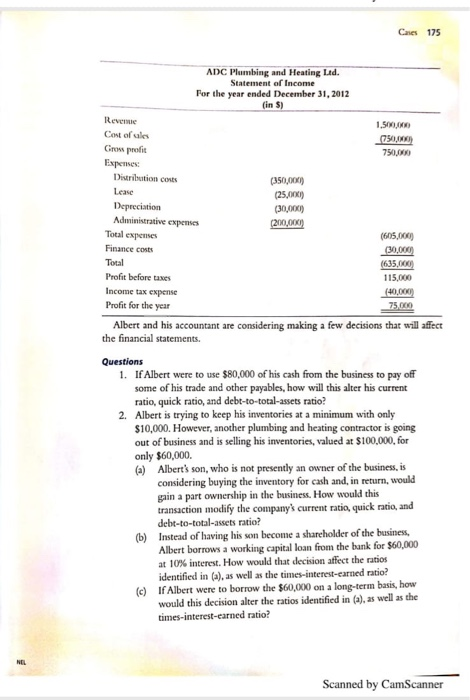

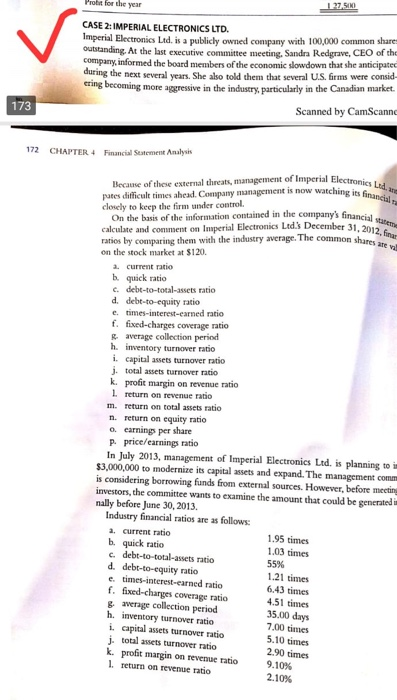

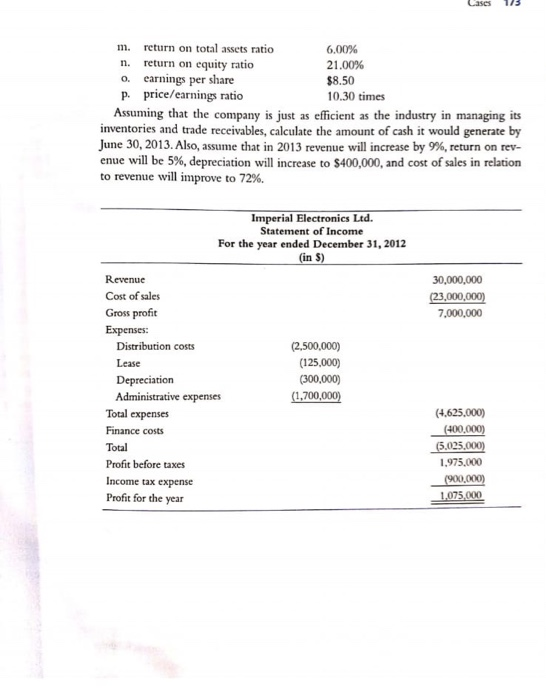

Caves 175 ADC Plumbing and Heating Ltd. Statement of Income For the year ended December 31, 2012 (in ) Reven 1,500,000 Cost of ules Grow profit 750,000 Expenses Distribution costs (350,0041 Lease (25,00) Depreciation (30,000 Administrative expenses (200,000) Total expenses (605,000 Finance costs (30,000) Total (635,000 Profit before taxes 115,000 Income tax expense Profit for the year 75.000 Albert and his accountant are considering making a few decisions that will affect the financial statements. Questions 1. If Albert were to use $80,000 of his cash from the business to pay off some of his trade and other payables, how will this alter his current ratio, quick ratio, and debt-to-total-assets ratio? 2. Albert is trying to keep his inventories at a minimum with only $10,000. However, another plumbing and heating contractor is going out of business and is selling his inventories, valued at $100,000, for only $60,000 (a) Albert's son, who is not presently an owner of the business, is considering buying the inventory for cash and, in return, would gain a part ownership in the business. How would this transaction modify the company's current ratio, quick ratio, and debt-to-total-assets ratio? (b) Instead of having his son become a shareholder of the business, Albert borrows a working capital loan from the bank for $60,000 at 10% interest. How would that decision affect the ratios identified in (a), as well as the times-interest-earned ratio? (c) If Albert were to borrow the $60,000 on a long-term basis, how would this decision alter the ratios identified in (a), as well as the times-interest-earned ratio? NEL Scanned by CamScanner 127.50 Because of these external threats, management of Imperial Electronics Ltd. utes difficult times ahead. Company management is now watching its facial calculate and comment on Imperial Electronics Ltd. December 31, 2012, fina On the basis of the information contained in the company's financial statem ratios by comparing them with the industry average. The common shares are Profit for the year CASE 2: IMPERIAL ELECTRONICS LTD. Imperial Electronics Ltd. is a publicly owned company with 100,000 common share outstanding. At the last executive committee meeting, Sandra Redgrave, CEO of the company informed the board members of the economic slowdown that she anticipated during the next several years. She also told them that several U.S. firms were consid ering becoming more aggressive in the industry, particularly in the Canadian market. 173 Scanned by CamScanne 172 CHAPTER 4 Financial Statement Analysis closely to keep the firm under control. on the stock market at $120. 1. current ratio b. quick ratio C. debt-to-total-assets ratio d. debt-to-equity ratio e.times-interest-earned ratio f. fixed-charges coverage ratio average collection period h. inventory turnover ratio i. capital assets turnover ratio j. total assets turnover ratio k profit margin on revenue ratio 1. return on revenue ratio m. return on total assets ratio n. return on equity ratio o. earning per share p.price/earnings ratio In July 2013, management of Imperial Electronics Ltd. is planning to in $3,000,000 to modernize its capital assets and expand. The management comm is considering borrowing funds from external sources. However, before meeting investors, the committee wants to examine the amount that could be generated in nally before June 30, 2013. Industry financial ratios are as follows: a. current ratio 1.95 times b. quick ratio c. debt-to-total-assets ratio 1.03 times 55% d. debt-to-equity ratio 1.21 times e times-interest-earned ratio 6.43 times f. fixed-charges coverage ratio gwerage collection period h. inventory turnover ratio i. capital assets turnover ratio j. total assets turnover ratio k profit margin on revenue ratio I return on revenue ratio 4.51 times 35.00 days 7.00 times 5.10 times 2.90 times 9.10% 2.10% Lases 113 m. n. return on total assets ratio 6.00% return on equity ratio 21.00% 0. earnings per share $8.50 p. price/earnings ratio 10.30 times Assuming that the company is just as efficient as the industry in managing its inventories and trade receivables, calculate the amount of cash it would generate by June 30, 2013. Also, assume that in 2013 revenue will increase by 9%, return on rev- enue will be 5%, depreciation will increase to $400,000, and cost of sales in relation to revenue will improve to 72%. 30,000,000 (23,000,000) 7,000,000 Imperial Electronics Ltd. Statement of Income For the year ended December 31, 2012 (in S) Revenue Cost of sales Gross profit Expenses: Distribution costs (2,500,000) Lease (125.000) Depreciation (300.000) Administrative expenses (1,700,000) Total expenses Finance costs Total Profit before taxes Income tax expense Profit for the year (4.625,000) (400.000) (5.025.000) 1,975.000 (900,000) 1,075,000