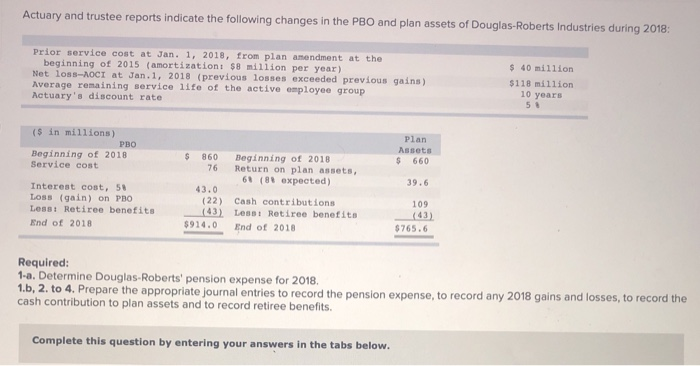

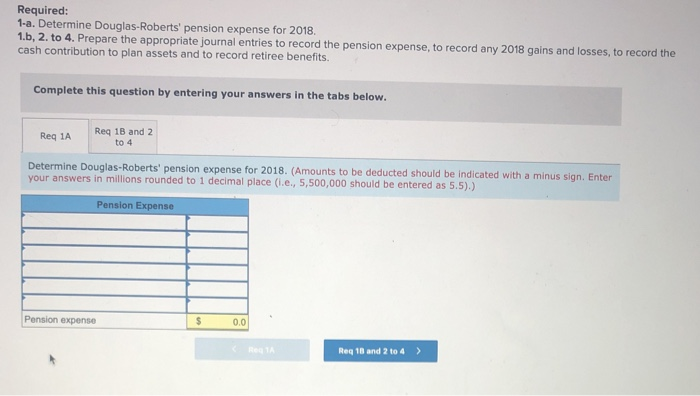

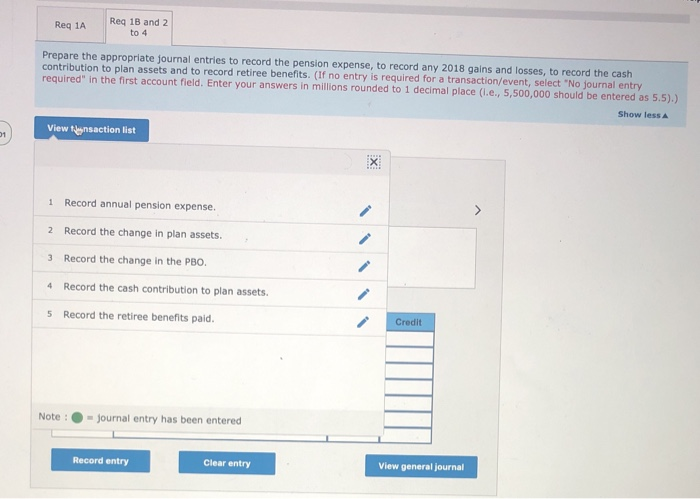

Actuary and trustee reports indicate the following changes in the PBO and plan assets of Douglas-Roberts Industries during 2018: Prior service costat Jan. 1. 2018, from plan amendment at the beginning of 2015 (amortization$8 million per year) Net loss-AOCI at Jan.1, 2018 (previous losses exceeded previous gains) Average remaining service life of the active employee group Actuary's discount rate $ 40 million $118 million 10 years 5 ($ in millions) P Beginning of 2018 Service cost Plan Assets $ 660 76 39.6 Interest cost, 58 Loss (gain) on PBO Less: Retiree benefits End of 2018 $ 860 Beginning of 2018 Return on plan assets, 68 (89 expected) 43.0 (22) Cash contributions (43) Less: Retiree benefits $914.0 End of 2018 109 (63) $765.6 Required: 1-a. Determine Douglas Roberts' pension expense for 2018, 1.b, 2. to 4. Prepare the appropriate journal entries to record the pension expense, to record any 2018 gains and losses, to record the cash contribution to plan assets and to record retiree benefits. Complete this question by entering your answers in the tabs below. Required: 1-a. Determine Douglas-Roberts' pension expense for 2018. 1.b, 2. to 4. Prepare the appropriate journal entries to record the pension expense, to record any 2018 gains and losses, to record the cash contribution to plan assets and to record retiree benefits. Complete this question by entering your answers in the tabs below. Reg 13 and 2 Reg 1A Determine Douglas-Roberts' pension expense for 2018. (Amounts to be deducted should be indicated with a minus sign. Enter your answers in millions rounded to 1 decimal place (.e., 5,500,000 should be entered as 5.5).) Pension Expense Pension expense Reg 18 and 2 to 4 > Reg 1A Reg 13 and 2 to 4 Prepare the appropriate journal entries to record the pension expense, to record any 2018 gains and losses, to record the cash contribution to plan assets and to record retiree benefits. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Enter your answers in millions rounded to 1 decimal place (I.e., 5,500,000 should be entered as 5.5).) Show less Viewynsaction list 1 Record annual pension expense. 2 Record the change in plan assets. 3 Record the change in the PBO. 4 Record the cash contribution to plan assets. 5 Record the retiree benefits paid. Credit Note : - Journal entry has been entered Record entry Clear entry View general journal