Question

Add Journal entries 1. Educational and general revenues earned during the year include tuition and fees for educational activities of $5,200,000 of which, $2,500,000 had

Add Journal entries

1. Educational and general revenues earned during the year include tuition and fees for educational activities of $5,200,000 of which, $2,500,000 had been collected, and $2,750,000 of state appropriations, all of which has been received.

2. Other revenues of $2,100,000 were collected through auxiliary enterprises

3. Total purchases of materials and supplies for the years amounted to $974,000 of which $843,000 has been paid

4. Materials and supplies used during the year amounted to $864,000, of which $550,000 is chargeable to educational activities, $250,000 charged to administration activities and $64,000 to auxiliary enterprises.

5. Salaries and wages paid totaled to $2,850,000 of which $1,450,000 is chargeable to educational activities, $460,000 chargeable to administration activities and $940,000 to auxiliary enterprises

6. Utility Expenses were incurred. All were paid with the exception of $1,400

Auxiliary Enterprises $3,800

Educational Activities: $10,500

Administration: $1,300

7. An individual donated preferred stock valued at $75,000 to finance auxiliary enterprises activities. She had acquired the investments for $59,000.

8. A $224,000 gift was received with the stipulation that the resources be used to help finance educational services.

9. Cash ($2,050,000) was donated by a family during the year to establish an endowment. Both the endowment and any revenue derived from need to be designated to educational activities.

10. The cash received on transaction 9 was invested in the following securities: Preferred Stock $450,000 Common stocks: $642,000 Bonds Par Value $290,000 Premiums $12,000 Bonds: Par value $486,000 Discounts: $15,000

11. Cash received on the endowment investments income was as follows: Dividends on preferred stocks $16,000 Dividend on common stocks $24,000 Interest $2,500

12. Depreciation for Universitys main campus was $146,000 for the year

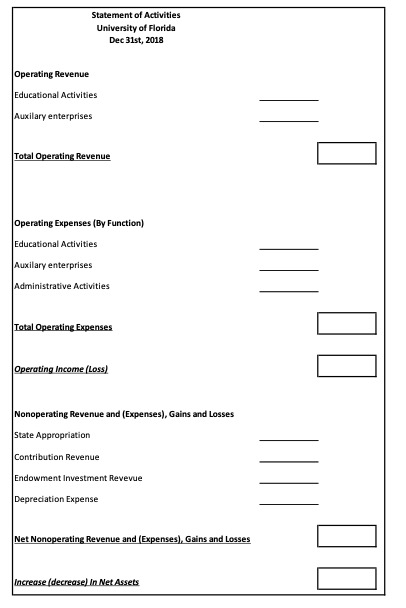

13. Prepare the Statement of Activities

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started