Answered step by step

Verified Expert Solution

Question

1 Approved Answer

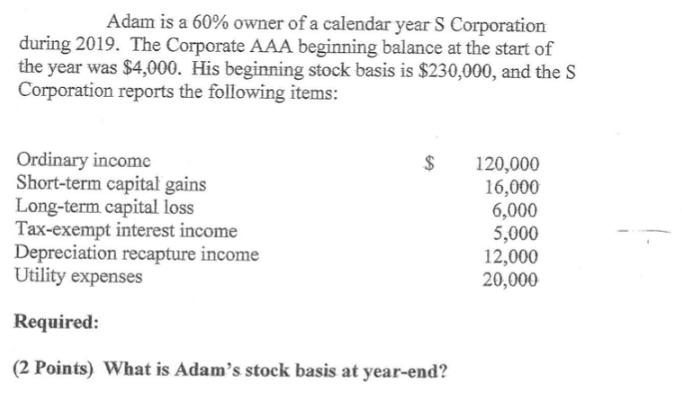

Adam is a 60% owner of a calendar year S Corporation during 2019. The Corporate AAA beginning balance at the start of the year

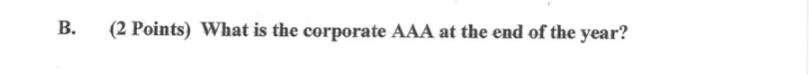

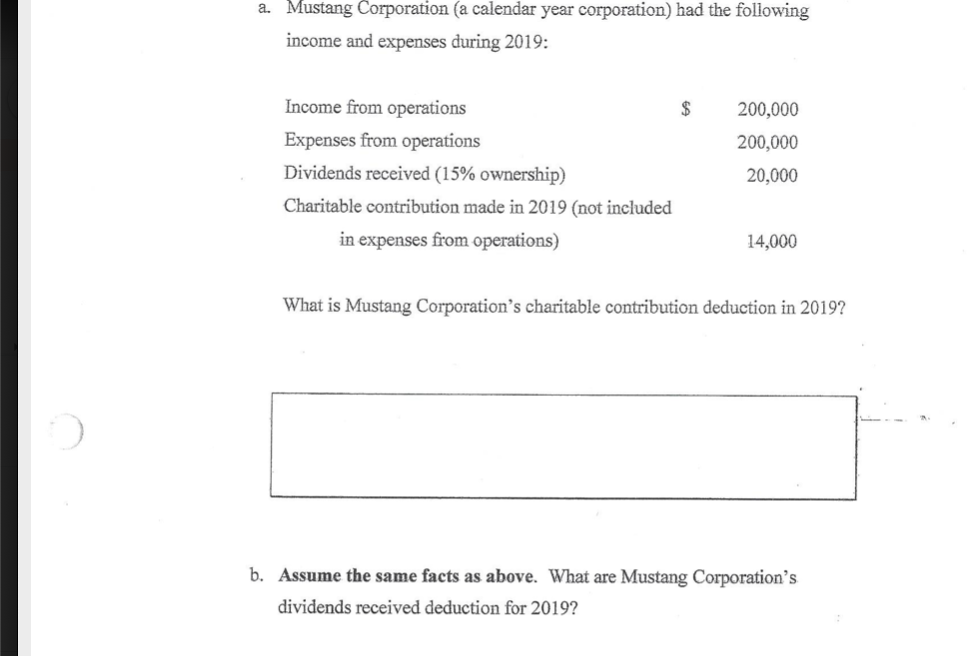

Adam is a 60% owner of a calendar year S Corporation during 2019. The Corporate AAA beginning balance at the start of the year was $4,000. His beginning stock basis is $230,000, and the S Corporation reports the following items: Ordinary income Short-term capital gains Long-term capital loss Tax-exempt interest income Depreciation recapture income Utility expenses Required: (2 Points) What is Adam's stock basis at year-end? 120,000 16,000 6,000 5,000 12,000 20,000 B. (2 Points) What is the corporate AAA at the end of the year? a. Mustang Corporation (a calendar year corporation) had the following income and expenses during 2019: Income from operations Expenses from operations Dividends received (15% ownership) Charitable contribution made in 2019 (not included in expenses from operations) $ 200,000 200,000 20,000 14,000 What is Mustang Corporation's charitable contribution deduction in 2019? b. Assume the same facts as above. What are Mustang Corporation's dividends received deduction for 2019?

Step by Step Solution

★★★★★

3.45 Rating (139 Votes )

There are 3 Steps involved in it

Step: 1

Answer To determine Adams stock basis at yearend we need to calculate the changes to his stock basis during the year and then adjust his beginning sto...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started