Answered step by step

Verified Expert Solution

Question

1 Approved Answer

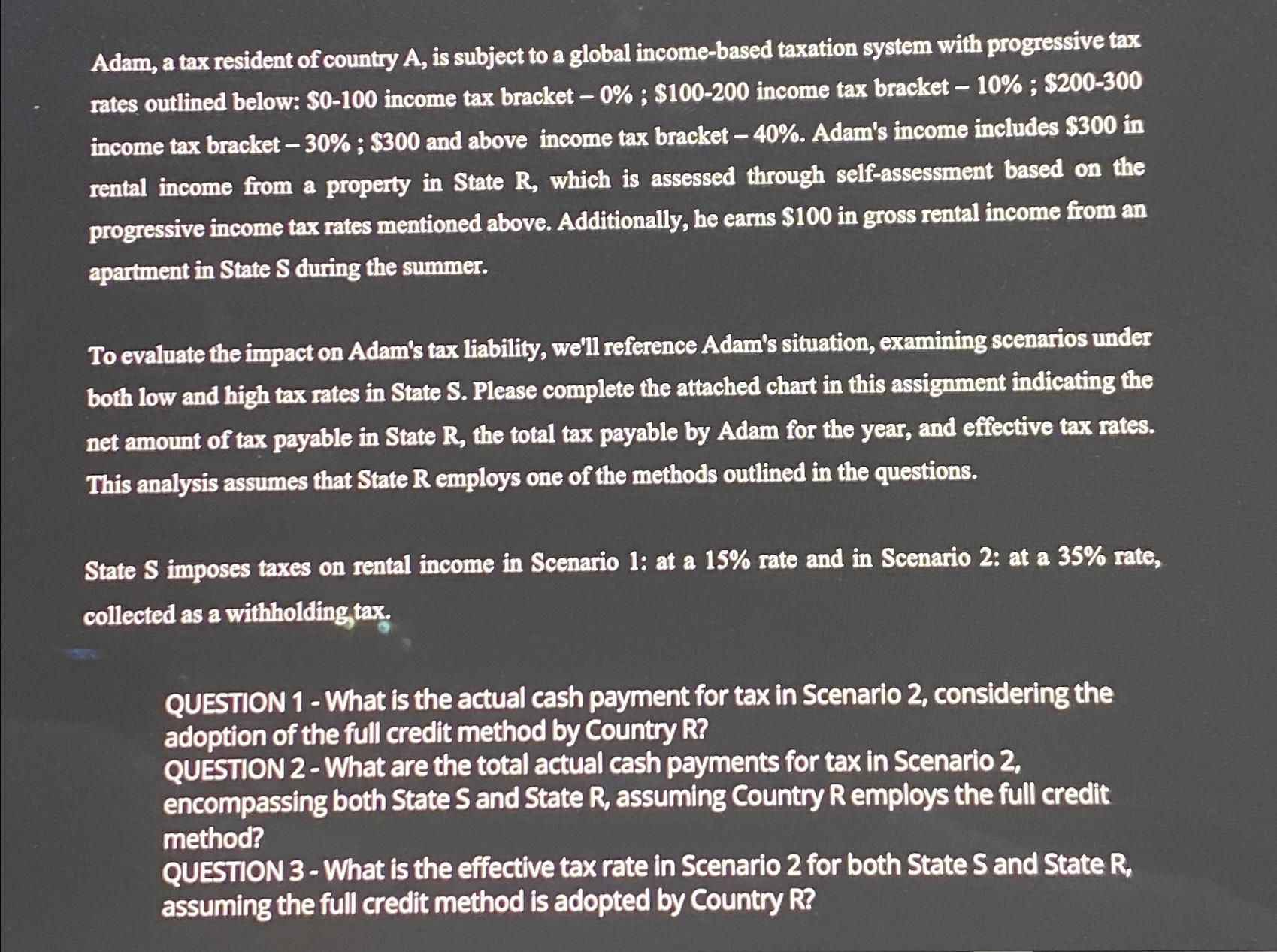

Adam, a tax resident of country A , is subject to a global income - based taxation system with progressive tax rates outlined below: $

Adam, a tax resident of country A is subject to a global incomebased taxation system with progressive tax rates outlined below: $ income tax bracket ; $ income tax bracket ; $ income tax bracket ;$ and above income tax bracket Adam's income includes $ in rental income from a property in State which is assessed through selfassessment based on the progressive income tax rates mentioned above. Additionally, he earns $ in gross rental income from an apartment in State during the summer.

To evaluate the impact on Adam's tax liability, we'll reference Adam's situation, examining scenarios under both low and high tax rates in State S Please complete the attached chart in this assignment indicating the net amount of tax payable in State the total tax payable by Adam for the year, and effective tax rates. This analysis assumes that State R employs one of the methods outlined in the questions.

State imposes taxes on rental income in Scenario : at a rate and in Scenario : at a rate, collected as a withholding tax.

QUESTION What is the actual cash payment for tax in Scenario considering the adoption of the full credit method by Country R

QUESTION What are the total actual cash payments for tax in Scenario encompassing both State and State assuming Country R employs the full credit method?

QUESTION What is the effective tax rate in Scenario for both State S and State R assuming the full credit method is adopted by Country R

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started