Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. Complete Mylas worksheet for November. Key adjusting entries by letter. 2. Prepare the income statement, the statement of retained earnings, and the classified balance

1. Complete Myla’s worksheet for November. Key adjusting entries by letter.

2. Prepare the income statement, the statement of retained earnings, and the classified balance sheet in account form for the month ended November 30, 2020.

| Additional data at November 30, 2020: | |||||

| a. Depreciation on equipment, $1,100. | |||||

| b. Accrued wage expense, $600. | |||||

| c. Supplies on hand, $200. | |||||

| d. Prepaid insurance expired during November, $200. | |||||

| e. Unearned service revenue earned during November, $4,000. | |||||

| f. Accrued service revenue, $800. | |||||

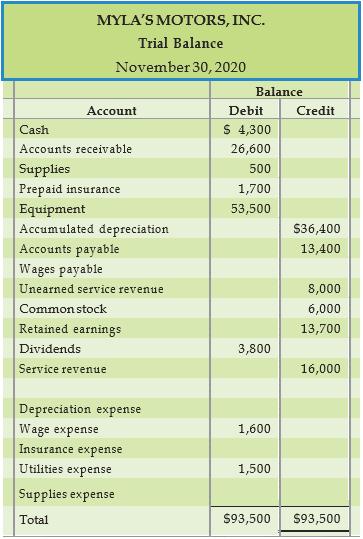

MYLA'S MOTORS, INC. Trial Balance November 30, 2020 Balance Account Debit Credit Cash $ 4,300 Accounts receivable 26,600 Supplies Prepaid insurance Equipment Accumulated depreciation Accounts payable Wages payable 500 1,700 53,500 S36,400 13,400 Unearned service revenue 8,000 Common stock 6,000 Retained earnings 13,700 Dividends 3,800 Service revenue 16,000 Depreciation expense Wage expense 1,600 Insurance expense Utilities expense 1,500 Supplies expense Total $93,500 $93,500

Step by Step Solution

★★★★★

3.36 Rating (146 Votes )

There are 3 Steps involved in it

Step: 1

The picture below shows the worksheet of Mylas Motors The adjusting entries Adjustmen...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started