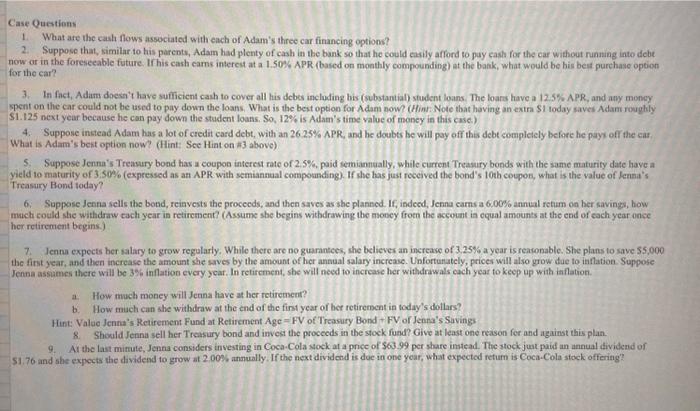

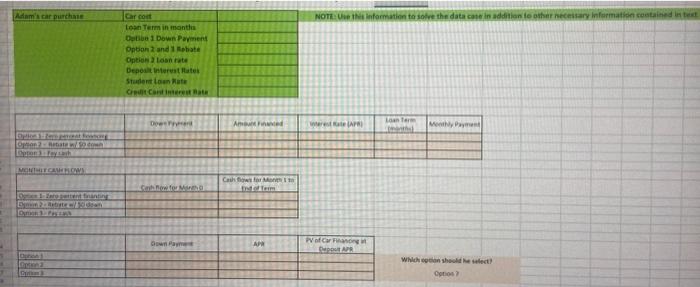

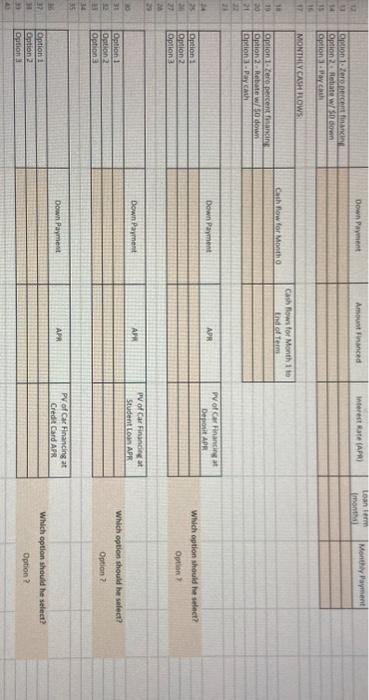

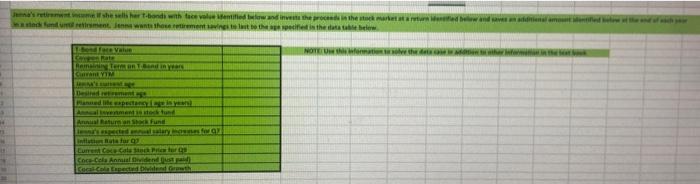

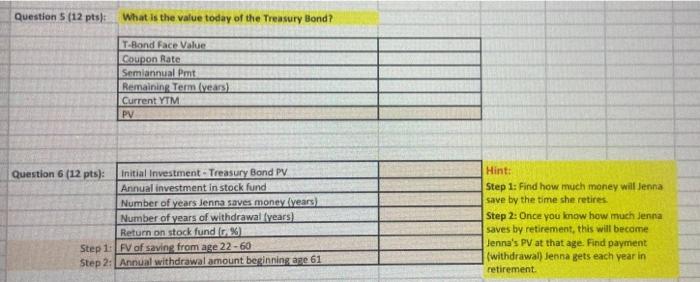

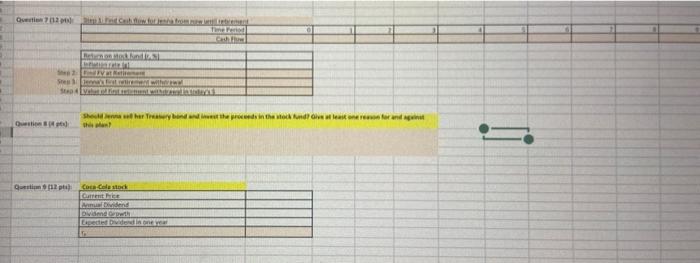

Adam has just graduated, and has a good job at a decent starting salary. He hopes to purchase his first aew car. The car that Adam is considering costs $47,000. The dealer has given him three payment options: 1. Zero percent fonancing. Make a $4,100 down payment from his savings and finance the remainder with a 0\%. APR loan for 60 months. Adam has more than enough eash for the down payment, thanks to generous graduation gifts. 2. Rebate with no money den*n. Receive a 54,400 rebate from the car dealer and finance the rest with a standard 60 -month loan. with an 6.00%. APR. He likes this option, as he could think of many other uses for the 54,100 of his saving: 3. Pay raxh. Giet the \$4,400 rebate and pay the rest with cash. While Adurn doesn't have balance of the car cost in hand, he wants to evaluale this option. His parents always paid cash when they bought a family car, Adam wobdens if this really was a good idehin Adam's fellow graduate, Jenna, has been trying to decide how much of her new salary she could save for retirement. Jena is considering putting 55,000 of her ansual savings in a stock fund. She just tumed 22 and has a long way to go until retirement at age 60 , and she considers this risk level reasonable. The fund she is looking at has carned an average of 6.00% over the past 15 years and could be expected to continue eaming this amount, on average. While she has no current retirement savings, five years ago Jenna'i grandparents gave her a new 30 -ysar U.S. Treasury bond with a 525,00 face value with 2.5% semiarinual coupons. Jenna wants to know ber retirement income if she both (1) sells her Treasury bond at its current market value and invests the proceeds in the stock fund an saves an addditional $5,000 at the end of each year in the stock fund from now until she retires. Once she retires, Jensa wants those saviags to last until shy Case Ouestions 1. What are the caah fows associated with each of Adam's three car financing options? 2. Suppose that, similar to his parents, Adam had plenty of cash in the bank so that he could casily afford to pay cash for the car without ruasiag into debe. now or in the foresecable future. If his cash cams intereat at a 1.50%. APR (based on monthly compounding) at the bank, what would be his bent purchase option for the car? 3. In fact, Adarm doesy't have suficient cash to cover all his debes including his (scbstantial) student loans. The loars have a 12.57, A PR, and any mongy pent on the car could not he used to pay down the loans. What is the beat option for Adan now? (Hint. Note that having an extra $1 today saves Adam roughly S1. 125 next year because he can pay down the stadent loans. So, 12% is Adam's time value of money in this case.) 4. Suppose instead Adam has a lot of credit card debt, with an 26.25% APR, and he doubts he will pay off this debt compleiely belore he payi off the car What is Adam's bent option now? (Hint: Sec Hiat on A 3 above) 5. Suppose Jenna's Treasury bond has a coupon intereat rate of 2.5%, paid semiannially, while current Treasury bonds with the same maturity date have a yield to maturity of 3.5076 (expressed as att APR with semiannal compoanding). If she has just reseived the bond's 10 ath coupon, what is the value of Jenat's Treasury Bond today? 6. Sappose Jenna sells the bond, reinvests the procecds, and then saves as she planned. If, indecd, Jenna carns a 6.00%5 annual retam en her savings, how mach could she withdraw cach year in retirement? (Assume she begins withdrawing the money froen the account in equal amounts at the end of cach year once her retirement begins:) 7. Jenna expects ber salary to grow regularly. While there are no guarantees, she believer an increase of 3.25% a year is reavonable. She plans to save $5,000 the lirst year, and then increase the amount she saves by the amount of her annual salary increase. Unforturately, prices will also grow due to iaflation. Suppose Jenna assumes there will be 3% inflation every year. In retirement, she will need to increase her withdrawals cach year to keep up with inflation. a. How much money will Jenna have at her rotireusert? b. How much can she withdraw at the end of the fins year of her retirement in today's dollars? Hint: Valde Jenna's Retirement Fund at Retirement Age = FV of Treasury Bond + FV of Jenna's Savings 8. Should Jenna sell her Treasury bond and invest the proceeds in the stock fund? Give at least one reison fer and against this plan. 9. At the Last mimute. Jenna considers investing in Coca. Cola Nock at a price of $63.99 per share instead. The stock juat paid an annual dividend of 53.76 and she expects the dividend to grow at 2.00., annually. If the next dividend is doe in one year, what expected retum is Coca. Cola stock offeriag? 2. Find how much money will Jenna by the time she retires. p. 2nce you know how much Jenna es by retirement, this will become na's PV at that age. Find payment. hidrawal) Jenna zets each year in rement. Adam has just graduated, and has a good job at a decent starting salary. He hopes to purchase his first aew car. The car that Adam is considering costs $47,000. The dealer has given him three payment options: 1. Zero percent fonancing. Make a $4,100 down payment from his savings and finance the remainder with a 0\%. APR loan for 60 months. Adam has more than enough eash for the down payment, thanks to generous graduation gifts. 2. Rebate with no money den*n. Receive a 54,400 rebate from the car dealer and finance the rest with a standard 60 -month loan. with an 6.00%. APR. He likes this option, as he could think of many other uses for the 54,100 of his saving: 3. Pay raxh. Giet the \$4,400 rebate and pay the rest with cash. While Adurn doesn't have balance of the car cost in hand, he wants to evaluale this option. His parents always paid cash when they bought a family car, Adam wobdens if this really was a good idehin Adam's fellow graduate, Jenna, has been trying to decide how much of her new salary she could save for retirement. Jena is considering putting 55,000 of her ansual savings in a stock fund. She just tumed 22 and has a long way to go until retirement at age 60 , and she considers this risk level reasonable. The fund she is looking at has carned an average of 6.00% over the past 15 years and could be expected to continue eaming this amount, on average. While she has no current retirement savings, five years ago Jenna'i grandparents gave her a new 30 -ysar U.S. Treasury bond with a 525,00 face value with 2.5% semiarinual coupons. Jenna wants to know ber retirement income if she both (1) sells her Treasury bond at its current market value and invests the proceeds in the stock fund an saves an addditional $5,000 at the end of each year in the stock fund from now until she retires. Once she retires, Jensa wants those saviags to last until shy Case Ouestions 1. What are the caah fows associated with each of Adam's three car financing options? 2. Suppose that, similar to his parents, Adam had plenty of cash in the bank so that he could casily afford to pay cash for the car without ruasiag into debe. now or in the foresecable future. If his cash cams intereat at a 1.50%. APR (based on monthly compounding) at the bank, what would be his bent purchase option for the car? 3. In fact, Adarm doesy't have suficient cash to cover all his debes including his (scbstantial) student loans. The loars have a 12.57, A PR, and any mongy pent on the car could not he used to pay down the loans. What is the beat option for Adan now? (Hint. Note that having an extra $1 today saves Adam roughly S1. 125 next year because he can pay down the stadent loans. So, 12% is Adam's time value of money in this case.) 4. Suppose instead Adam has a lot of credit card debt, with an 26.25% APR, and he doubts he will pay off this debt compleiely belore he payi off the car What is Adam's bent option now? (Hint: Sec Hiat on A 3 above) 5. Suppose Jenna's Treasury bond has a coupon intereat rate of 2.5%, paid semiannially, while current Treasury bonds with the same maturity date have a yield to maturity of 3.5076 (expressed as att APR with semiannal compoanding). If she has just reseived the bond's 10 ath coupon, what is the value of Jenat's Treasury Bond today? 6. Sappose Jenna sells the bond, reinvests the procecds, and then saves as she planned. If, indecd, Jenna carns a 6.00%5 annual retam en her savings, how mach could she withdraw cach year in retirement? (Assume she begins withdrawing the money froen the account in equal amounts at the end of cach year once her retirement begins:) 7. Jenna expects ber salary to grow regularly. While there are no guarantees, she believer an increase of 3.25% a year is reavonable. She plans to save $5,000 the lirst year, and then increase the amount she saves by the amount of her annual salary increase. Unforturately, prices will also grow due to iaflation. Suppose Jenna assumes there will be 3% inflation every year. In retirement, she will need to increase her withdrawals cach year to keep up with inflation. a. How much money will Jenna have at her rotireusert? b. How much can she withdraw at the end of the fins year of her retirement in today's dollars? Hint: Valde Jenna's Retirement Fund at Retirement Age = FV of Treasury Bond + FV of Jenna's Savings 8. Should Jenna sell her Treasury bond and invest the proceeds in the stock fund? Give at least one reison fer and against this plan. 9. At the Last mimute. Jenna considers investing in Coca. Cola Nock at a price of $63.99 per share instead. The stock juat paid an annual dividend of 53.76 and she expects the dividend to grow at 2.00., annually. If the next dividend is doe in one year, what expected retum is Coca. Cola stock offeriag? 2. Find how much money will Jenna by the time she retires. p. 2nce you know how much Jenna es by retirement, this will become na's PV at that age. Find payment. hidrawal) Jenna zets each year in rement