Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Adams Manufacturing allocates overhead to production on the basis of direct labor costs. At the beginning of the year, Adams estimated total overhead of $345,600;

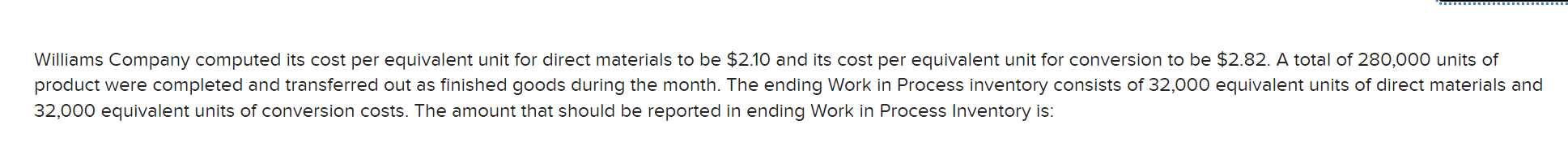

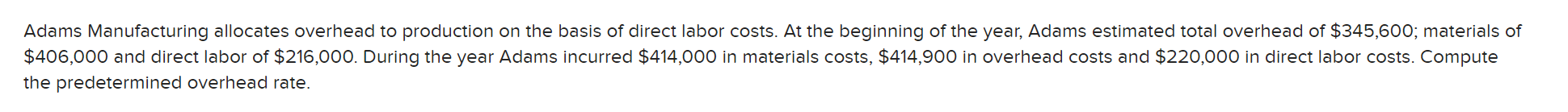

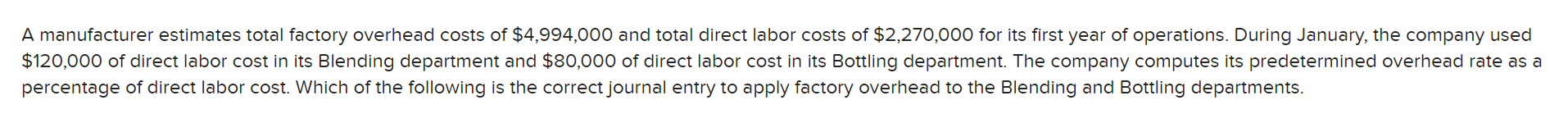

Adams Manufacturing allocates overhead to production on the basis of direct labor costs. At the beginning of the year, Adams estimated total overhead of $345,600; materials of $406,000 and direct labor of $216,000. During the year Adams incurred $414,000 in materials costs, $414,900 in overhead costs and $220,000 in direct labor costs. Compute the predetermined overhead rate. Williams Company computed its cost per equivalent unit for direct materials to be $2.10 and its cost per equivalent unit for conversion to be $2.82. A total of 280,000 units of product were completed and transferred out as finished goods during the month. The ending Work in Process inventory consists of 32,000 equivalent units of direct materials and 32,000 equivalent units of conversion costs. The amount that should be reported in ending Work in Process Inventory is: A manufacturer estimates total factory overhead costs of $4,994,000 and total direct labor costs of $2,270,000 for its first year of operations. During January, the company used $120,000 of direct labor cost in its Blending department and $80,000 of direct labor cost in its Bottling department. The company computes its predetermined overhead rate as a percentage of direct labor cost. Which of the following is the correct journal entry to apply factory overhead to the Blending and Bottling departments

Adams Manufacturing allocates overhead to production on the basis of direct labor costs. At the beginning of the year, Adams estimated total overhead of $345,600; materials of $406,000 and direct labor of $216,000. During the year Adams incurred $414,000 in materials costs, $414,900 in overhead costs and $220,000 in direct labor costs. Compute the predetermined overhead rate. Williams Company computed its cost per equivalent unit for direct materials to be $2.10 and its cost per equivalent unit for conversion to be $2.82. A total of 280,000 units of product were completed and transferred out as finished goods during the month. The ending Work in Process inventory consists of 32,000 equivalent units of direct materials and 32,000 equivalent units of conversion costs. The amount that should be reported in ending Work in Process Inventory is: A manufacturer estimates total factory overhead costs of $4,994,000 and total direct labor costs of $2,270,000 for its first year of operations. During January, the company used $120,000 of direct labor cost in its Blending department and $80,000 of direct labor cost in its Bottling department. The company computes its predetermined overhead rate as a percentage of direct labor cost. Which of the following is the correct journal entry to apply factory overhead to the Blending and Bottling departments Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started