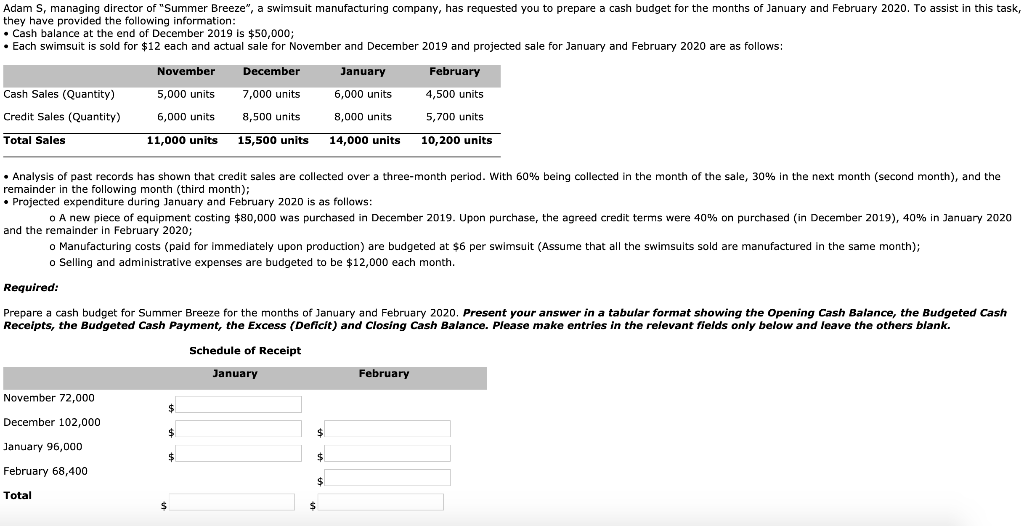

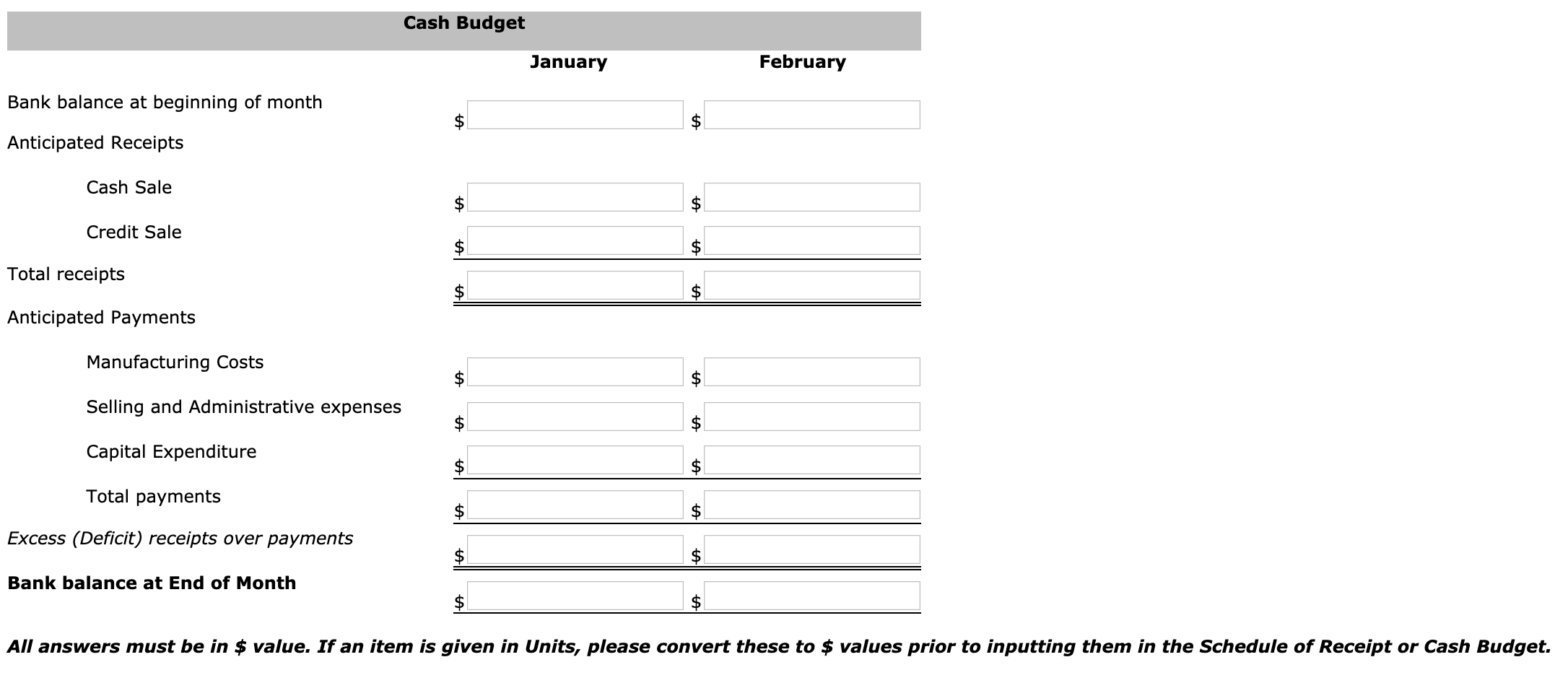

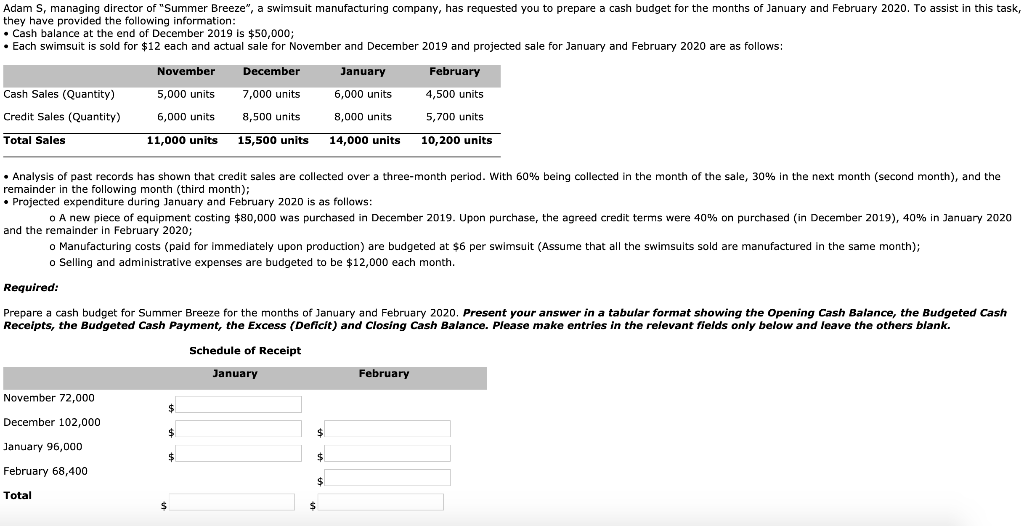

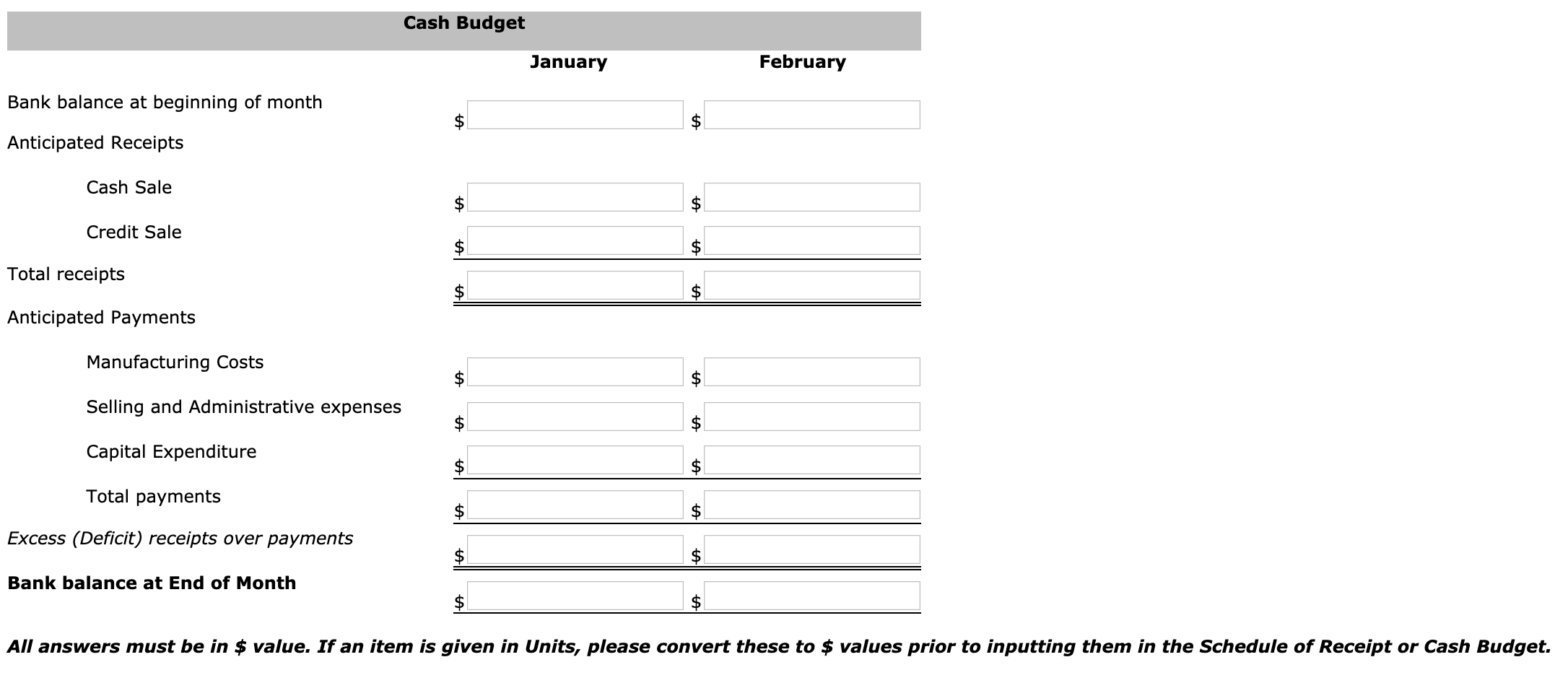

Adam S, managing director of "Summer Breeze", a swimsuit manufacturing company, has requested you to prepare a cash budget for the months of January and February 2020. To assist in this task, they have provided the following information: Cash balance at the end of December 2019 is $50,000; Each swimsuit is sold for $12 each and actual sale for November and December 2019 and projected sale for January and February 2020 are as follows: November December January February Cash Sales (Quantity) Credit Sales (Quantity) Total Sales 5,000 units 6,000 units 11,000 units 7,000 units 8,500 units 15,500 units 6,000 units 8,000 units 14,000 units 4,500 units 5,700 units 10,200 units Analysis of past records has shown that credit sales are collected over a three-month period. With 60% being collected in the month of the sale, 30% in the next month (second month), and the remainder in the following month (third month); Projected expenditure during January and February 2020 is as follows: O A new piece of equipment casting $80,000 was purchased in December 2019. Upon purchase, the agreed credit terms were 40% on purchased (in December 2019), 40% in January 2020 and the remainder in February 2020; o Manufacturing costs (paid for immediately upon production) are budgeted at $6 per swimsuit (Assume that all the swimsuits sold are manufactured in the same month); o Selling and administrative expenses are budgeted to be $12,000 each month. Required: Prepare a cash budget for Summer Breeze for the months of January and February 2020. Present your answer in a tabular format showing the Opening Cash Balance, the Budgeted Cash Receipts, the Budgeted Cash Payment, the Excess (Deficit) and Closing Cash Balance. Please make entries in the relevant fields only below and leave the others blank. Schedule of Receipt January February November 72,000 A December 102,000 January 96,000 February 68,400 Total Cash Budget January February Bank balance at beginning of month A Anticipated Receipts - Cash Sale A A Credit Sale A A Total receipts A A Anticipated Payments Manufacturing Costs A A Selling and Administrative expenses A Capital Expenditure A Al Total payments A Excess (Deficit) receipts over payments Al Al A Bank balance at End of Month Al All answers must be in $ value. If an item is given in Units, please convert these to $ values prior to inputting them in the Schedule of Receipt or Cash Budget