Question

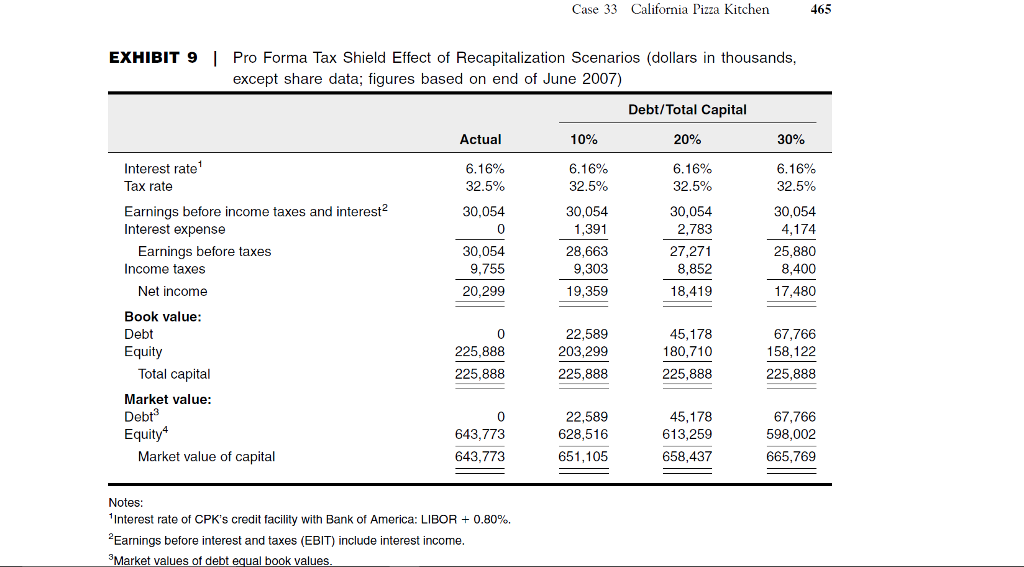

Add the following values to the table provide in Exhibit 9 and complete it them for the actual scenario and the three proposed scenarios: Market

Add the following values to the table provide in Exhibit 9 and complete it them for the actual scenario and the three proposed scenarios:

| Market value of Debt/MV of Capital |

| Price per share |

| Shares repurchased (thousands) |

| Shares outstanding (thousands) |

| Earnings per share |

| Price to earning ratio |

| Beta |

| Cost of equity |

| WACC |

Present value of tax shield using perpetuity formula = (kd D t)/kd = D t.

Post-announcement share price = PN = Pre-Announcement Price + D t/shares outstanding.

Number of shares repurchased = D/PN.

Cost of Equity = Risk Free Rate(Given in Ex. 8) + Beta*(MRP=5%)

WACC: Use MV weights and Debt Rate provided and Cost of Equity calculated

Discuss what scenario investors would prefer and what the tradeoff is for investors as the firm adds leverage.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started