Question

ADD IN THE EXCEL FORMAT WITH THE FORMALS AND EXPLAIN WITH YOUR ANSWERS. 11. Compute the USD NPV and IRR of the following investment by

ADD IN THE EXCEL FORMAT WITH THE FORMALS AND EXPLAIN WITH YOUR ANSWERS.

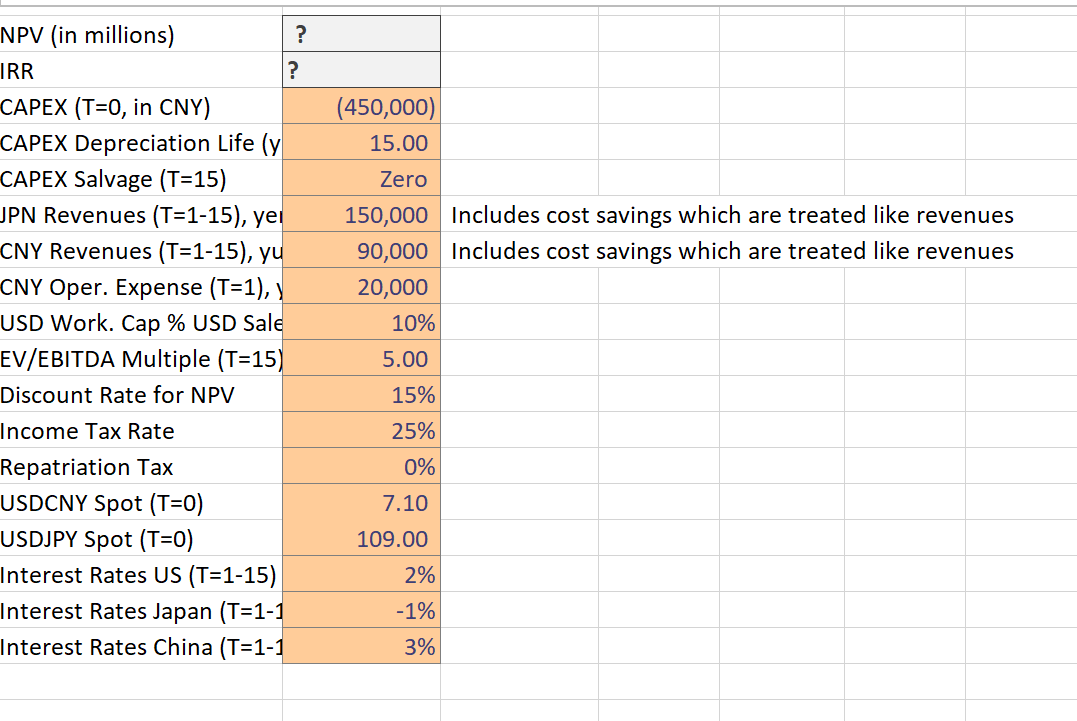

11. Compute the USD NPV and IRR of the following investment by Ingersoll-Rand (IR) to build a distribution center (DC) in China. The DC will allow the company to generate additional sales and cost savings in China (CNY) and Japan (JPN). Convert the CAPEX to USD using the spot exchange rate and depreciate a straight line over its life. Use IRP theory to forecast future exchange rates. Assume the business is valued at 5 times EBITDA in 15 years-- which should be included in the NPV and IRR. Currency amounts are in millions.

NPV (in millions) IRR ? ? CAPEX (T=0, in CNY) CAPEX Depreciation Life (y CAPEX Salvage (T=15) JPN Revenues (T=1-15), ye CNY Revenues (T=1-15), yu CNY Oper. Expense (T=1), USD Work. Cap % USD Sale EV/EBITDA Multiple (T=15) Discount Rate for NPV Income Tax Rate Repatriation Tax USDCNY Spot (T=0) USDJPY Spot (T=0) Interest Rates US (T=1-15)| Interest Rates Japan (T=1-1 Interest Rates China (T=1-1 (450,000) 15.00 Zero 150,000 Includes cost savings which are treated like revenues 90,000 Includes cost savings which are treated like revenues 20,000 10% 5.00 15% 25% 0% 7.10 109.00 2% -1% 3%

Step by Step Solution

3.44 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Here are the steps to calculate the NPV and IRR of the IngersollRand investment in China with...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started