Answered step by step

Verified Expert Solution

Question

1 Approved Answer

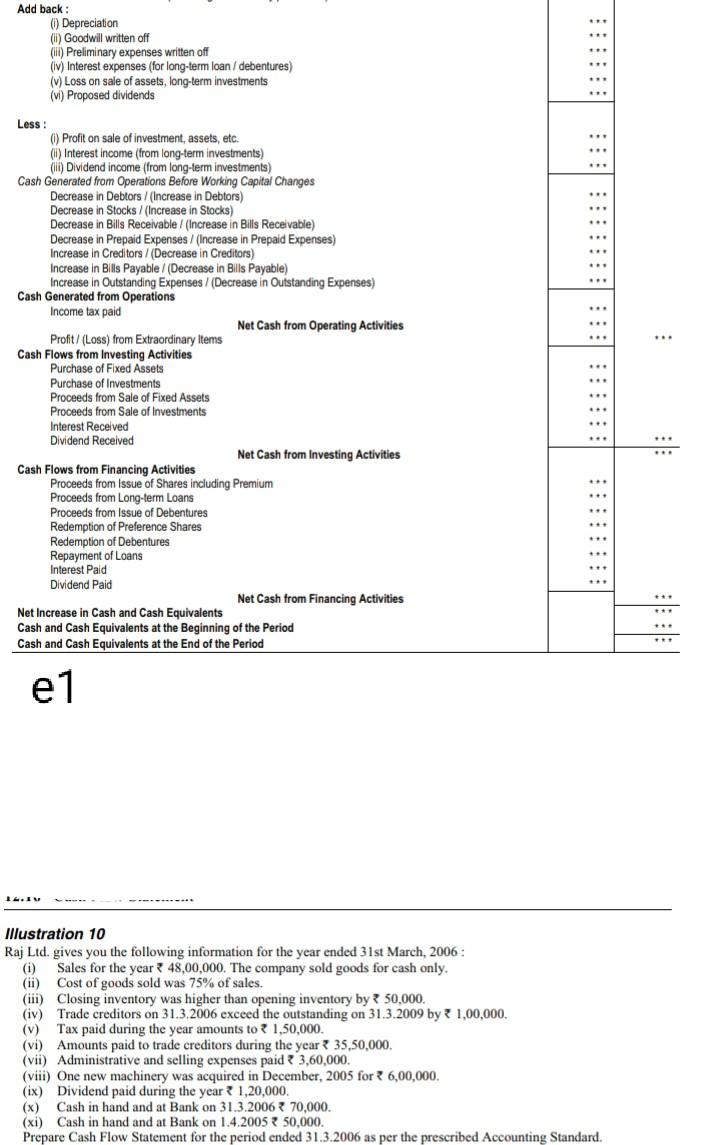

Add back: () Depreciation () Goodwill written off (III) Preliminary expenses written off (iv) Interest expenses (for long-term loan/ debentures) (1) Loss on sale of

Add back: () Depreciation () Goodwill written off (III) Preliminary expenses written off (iv) Interest expenses (for long-term loan/ debentures) (1) Loss on sale of assets, long-term investments (vi) Proposed dividends .. ... Less : () Profit on sale of investment, assets, etc. () Interest income (from long-term investments) (iii) Dividend income (from long-term investments) Cash Generated from Operations Before Working Capital Changes Decrease in Debtors / (Increase in Debtors) Decrease in Stocks / (Increase in Stocks) Decrease in Bills Receivable / (Increase in Bills Receivable) Decrease in Prepaid Expenses/ (Increase in Prepaid Expenses) Increase in Creditors/ (Decrease in Creditors) Increase in Bilis Payable (Decrease in Bills Payable) Increase in Outstanding Expenses/ (Decrease in Outstanding Expenses) Cash Generated from Operations Income tax paid Net Cash from Operating Activities Profit/(Loss) from Extraordinary Items Cash Flows from Investing Activities Purchase of Fixed Assets Purchase of Investments Proceeds from Sale of Fixed Assets Proceeds from Sale of Investments Interest Received Dividend Received Net Cash from Investing Activities Cash Flows from Financing Activities Proceeds from Issue of Shares including Premium Proceeds from Long-term Loans Proceeds from Issue of Debentures Redemption of Preference Shares Redemption of Debentures Repayment of Loans Interest Pald Dividend Paid Net Cash from Financing Activities Net Increase in Cash and Cash Equivalents Cash and Cash Equivalents at the Beginning of the Period Cash and Cash Equivalents at the End of the Period e1 IA.EU Illustration 10 Raj Ltd. gives you the following information for the year ended 31st March, 2006: (i) Sales for the year 48,00,000. The company sold goods for cash only. (ii) Cost of goods sold was 75% of sales. (iii) Closing inventory was higher than opening inventory by 50,000. (iv) Trade creditors on 31.3.2006 exceed the outstanding on 31.3.2009 by ? 1,00,000. W Tax paid during the year amounts to 2 1,50,000. (vi) Amounts paid to trade creditors during the year 35,50,000. (vii) Administrative and selling expenses paid 3,60,000 (viii) One new machinery was acquired in December, 2005 for ? 6,00,000. (ix) Dividend paid during the year 1,20,000, (x) Cash in hand and at Bank on 31.3.2006 70,000. (xi) Cash in hand and at Bank on 1.4.2005 * 50,000. Prepare Cash Flow Statement for the period ended 31.3.2006 as per the prescribed Accounting Standard

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started