Question

Adam Bhd, a public listed company on Bursa Malaysia since the year 2005 had acquired Bubble Bhd and Crypto Bhd. The following are the financial

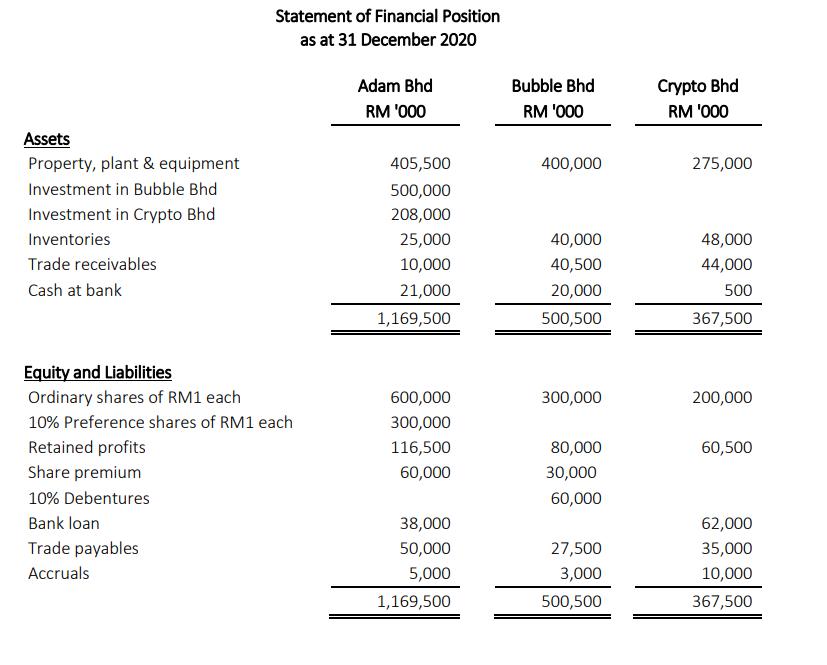

Adam Bhd, a public listed company on Bursa Malaysia since the year 2005 had acquired Bubble Bhd and Crypto Bhd. The following are the financial statements of the companies for the year ended 31 December 2020:

Additional information:

1. Adam Bhd bought 240 million ordinary shares of Bubble Bhd on 1 January 2017 by paying cash of RM500 million. On that date, the share premium and retained profits of Bubble Bhd amounted to RM20 million and RM40 million respectively. As at the acquisition date, a non-depreciable asset of Bubble Bhd had a fair value of RM15 million than its carrying amount. Bubble Bhd did not adjust its record to account for the increase in value.

2. A year after, on 1 January 2018, Adam Bhd acquired 40% ordinary shares of Crypto Bhd when the retained profits of Crypto Bhd was RM 30 million. The consideration was paid by cash of RM208 million. There has been no new issue of shares of Crypto Bhd since the date of acquisition.

3. During the year ended 2020, Adam Bhd purchased inventories from Bubble Bhd at a selling price of RM75 million with a 20% margin. The purchase was on a credit basis and no payment has been made until 31 December 2020. 40% of these inventories remain unsold at the end of the year.

4. Adam Bhd disposed of a machine to Bubble Bhd on September 2020 at RM100,000 above its carrying amount. The remaining useful life of this machine was ten years.

5. Group policies:

i. 10% for the impairment of the goodwill on consolidation, and

ii. Non-controlling interest is to be valued at its proportionate share of the fair value of the identifiable net assets of the subsidiaries on the date of acquisition.

Required: Prepare the Consolidated Statement of Financial Position of Adam Bhd Group as of 31 December 2020. Disclose all workings.

Statement of Financial Position as at 31 December 2020 Crypto Bhd RM '000 Adam Bhd Bubble Bhd RM '000 RM '000 Assets Property, plant & equipment 405,500 400,000 275,000 Investment in Bubble Bhd 500,000 Investment in Crypto Bhd 208,000 Inventories 25,000 40,000 48,000 Trade receivables 10,000 40,500 44,000 Cash at bank 21,000 20,000 500 1,169,500 500,500 367,500 Equity and Liabilities Ordinary shares of RM1 each 600,000 300,000 200,000 10% Preference shares of RM1 each 300,000 Retained profits 116,500 80,000 60,500 Share premium 60,000 30,000 10% Debentures 60,000 Bank loan 38,000 62,000 Trade payables 50,000 27,500 35,000 Accruals 5,000 3,000 10,000 1,169,500 500,500 367,500

Step by Step Solution

3.41 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Pg2 Case 2 JOURNAL ENTRIES Credit Particulars Date 2021 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started