Answered step by step

Verified Expert Solution

Question

1 Approved Answer

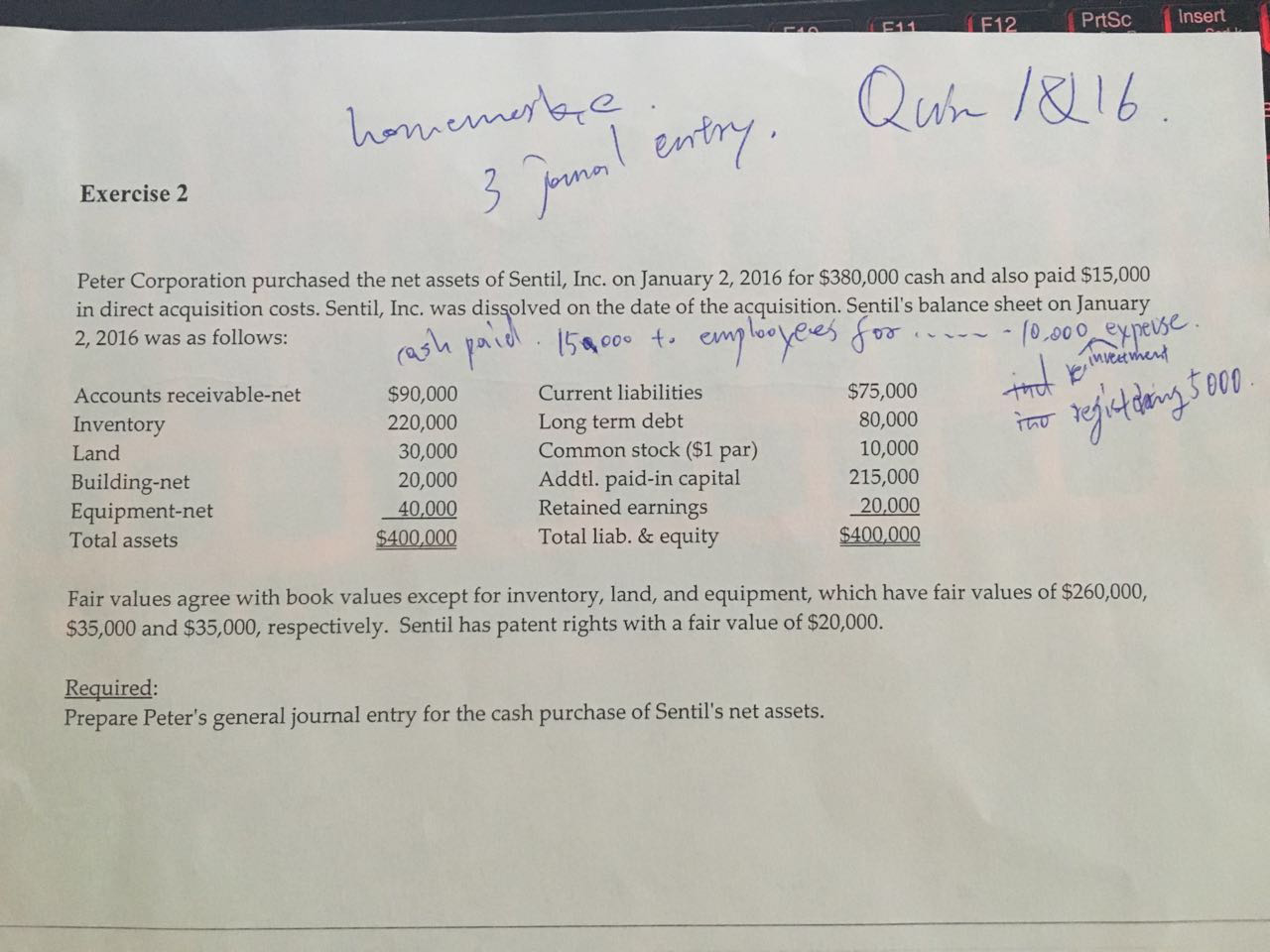

Add three conditions: cash paid for employee 15000; 10000 investment expense, registering fee 5000. Prepare three Journal entries as the reuiqred in the picture. F12,

Add three conditions:

cash paid for employee 15000; 10000 investment expense, registering fee 5000.

Prepare three Journal entries as the reuiqred in the picture.

F12, PrSc Insert Quhn IRL If Exercise 2 Peter Corporation purchased the net assets of Sentil, Inc. on January 2, 2016 for $380,000 cash and also paid $15,000 in direct acquisition costs. Sentil, Inc. was dissolved on the date of the acquisition. Sentils balance sheet on January 2, 2016 was as follows: DC I5 a ooo emy t loo va --- - (0,000 MV Accounts receivable-net Inventory Land Building-net Equipment-net Total assets $90,000 220,000 Current liabilities 30,000 20.000 $75,000 80,000 10,000 215,000 20.000 Long term debt Common stock ($1 par) Addtl. paid-in capital Retained earnings Total liab. & equity ef adors in out 40,000 000 $400,000 Fair values agree with book values except for inventory, land, and equipment, which have fair values of $260,000, $35000 and $35,000, respectively. Sentil has patent rights with a fair value of $20000. Required: Prepare Peters general journal entry for the cash purchase of Sentil's net assetsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started