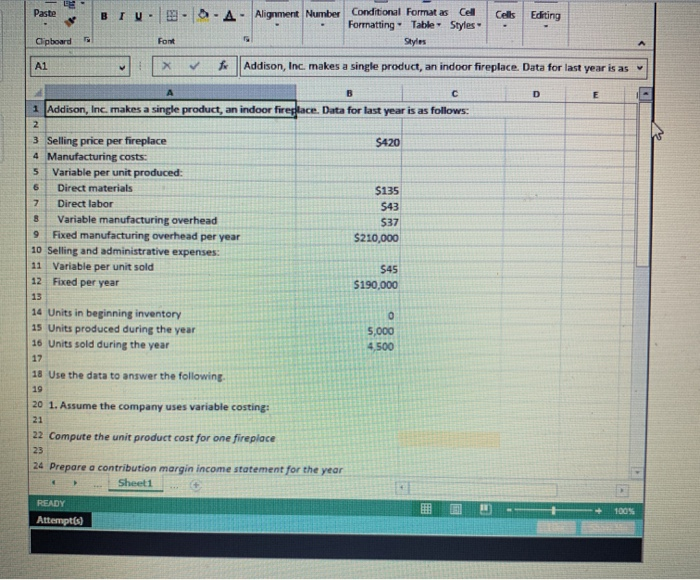

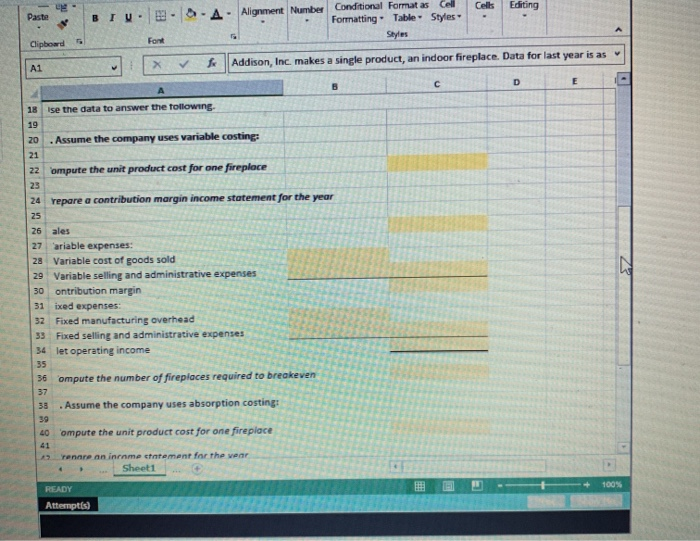

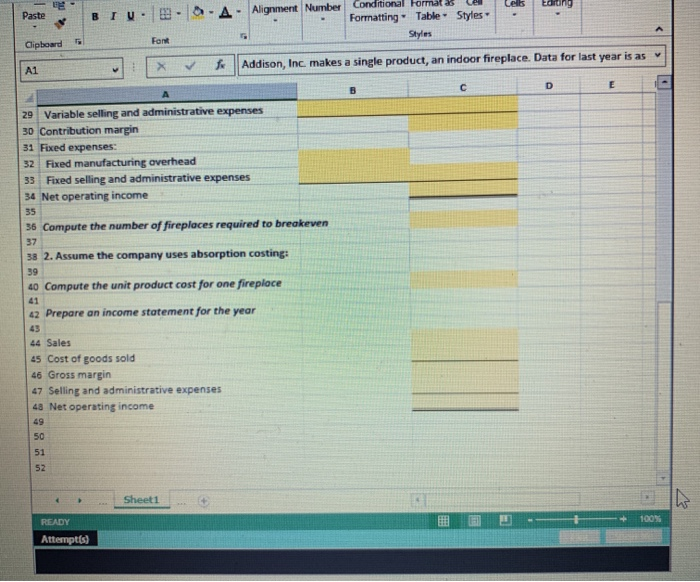

Addison, Inc. makes a single product, an Indoor fireplace, and has provided data from last year of operations. The Controller has asked you to compare Income statements of the company used the variable costing approach vs. the absorption costing report. Use the information included in the Excel Simulation and the Excel functions described below to complete the task. Cell Reference: Allows you to refer to data from another cell in the worksheet. From the Excel Simulation below. If in a blank coll, -63 was entered the formula would output the result from cell BS. or 420 in this example Basic Math functions. Allows you to use the basic math symbols to perform mathematical functions. You can use the following keys: - (plus sign to add). - (minus sign to subtract)." (asterisk sign to multiply). and/orward slash to divide). From the Excel Simulation below. If in a blank cell-315-316 was entered, the formula would add the values from those cells and output the result, or 9,500 In this example. If using the other math symbols the result would output an appropriate answer for its function SUM function: Allows you to refer to multiple cells and adds all the values. You can add Individual cell references or ranges to utilize this function. From the Excel Simulation below, if in a blank cell -SUMB6 B7,B8) was entered the formula would output the result of adding those three separate cells, or 215 in this example. Similarly, if in a blank cell" SUM(B6:38)" was entered the formula would output the same result of adding those cells, except they are expressed as a range in the formula, and the result would be 215 In this example. Paste B T -AAlignment Number Celts Editing Conditional Format as a a Formatting Table Styles Styles Coboard Addison, Inc. makes a single product, an indoor fireplace. Data for last year is as Addison, Inc. makes a single product, an indoor fireplace. Data for last year is as follows: S420 $135 3 Selling price per fireplace 4 Manufacturing costs: 5 Variable per unit produced 6 Direct materials 7 Direct labor 8 Variable manufacturing overhead 9 Fixed manufacturing overhead per year 10 Selling and administrative expenses: 11 Variable per unit sold 12 Fixed per year S43 537 $210,000 $45 $190,000 14 Units in beginning inventory 15 Units produced during the year 16 Units sold during the year 18 Use the data to answer the following 20 1. Assume the company uses variable costing 22 Compute the unit product cost for one fireplace 24 Prepare a contribution margin income statement for the year Sheet1 READY Attempt(s) 100 Cells Editing Paste BIV -S A Alignment Number Conditional Format as Cell Formatting Table Styles Styles Clipboard M T X Addison, Inc. makes a single product, an indoor fireplace. Data for last year is as 18 ise the data to answer the following . Assume the company uses variable costing: Compute the unit product cost for one fireplace 24 repare a contribution margin income statement for the year 26 ales 27 ariable expenses: 28 Variable cost of goods sold 29 Variable selling and administrative expenses 30 ontribution margin 31 ixed expenses 32 Fixed manufacturing overhead 33 Fixed selling and administrative expenses 34 let operating income 36 ompute the number of fireplaces required to breakeven . Assume the company uses absorption costing: 40 'ompute the unit product cost for one fireplace renare an inenme statement for the year + Sheet1 READY Attempts) Cells Editing Paste BIV A Alignment Number Conditional Formal Formatting Table Styles Styles Clipboard Addison, Inc. makes a single product, an indoor fireplace. Data for last year is as 29 Variable selling and administrative expenses 30 Contribution margin 31 Fixed expenses 32 Fixed manufacturing overhead 33 Fixed selling and administrative expenses 34 Net operating income 36 Compute the number of fireplaces required to breakeven 38 2. Assume the company uses absorption costing: 40 Compute the unit product cost for one fireplace 42 Prepare an income statement for the year . 44 Sales 45 Cost of goods sold 46 Gross margin 47 Selling and administrative expenses 48 Net operating income Sheet1 READY 1005 Attempt(s)