Answered step by step

Verified Expert Solution

Question

1 Approved Answer

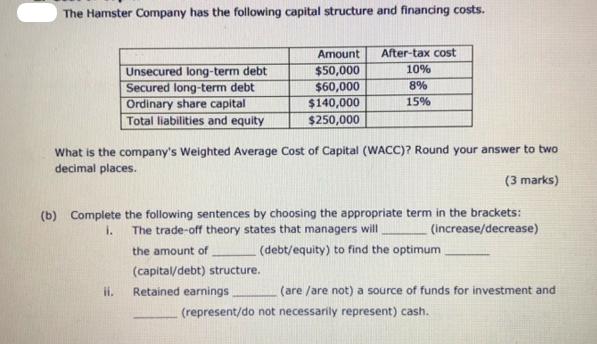

The Hamster Company has the following capital structure and financing costs. Unsecured long-term debt Secured long-term debt Ordinary share capital Total liabilities and equity

The Hamster Company has the following capital structure and financing costs. Unsecured long-term debt Secured long-term debt Ordinary share capital Total liabilities and equity ii. Amount $50,000 $60,000 $140,000 $250,000 What is the company's Weighted Average Cost of Capital (WACC)? Round your answer to two decimal places. (3 marks) After-tax cost 10% 8% 15% (b) Complete the following sentences by choosing the appropriate term in the brackets: The trade-off theory states that managers will 1. (increase/decrease) the amount of (debt/equity) to find the optimum (capital/debt) structure. Retained earnings (are /are not) a source of funds for investment and (represent/do not necessarily represent) cash.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To calculate the Weighted Average Cost of Capital WACC we use the formula WACC fracE times re D time...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started