Answered step by step

Verified Expert Solution

Question

1 Approved Answer

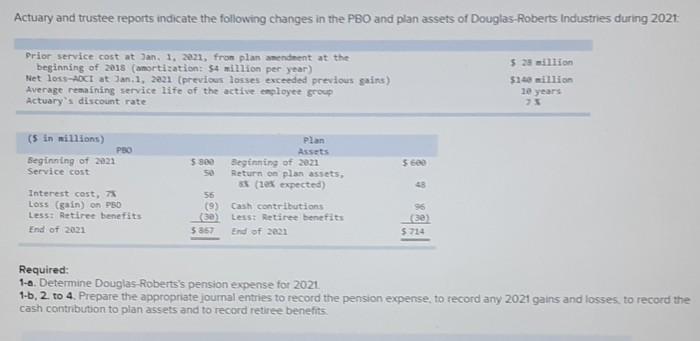

Actuary and trustee reports indicate the following changes in the PBO and plan assets of Douglas-Roberts Industries during 2021 Prior service cost at Jan.

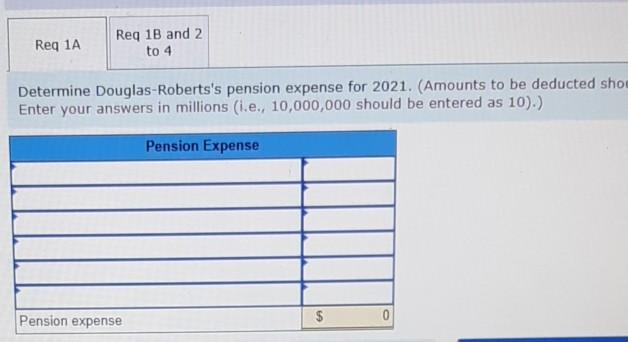

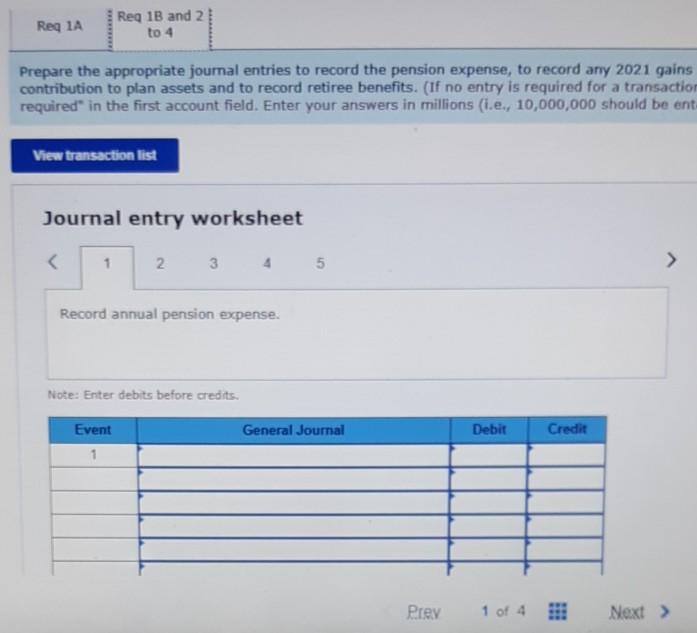

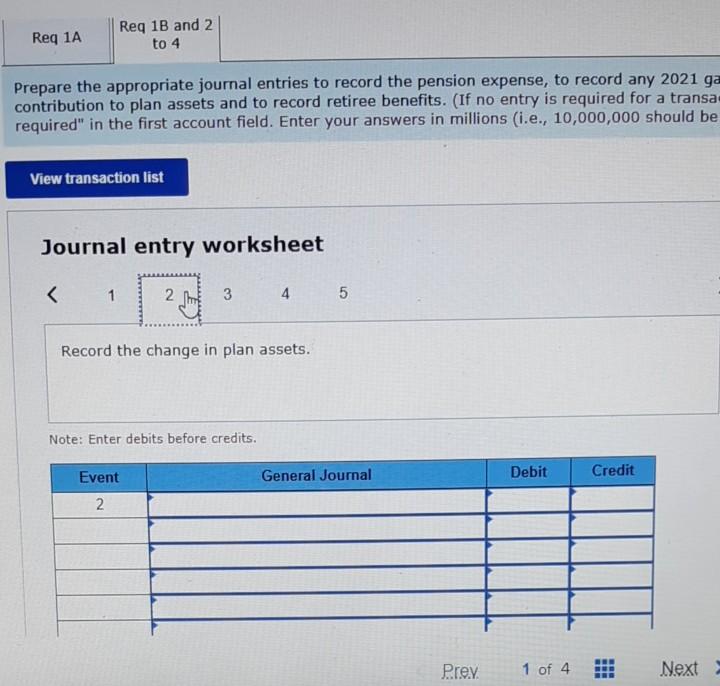

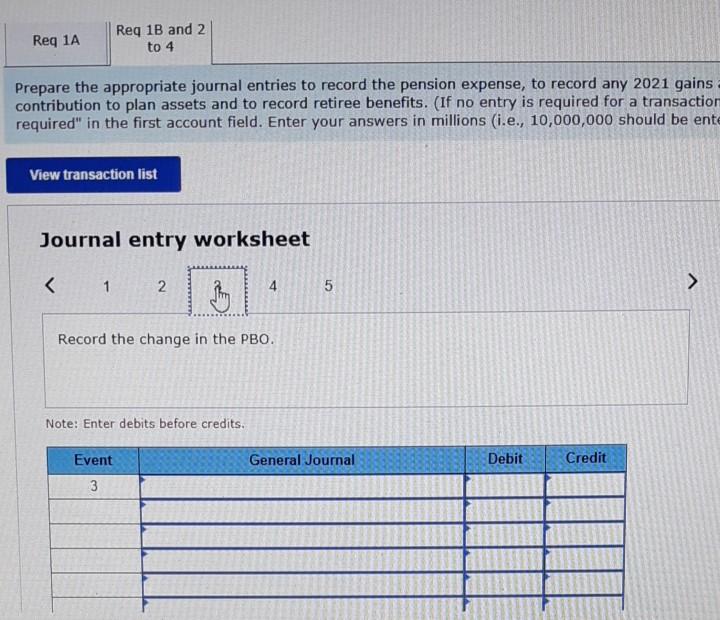

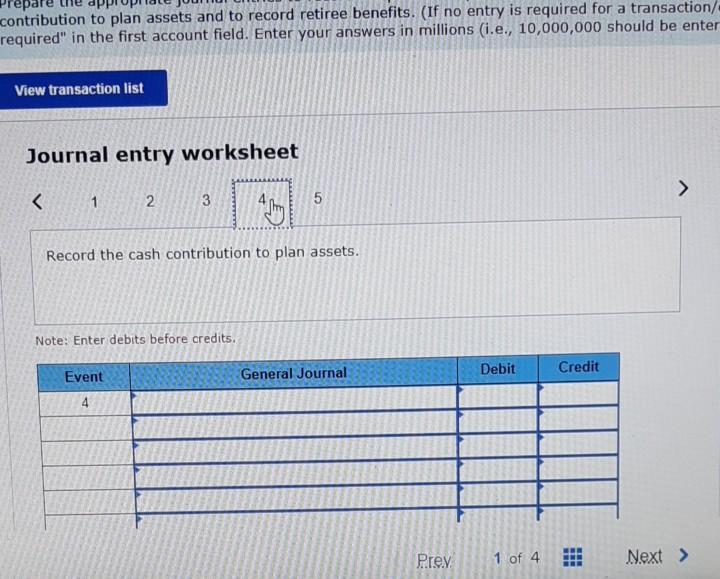

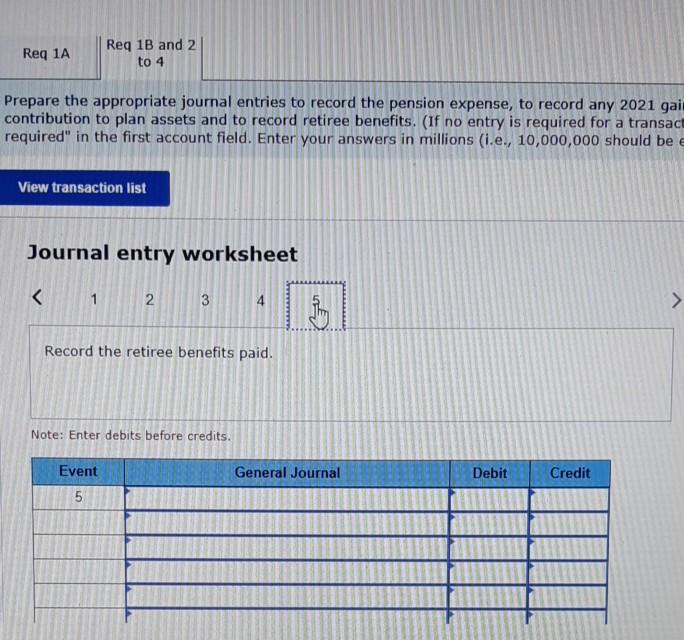

Actuary and trustee reports indicate the following changes in the PBO and plan assets of Douglas-Roberts Industries during 2021 Prior service cost at Jan. 1, 2021, from plan amendment at the beginning of 2018 (amortization: $4 million per year) Net loss-ADCI at Jan.1, 2821 (previous losses exceeded previous gains) Average remaining service life of the active employee group Actuary's discount rate $ 28 million $140 million 10 years 75 (5 in millions) PBO Plan Assets Beginning of 2021 5.800 Beginning of 2021 $600 Service cost 50 Return on plan assets, 8% (10% expected) 48 Interest cost, 7% 56 Loss (gain) on PBO (9) Cash contributions Less: Retiree benefits (30) Less: Retiree benefits (38) End of 2021 $867 End of 2021 5714 Required: 1-a. Determine Douglas-Roberts's pension expense for 2021 1-b, 2. to 4. Prepare the appropriate journal entries to record the pension expense, to record any 2021 gains and losses, to record the cash contribution to plan assets and to record retiree benefits Req 1A Req 1B and 2 to 4 Determine Douglas-Roberts's pension expense for 2021. (Amounts to be deducted show Enter your answers in millions (i.e., 10,000,000 should be entered as 10).) Pension Expense Pension expense Req 1A Req 1B and 2 to 4 Prepare the appropriate journal entries to record the pension expense, to record any 2021 gains contribution to plan assets and to record retiree benefits. (If no entry is required for a transaction required" in the first account field. Enter your answers in millions (i.e., 10,000,000 should be ent- View transaction list Journal entry worksheet < 1 2 3 45 Record annual pension expense. Note: Enter debits before credits. Event 1 General Journal Debit Credit Prev 1 of 4 Next > Req 1A Req 1B and 2 to 4 Prepare the appropriate journal entries to record the pension expense, to record any 2021 ga contribution to plan assets and to record retiree benefits. (If no entry is required for a transa required" in the first account field. Enter your answers in millions (i.e., 10,000,000 should be View transaction list Journal entry worksheet < 1 2 3 4 5 Record the change in plan assets. Note: Enter debits before credits. Event 2 General Journal Debit Credit Prev 1 of 4 Next > Req 1A Req 1B and 2 to 4 Prepare the appropriate journal entries to record the pension expense, to record any 2021 gains contribution to plan assets and to record retiree benefits. (If no entry is required for a transaction required" in the first account field. Enter your answers in millions (i.e., 10,000,000 should be ente View transaction list Journal entry worksheet < 1 2 Record the change in the PBO. Note: Enter debits before credits. Event 3 4 General Journal Debit Credit > contribution to plan assets and to record retiree benefits. (If no entry is required for a transaction/ required" in the first account field. Enter your answers in millions (i.e., 10,000,000 should be enter View transaction list Journal entry worksheet < 1 2 3 5 Record the cash contribution to plan assets. Note: Enter debits before credits. Event 4 General Journal Debit Credit > Prev 1 of 4 Next > Req 1A Req 1B and 2 to 4 Prepare the appropriate journal entries to record the pension expense, to record any 2021 gain contribution to plan assets and to record retiree benefits. (If no entry is required for a transact required" in the first account field. Enter your answers in millions (i.e., 10,000,000 should be e View transaction list Journal entry worksheet < 1 2 3 4 Record the retiree benefits paid. Note: Enter debits before credits. Event 5 General Journal Debit Credit >

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started