Question

ADAM COMPANY HAS AN OLD MACHINE THAT COST WHEN PURCHASED $130000THE FIRM DEPRECIATION METHOD IS MACRS FOR 3 YEARS (PERCENTAGED Y1=33% Y2 45%,Y3=15%Y4=7%) THE EXPECTED

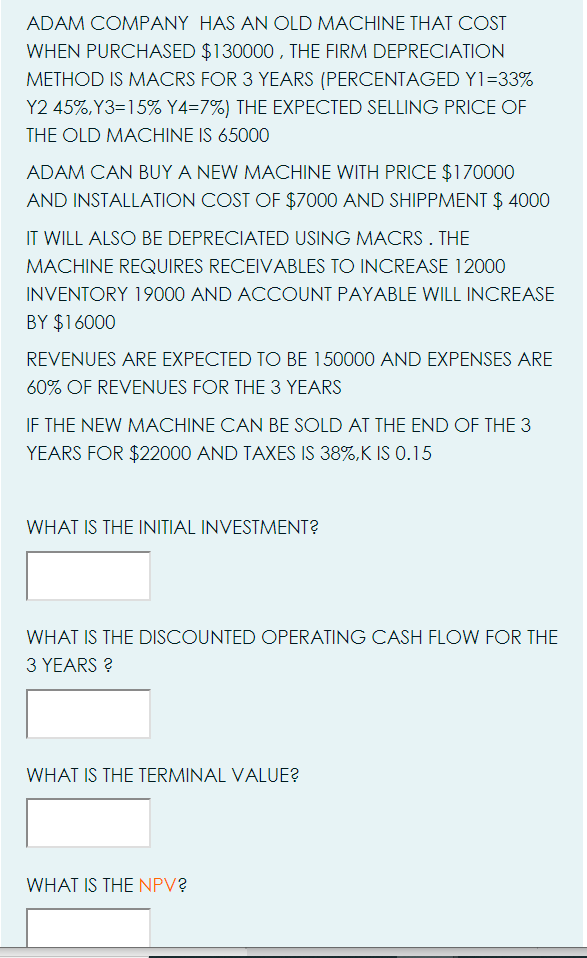

ADAM COMPANY HAS AN OLD MACHINE THAT COST WHEN PURCHASED $130000THE FIRM DEPRECIATION METHOD IS MACRS FOR 3 YEARS (PERCENTAGED Y1=33\% Y2 45\%,Y3=15\%Y4=7\%) THE EXPECTED SELLING PRICE OF THE OLD MACHINE IS 65000 ADAM CAN BUY A NEW MACHINE WITH PRICE $170000 AND INSTALLATION COST OF $7000 AND SHIPPMENT $ 4000 IT WILL ALSO BE DEPRECIATED USING MACRS THE MACHINE REQUIRES RECEIVABLES TO INCREASE 12000 INVENTORY 19000 AND ACCOUNT PAYABLE WILL INCREASE BY $16000 REVENUES ARE EXPECTED TO BE 150000 AND EXPENSES ARE 60% OF REVENUES FOR THE 3 YEARS IF THE NEW MACHINE CAN BE SOLD AT THE END OF THE 3 YEARS FOR $22000 AND TAXES 38% K IS

ADAM COMPANY HAS AN OLD MACHINE THAT COST WHEN PURCHASED $130000THE FIRM DEPRECIATION METHOD IS MACRS FOR 3 YEARS (PERCENTAGED Y1=33\% Y2 45\%,Y3=15\%Y4=7\%) THE EXPECTED SELLING PRICE OF THE OLD MACHINE IS 65000 ADAM CAN BUY A NEW MACHINE WITH PRICE $170000 AND INSTALLATION COST OF $7000 AND SHIPPMENT $ 4000 IT WILL ALSO BE DEPRECIATED USING MACRS THE MACHINE REQUIRES RECEIVABLES TO INCREASE 12000 INVENTORY 19000 AND ACCOUNT PAYABLE WILL INCREASE BY $16000 REVENUES ARE EXPECTED TO BE 150000 AND EXPENSES ARE 60% OF REVENUES FOR THE 3 YEARS IF THE NEW MACHINE CAN BE SOLD AT THE END OF THE 3 YEARS FOR $22000 AND TAXES 38% K IS

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started