Answered step by step

Verified Expert Solution

Question

1 Approved Answer

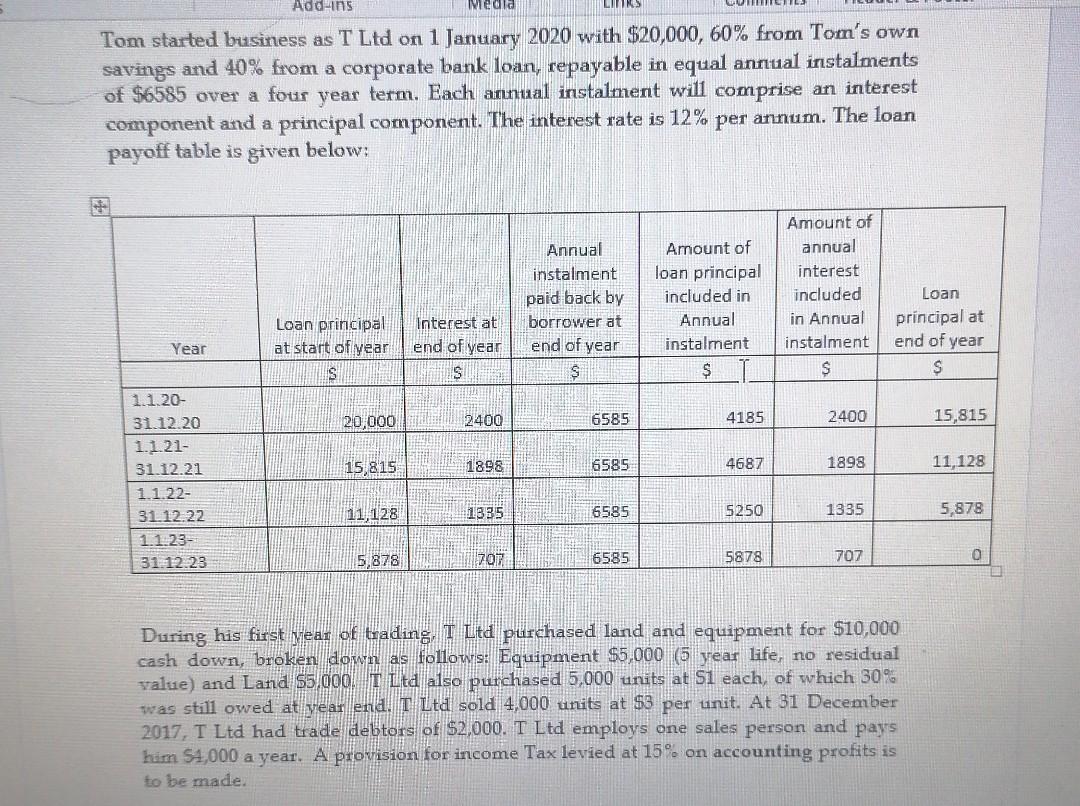

Add-ins Media LILINS Tom started business as T Ltd on 1 January 2020 with $20,000, 60% from Tom's own savings and 40% from a corporate

Add-ins Media LILINS Tom started business as T Ltd on 1 January 2020 with $20,000, 60% from Tom's own savings and 40% from a corporate bank loan, repayable in equal annual instalments of $6585 over a four year term. Each annual instalment will comprise an interest component and a principal component. The interest rate is 12% per annum. The loan payoff table is given below: Annual instalment paid back by borrower at end of year Amount of loan principal included in Annual instalment $ Amount of annual interest included in Annual instalment $ Loan principal at start of year IS Year Loan principal at end of year $ Interest at end of year S 20,000 2400 6585 4185 2400 15,815 15,815 1898 6585 4687 1898 11,128 1.1.20- 31.12.20 1.1.21- 31.12.21 1.1.22 31.12.22 1.1.23- 31.12.23 11,128 1335 6585 5250 1335 5,878 5,878 1707 6585 5878 O 707 During his first year of trading T Ltd purchased land and equipment for $10,000 cash down, broken down as follows: Equipment $5,000 (5 year life, no residual value) and Land 55.000! T Ltd also purchased 5,000 units at S1 each, of which 30% was still owed at vear end. T Ltd sold 4,000 units at $3 per unit. At 31 December 2017, T Ltd had trade debtors of $2,000. T Ltd employs one sales person and pays him $4,000 a year. A provision for income Tax levied at 15% on accounting profits is to be made. During his first year of trading, T Ltd purchased land and equipment for $10,000 cash down, broken down as follows: Equipment $5,000 (5 year life, no residual value) and Land $5,000. T Ltd also purchased 5,000 units at $1 each, of which 30% was still owed at year end. T Ltd sold 4,000 units at $3 per unit. At 31 December 2017, T Ltd had trade debtors of $2,000. T Ltd employs one sales person and pays him $4,000 a year. A provision for income Tax levied at 15% on accounting profits is to be made. Required: Prepare for T Ltd the statement of financial position as at 31 December 2020 and the statement of profit or loss for the year ended 31 December 2020. (25 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started