Answered step by step

Verified Expert Solution

Question

1 Approved Answer

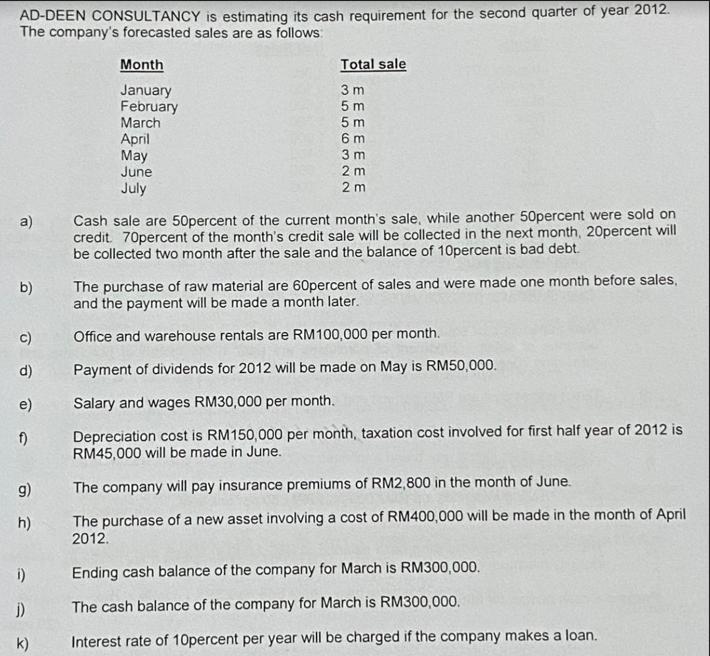

AD-DEEN CONSULTANCY is estimating its cash requirement for the second quarter of year 2012. The company's forecasted sales are as follows: a) b) c)

AD-DEEN CONSULTANCY is estimating its cash requirement for the second quarter of year 2012. The company's forecasted sales are as follows: a) b) c) d) e) f) g) h) i) j) k) Month January February March April May June July Total sale 3 m 5m 5 m 6m 3 m 2 m 2 m Cash sale are 50percent of the current month's sale, while another 50percent were sold on credit. 70percent of the month's credit sale will be collected in the next month, 20percent will be collected two month after the sale and the balance of 10percent is bad debt. The purchase of raw material are 60percent of sales and were made one month before sales, and the payment will be made a month later. Office and warehouse rentals are RM100,000 per month. Payment of dividends for 2012 will be made on May is RM50,000. Salary and wages RM30,000 per month. Depreciation cost is RM150,000 per month, taxation cost involved for first half year of 2012 is RM45,000 will be made in June. The company will pay insurance premiums of RM2,800 in the month of June. The purchase of a new asset involving a cost of RM400,000 will be made in the month of April 2012. Ending cash balance of the company for March is RM300,000. The cash balance of the company for March is RM300,000. Interest rate of 10percent per year will be charged if the company makes a loan. Required Prepare a cash budget for the second quarter of 2012 of AD-DEEN CONSULTANCY.

Step by Step Solution

★★★★★

3.41 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

To estimate ADDEEN CONSULTANCYs cash requirement for the second quarter of 2012 we need to consider ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started