Question

Adams, Inc., acquires Clay Corporation on January 1, 2017, in exchange for $674,800 cash. Immediately after the acquisition, the two companies have the following account

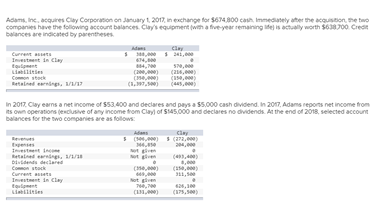

Adams, Inc., acquires Clay Corporation on January 1, 2017, in exchange for $674,800 cash. Immediately after the acquisition, the two companies have the following account balances. Clays equipment (with a five-year remaining life) is actually worth $638,700. Credit balances are indicated by parentheses.

Adams Clay Current assets $ 388,000 $ 241,000 Investment in Clay 674,800 0 Equipment 884,700 570,000 Liabilities (200,000 ) (216,000 ) Common stock (350,000 ) (150,000 ) Retained earnings, 1/1/17 (1,397,500 ) (445,000 ) In 2017, Clay earns a net income of $53,400 and declares and pays a $5,000 cash dividend.

In 2017, Adams reports net income from its own operations (exclusive of any income from Clay) of $145,000 and declares no dividends. At the end of 2018, selected account balances for the two companies are as follows:

Adams Clay Revenues $ (506,000 ) $ (272,000 ) Expenses 366,850 204,000 Investment income Not given 0 Retained earnings, 1/1/18 Not given (493,400 ) Dividends declared 0 8,000 Common stock (350,000 ) (150,000 ) Current assets 669,000 311,500 Investment in Clay Not given 0 Equipment 760,700 626,100 Liabilities (131,000 ) (175,500 )

A: What are the December 31, 2018, Investment Income and Investment in Clay account balances assuming Adams uses the:

Equity method.

Initial value method.

B: How does the parents internal investment accounting method choice affect the amount reported for expenses in its December 31, 2018, consolidated income statement?

C: How does the parents internal investment accounting method choice affect the amount reported for equipment in its December 31, 2018, consolidated balance sheet?

D: What is Adamss January 1, 2018, Retained Earnings account balance assuming Adams accounts for its investment in Clay using the:

Equity value method.

Initial value method.

E: What worksheet adjustment to Adamss January 1, 2018, Retained Earnings account balance is required if Adams accounts for its investment in Clay using the initial value method?

F: Prepare the worksheet entry to eliminate Clays stockholders equity.

G: What is consolidated net income for 2018?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started