Question

Adam Mullings is a retailer who had not kept a full set of accounting records. The following is a summary of her bank transactions in

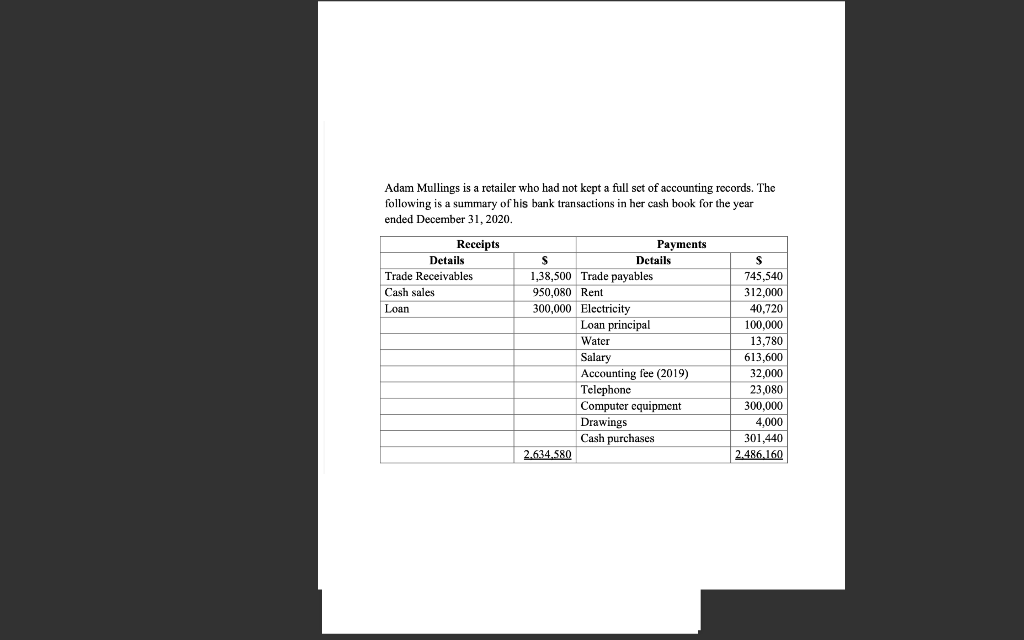

Adam Mullings is a retailer who had not kept a full set of accounting records. The following is a summary of her bank transactions in her cash book for the year ended December 31, 2020.

You are given the following additional information:

1 Favourable bank balance per cash book on January 1, 2020 amounting to

$106,920

2 During the financial year discounts allowed by trade payables amounted to $440 and those allowed to trade receivables $800.

3 During the financial year goods returned by trade receivables amounted to $1,600 and goods returned to trade payables amounted to $6,900.

4 During the financial year a trade debt of $1,200 owed by Lottie Graham was off-set against the $2,000 owing to the same Lottie Graham a trade creditor.

5 Janet Hutton, a cash sales customer returned goods during the financial year amounting to $700. Janet Hutton was repaid her $700 from the daily cash sales.

6 Adam Mullings grants a credit period of 30 days to trade receivables. The closing trade receivables balance includes a debt of $800 from Fanon Browning. The goods were sold to Fanon in November 2019. Fanon went to the United States of America for a two (2) weeks vacation in February 2020. On December 31, 2020 Fanon was still in the USA.

7 The amount of cash received from cash sales were all paid into the bank with the exception of:

$2,800 Plumbing repairs $4,000 Donation to community Christmas party

8 Adam Mullings keeps a cash float of $10,000 for change in his retail outlet.

9 Adam Mullings agreed to pay his daughter Virginia, a commission of 5% of the net profit after charging such commission, for working in the retail outlet on Sundays. (Round to the nearest dollar)

10 The computer equipment was purchased on April 9, 2020. Depreciation should be calculated on the computer equipment on the straight line basis at a rate of 20% per annum on cost. It is the policy of the business to charge a full months depreciation in the month of acquisition ordisposal.

11 The accounting fee for preparing the 2020 financial statements is estimated at $35,200.

12 During the year, Adam Mullings puts a further $135,000 into the bank account of the business to shore up working capital.

13 On April 1, 2020 Adam Mullings received a loan of $300,000 from his

mother Mara Mullings. Interest should be charged on the reducing

balance at a rate of 10% per annum. The first interest payment is to be

made on March 31, 2021. The principal is being paid in equal instalments

of $100,000 on September 30, 2020, September 30, 2021 and September 30,2022.

Required: Prepare the Trade Debtors and Trade Creditors Control Account

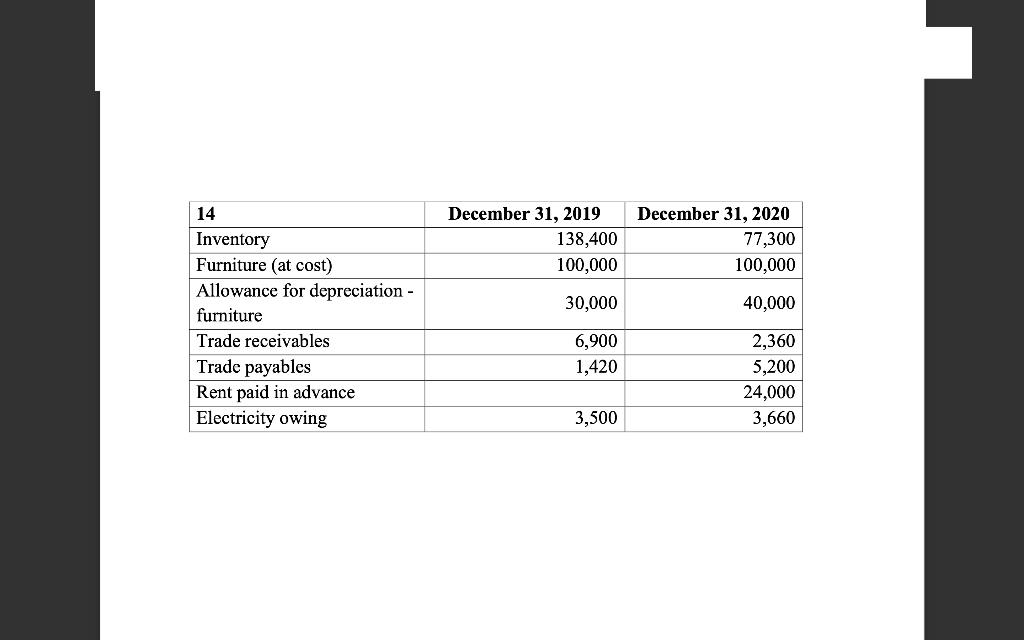

Adam Mullings is a retailer who had not kept a full set of accounting records. The following is a summary of his bank transactions in her cash book for the year ended December 31, 2020. \begin{tabular}{|l|r|r|} \hline 14 & December 31, 2019 & December 31, 2020 \\ \hline Inventory & 138,400 & 77,300 \\ \hline Furniture (at cost) & 100,000 & 100,000 \\ \hline Allowance for depreciation -furniture & 30,000 & 40,000 \\ \hline Trade receivables & 6,900 & 2,360 \\ \hline Trade payables & 1,420 & 5,200 \\ \hline Rent paid in advance & & 24,000 \\ \hline Electricity owing & 3,500 & 3,660 \\ \hline \end{tabular} Adam Mullings is a retailer who had not kept a full set of accounting records. The following is a summary of his bank transactions in her cash book for the year ended December 31, 2020. \begin{tabular}{|l|r|r|} \hline 14 & December 31, 2019 & December 31, 2020 \\ \hline Inventory & 138,400 & 77,300 \\ \hline Furniture (at cost) & 100,000 & 100,000 \\ \hline Allowance for depreciation -furniture & 30,000 & 40,000 \\ \hline Trade receivables & 6,900 & 2,360 \\ \hline Trade payables & 1,420 & 5,200 \\ \hline Rent paid in advance & & 24,000 \\ \hline Electricity owing & 3,500 & 3,660 \\ \hline \end{tabular}Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started