action for those variances. b. In order to get a better control over the amounts spent on direct materials and direct labor, the company had previously implemented the following standards and achieved the corresponding results when 126,000 units were produced: Standards Actual Results Direct materials Each unit should have 1/8 Actual production used 17 325 pound of direct materials pounds of direct materials at purchased at $0 30 per pound an average cost of 50 28 per pound Direct labor Each unit should be produced Actual production required 740. in 20 seconds at a direct labor direct labor hours at on cost of $12 per hour average cost of $12.50 per hour Calculate the price, quantity and total manufacturing variance for direct materials and direct labor, as needed. round final calculations (i.e. each variance) to the nearest whole dollar. Given your results, speculate on a possible cause for each price and quantity variance and suggest a follow-up action for each variance. C. How much of a year-end bonus (if any) would you give to each employee? Briefly explain why. Actual Budget Variance 2,800 $65,800 Last year when the packaged meal division (i.e. investment center) had a return on investment (ROI) target of 8% and an actual ROI of 8.2 percent, the company paid a year- end bonus of $250 to each employee in the division. This year due to anticipated economic growth in general, the ROI target was raised to 9.5 percent. The division has invested assets at the end of the year of $260,000 9,000 Budget Sales $63,000 Less operating expenses Advertising 9,600 Less production expenses Direct Materials 4,725 Direct labor 8,400 Variable Overhead 14,800 Rent on Equipment 4,600 Income from operations 20,875 600 126 850 4,851 9,250 12,000 4,000 2,800 600 26,699 5,824 * All variable costs have been flexed for the budget column Required: a Complete the performance report, then speculate on a possible cause for each variance (except for direct materials and direct labor) and then suggest a follow-up action for those variances. b. In order to get a better control over the amounts spent on direct materials and direct labor, the company had previously implemented the following standards and achieved the corresponding results when 126,000 units were produced: Standards Actual Results Direct materials Each unit should have 1/8 Actual production used 17 325 pound of direct materials pounds of direct materials at purchased at $0 30 per pound an average cost of 50 28 per pound Direct labor Each unit should be produced Actual production required 740. in 20 seconds at a direct labor direct labor hours at on cost of $12 per hour average cost of $12.50 per hour Calculate the price, quantity and total manufacturing variance for direct materials and direct labor, as needed. round final calculations (i.e. each variance) to the nearest whole dollar. Given your results, speculate on a possible cause for each price and quantity variance and suggest a follow-up action for each variance. C. How much of a year-end bonus (if any) would you give to each employee? Briefly explain why